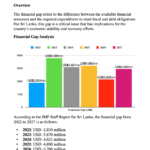

The economic pressures continued during the quarter under review, with excise taxes increasing by 14% in January 24, which was on top of a 20% duty hike in July 2023 for the 23/24 financial year. VAT was also higher by 3% vs prior year quarter. The escalation in price of alcoholic beverages has brought further pressure to consumers who have seen a rapid deterioration of their disposable income which has led to the widespread availability of illicit products. Consequently, company volumes declined for the full year.

The Government and regulator must take this into consideration and provide price stability for the industry to recover, if this level of excise increases continue, Government revenue will be impacted due to lower volumes. In order to support consumer affordability, the launch of the 500ml returnable bottles from Lion Strong and Carlsberg Special Brew at lower price threshold was an attempt to minimize consumers downtrading to illicit product.

Cost saving initiatives were a central focus to offset the adverse impacts of tax hikes on the company’s profitability. However, there is a limit to cost reduction before quality and other critical elements are impacted. The outlook for 24/25 is in keeping with 23/24 – volume and margin pressure. In addition to an excise duty hike in January 2025, we expect there to be a margin headwind in the event of a Rupee depreciation in the second half of the financial year. Furthermore, national elections in the second half of the year will also increase uncertainty. Total taxes paid to the Government during the fiscal year amounted to Rs. 73.5 Bn.

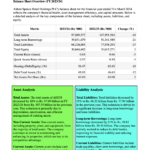

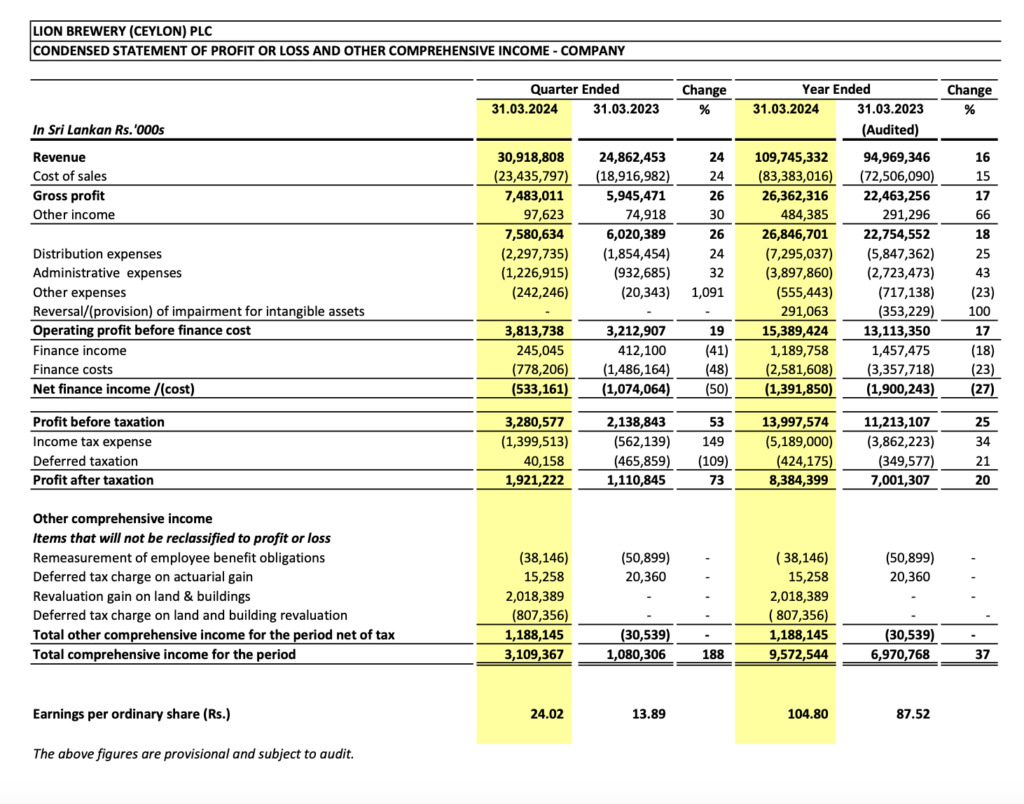

Revenue:

- The company reported a revenue of Rs. 109,755,568,000 for the year ended 31st March 2024.

- This represents a 16% increase from the previous year’s revenue of Rs. 94,969,346,000.

Cost of Sales:

- The cost of sales for the year was Rs. 83,390,743,000, which is a 15% increase from the previous year’s figure of Rs. 72,506,090,000.

Gross Profit:

- Gross profit for the year stood at Rs. 26,364,825,000, marking a 17% increase compared to Rs. 22,463,256,000 in the previous year.

Net Profit for the Period:

- The profit for the period (net income) was Rs. 8,403,478,000, making a 20% increase compared to Rs 7,001,307,000 reported in the previous year.

Excise Taxes and VAT:

- The company faced increased economic pressures with excise taxes rising by 14% in January 2024, in addition to a 20% duty hike in July 2023 for the 23/24 financial year.

- VAT also increased by 3% compared to the prior year quarter.

The financial performance indicates that Lion Brewery (Ceylon) PLC has managed to increase its revenue and gross profit despite facing challenges such as increased excise duties, VAT, and a decline in volume. The company’s capital expenditure commitments suggest ongoing investments, which could be indicative of future growth strategies or operational enhancements. However, the decline in volume and the increase in excise duties and VAT are factors that could impact future profitability and market competitiveness.