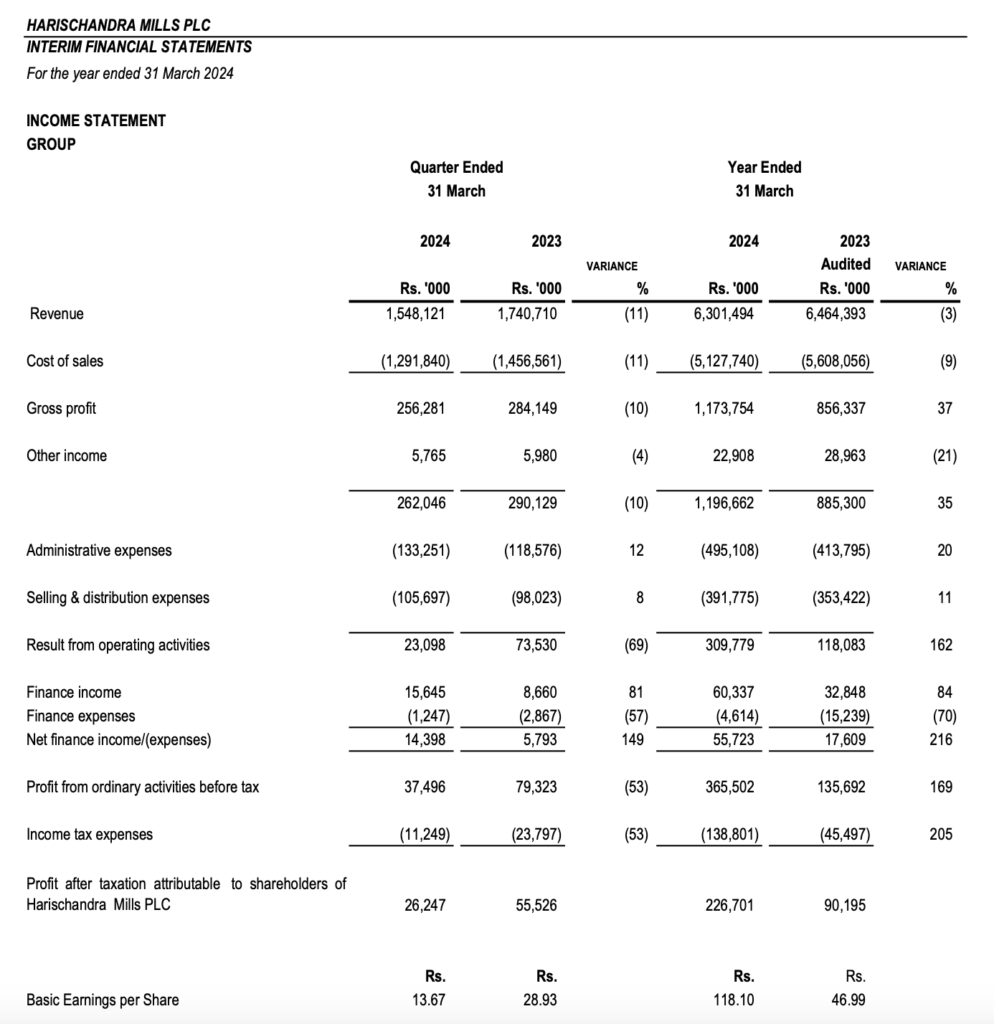

Based on the latest available interim financial statements for Harischandra Mills PLC for the year ended 31 March 2024, the company has experienced some variances in its financial performance compared to the previous year. Here are some key points from the data provided:

- Revenue: The company’s revenue has decreased by 11% from Rs. 1,740,710,000 in 2023 to Rs. 1,548,121,000 in 2024.

- Cost of Sales: There was also a decrease in the cost of sales, which went down from Rs. 1,456,561,000 in 2023 to Rs. 1,291,840,000 in 2024.

- Net Assets Value Per Share: The Net Assets Value (NAV) per share has increased from Rs. 828.84 in 2023 to Rs. 907.22 in 2024, indicating an improvement in the value of the company’s net assets per share.

- Cash Flows: The cash flows from operating activities show a profit before income tax expense of Rs. 365,502,000 in 2024, up from Rs. 135,692,000 in 2023. This suggests a significant improvement in profitability before tax.

- Adjustments: The company made adjustments for provisions for employee benefits, depreciation/amortization, interest expenses, and changes in the fair value of unit trusts. Notably, interest expenses decreased from Rs. 12,407,000 in 2023 to Rs. 4,614,000 in 2024.

- Share Prices: The highest share price recorded was Rs. 4,360.00, with the lowest being Rs. 3,510.75, and the closing price standing at Rs. 4,000.00 as of the last available data.

These figures are provisional and subject to audit, as noted in the documents. The overall performance shows a mixed picture with a decrease in revenue but an increase in net asset value per share and a significant improvement in profit before tax. It is important for investors and stakeholders to consider both the positive and negative aspects of the financial performance when making decisions.

Key Ratios

To evaluate Harischandra Mills PLC’s financial performance, key financial ratios can be calculated using the data provided in the interim financial statements. Here are some of the key financial ratios:

- Earnings Per Share (EPS):

- For the year ended 31 March 2024: Rs. 118.10

- For the year ended 31 March 2023: Rs. 46.99

- Net Asset Value (NAV) Per Share:

- As of 31 March 2024: Rs. 907.22

- As of 31 March 2023: Rs. 828.84

- Profit Margins:

- Profit After Tax Margin for the year ended 31 March 2024 can be calculated as Profit After Taxation divided by Revenue. Using the figures provided:

- Profit After Taxation (2024): Rs. 226,701,000

- Revenue (2024): Rs. 1,548,121,000

- Profit After Tax Margin (2024) = (Profit After Taxation / Revenue) * 100

- Profit After Tax Margin (2024) = (226,701 / 1,548,121) * 100 ≈ 14.64%

- Profit After Tax Margin for the year ended 31 March 2023 can be calculated similarly using the respective figures for that year.

- Profit After Tax Margin for the year ended 31 March 2024 can be calculated as Profit After Taxation divided by Revenue. Using the figures provided:

- Return on Equity (ROE):

- ROE for the year ended 31 March 2024 can be calculated as Profit After Taxation divided by Total Equity. Using the figures provided:

- Profit After Taxation (2024): Rs. 226,701,000

- Total Equity (2024): Rs. 1,741,490,000

- ROE (2024) = (Profit After Taxation / Total Equity) * 100

- ROE (2024) = (226,701 / 1,741,490) * 100 ≈ 13.02%

- ROE for the year ended 31 March 2023 can be calculated similarly using the respective figures for that year.

- ROE for the year ended 31 March 2024 can be calculated as Profit After Taxation divided by Total Equity. Using the figures provided:

- Price to Earnings Ratio (P/E):

- The P/E ratio requires the share price and the earnings per share. The closing share price as of the last available data is Rs. 4,000.00, and the EPS for the year ended 31 March 2024 is Rs. 118.10.

- P/E Ratio (2024) = Share Price / EPS

- P/E Ratio (2024) = 4,000 / 118.10 ≈ 33.87

Please note that these ratios are based on provisional figures and are subject to audit. Additionally, for a comprehensive analysis, it would be beneficial to compare these ratios with industry averages and the company’s historical performance.

Future Outlook

When assessing the future outlook of Harischandra Mills PLC, several factors should be considered, including historical performance, current financial health, industry trends, and broader economic conditions. Based on the provided context, here are some points to consider:

- Historical Performance: The company’s past financial statements can give insights into its operational efficiency, profitability, and growth trends. For instance, comparing revenue and net profit margins over the years can indicate whether the company is growing and managing its costs effectively.

- Current Financial Health: Key financial ratios derived from the most recent interim financial statements, such as the Earnings Per Share (EPS), Net Asset Value (NAV) per share, and Return on Equity (ROE), can provide a snapshot of the company’s current financial health. These ratios can be compared with industry averages to gauge Harischandra Mills PLC’s standing relative to its peers.

- Industry Trends: The company operates in the food products, fuel and lubricants, and soap segments. Each of these industries may have different growth prospects and challenges. For example, the food products segment might be more stable due to consistent demand, whereas the fuel and lubricants segment could be more volatile due to fluctuating oil prices.

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and exchange rates can impact the company’s costs and sales. Additionally, the economic climate in Sri Lanka and the global market can influence the company’s performance.

- Regulatory Environment: Changes in regulations, such as food safety standards or environmental laws, can affect operational costs and market strategies.

- Innovation and Expansion: The company’s plans for innovation, product development, and market expansion can also shape its future outlook. Investments in new technologies or entry into new markets can provide growth opportunities.

- Competitive Landscape: The competitive dynamics within the industries Harischandra Mills PLC operates in will also play a crucial role. The company’s ability to maintain or improve its market position against competitors can impact its future success.

- Management and Strategy: The vision and strategy outlined by the company’s management, as well as their execution capabilities, are critical for future growth.

Given the lack of specific future-oriented data in the provided context, it is not possible to predict the company’s future performance with certainty. However, investors and stakeholders should monitor the company’s quarterly and annual reports, press releases, and industry news for updates on these factors to form a more informed outlook on Harischandra Mills PLC’s future.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net