Based on the provided context from the interim report for Hayleys PLC for the quarter ended 31st March 2024, the following key financial figures can be highlighted to assess the company’s profitability and financial performance:

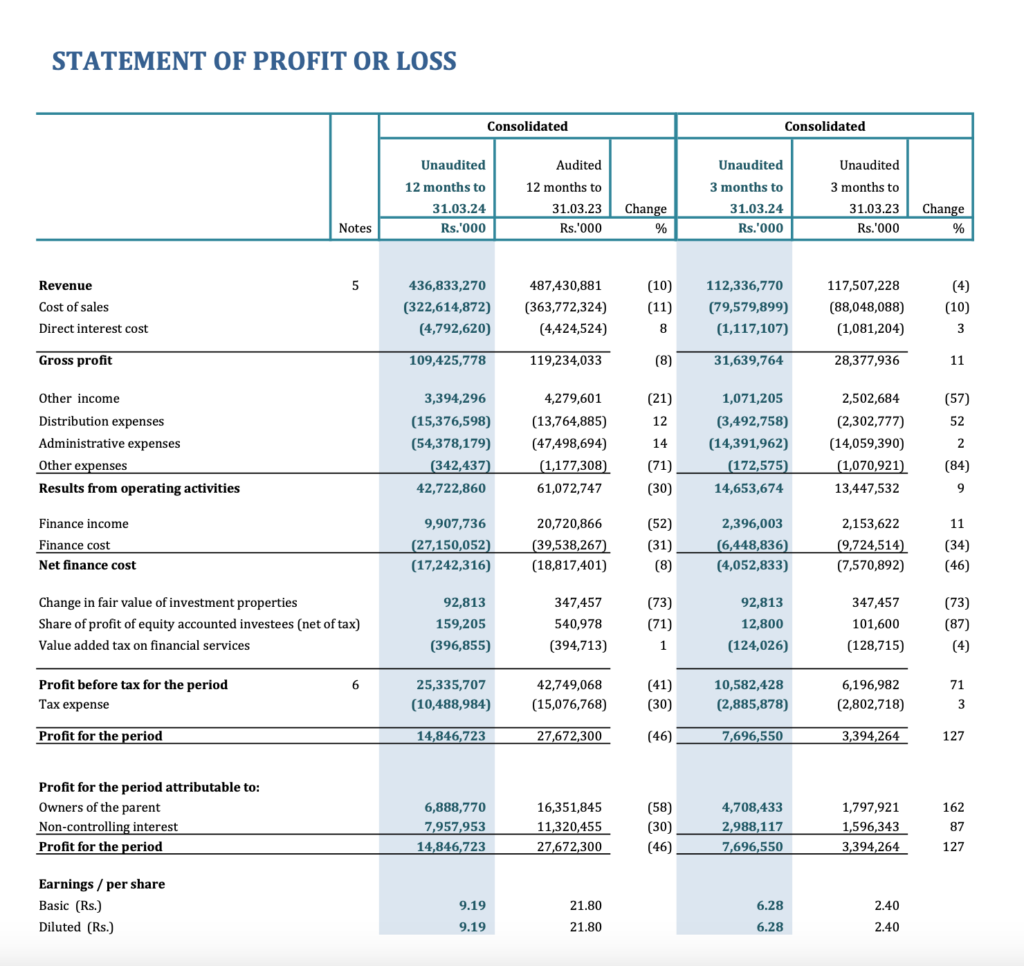

Profit for the Period:

- The profit for the 12 months ended 31st March 2024 was Rs. 14,846,723,000.

- This represents a significant decrease of 46% compared to the profit of Rs. 27,672,300,000 for the 12 months ended 31st March 2023.

Earnings Per Share (EPS):

- Basic and Diluted EPS for the 12 months ended 31st March 2024 were Rs. 9.19.

- This is a substantial decrease from the Basic and Diluted EPS of Rs. 21.80 for the 12 months ended 31st March 2023.

Revenue:

- Revenue for the 12 months ended 31st March 2024 was Rs. 436,833,270,000, which is a 10% decrease from the previous year’s revenue of Rs. 487,430,881,000.

Cost of Sales:

- The cost of sales for the 12 months ended 31st March 2024 was Rs. 322,614,872,000, an 11% decrease from the previous year’s cost of sales of Rs. 363,772,324,000.

Profit Before Tax:

- Profit before tax for the 12 months ended 31st March 2024 was Rs. 25,335,707,000, a decrease from the previous year’s profit before tax of Rs. 42,749,068,000.

Net Finance Costs:

- Net finance costs for the 12 months ended 31st March 2024 were Rs. 17,242,316,000, slightly lower than the previous year’s net finance costs of Rs. 18,817,401,000.

Depreciation on Property, Plant & Equipment:

- Depreciation for the 12 months ended 31st March 2024 was Rs. 8,531,775,000, an increase from the previous year’s depreciation of Rs. 8,052,642,000.

The decrease in profit for the period and earnings per share indicates that Hayleys PLC’s profitability has declined significantly over the past year. The reduction in revenue suggests that the company may have faced challenges in sales or market conditions. Despite the decrease in cost of sales, the drop in profit before tax and net profit indicates that other factors have negatively impacted the company’s bottom line.

It is important to consider the broader economic context, industry trends, and any company-specific events or strategic decisions that may have influenced these financial results. Additionally, a more detailed analysis of the company’s financial statements, including cash flow and balance sheet information, would provide a more comprehensive understanding of Hayleys PLC’s financial health and performance during this period.

Future Prospects and potential risks

Based on the available context, Hayleys PLC is a diversified conglomerate with operations spanning multiple sectors, including Eco Solutions, Hand Protection, Purification, Textiles, Construction Materials, Plantation, Agriculture, Consumer & Retail, Leisure, Industry Inputs, Power and Energy, Transportation and Logistics, and others. This diversification can be both a strength and a potential risk factor.

Future Prospects:

- Diversification: Hayleys PLC’s involvement in various industries may provide resilience against sector-specific downturns, allowing the company to leverage growth in one sector to offset challenges in another.

- Renewable Energy: The company’s engagement in renewable energy supplies could be a significant growth area, especially with the global shift towards sustainable energy sources.

- Consumer & Retail Expansion: The Consumer & Retail segment, including consumer durables, has potential for growth, particularly if the company capitalizes on increasing consumer spending and market expansion.

- Tourism Recovery: The Leisure segment, which includes resort properties in Sri Lanka and the Maldives, could benefit from the recovery of the tourism industry post-pandemic.

- Logistics and Transportation: As global trade recovers and evolves, the Transportation and Logistics segment may see increased demand for freight management and logistics services.

Potential Risks:

- Economic Volatility: Economic instability in Sri Lanka and globally can impact Hayleys PLC’s performance, particularly in sectors like tourism and consumer goods.

- Commodity Price Fluctuations: The company’s Plantation segment could be vulnerable to fluctuations in tea and rubber prices, which can be influenced by global supply and demand dynamics.

- Regulatory Changes: Changes in regulations, especially concerning environmental standards and labor laws, could impact operations and profitability, particularly in manufacturing segments like Hand Protection and Purification.

- Competition: Intense competition in the sectors Hayleys operates in, such as from Richard Pieris & Co. PLC and John Keells Holdings PLC, could pressure margins and market share.

- Debt Levels: If the company has significant debt, interest rate fluctuations and refinancing risks could impact financial stability.

- Global Supply Chain Disruptions: As a conglomerate with international operations, Hayleys PLC could face challenges due to global supply chain disruptions, which can affect production and distribution.

To make informed decisions, stakeholders should monitor Hayleys PLC’s financial performance, strategic initiatives, and the broader economic and regulatory environment. It is also advisable to review the company’s annual reports, financial statements, and industry analyses for a comprehensive understanding of its prospects and risks.