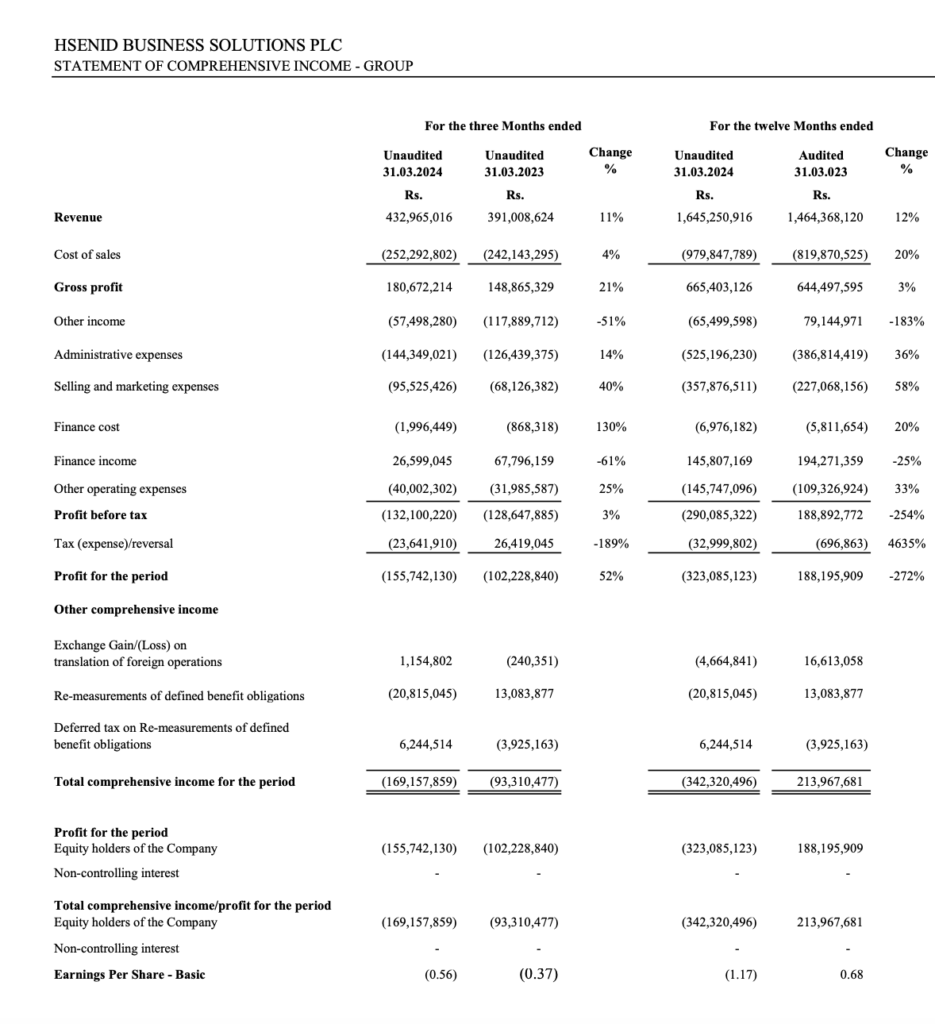

- Total revenue for the year ended 31st March 2024 was LKR 1,645.3 million, which represents a year-over-year growth of 12.4% compared to the previous financial year’s revenue of LKR 1,464.4 million. In USD constant currency terms, this growth rate was 19.6%.

- The company recorded a net loss of LKR 155.3 million for the quarter ended 31st March 2024. This loss included approximately LKR 102 million in one-off non-cash items, which comprised LKR 57 million in forex losses, LKR 22 million in gratuity provisions, and LKR 23 million in deferred tax expenses due to reversals in debtor provisions.

- The normalized EBITDA margins for the quarter were not explicitly stated in the provided context, but it is indicated that the net loss was influenced by the one-off non-cash items.

- The gross profit for the three months ending 31st March 2024 was LKR 176.8 million, a significant increase of 53% from the same period in the previous year, which had a gross profit of LKR 115.9 million.

- The cost of sales for the year ended 31st March 2024 was LKR 979.8 million, which is a 4% increase from the previous year’s cost of sales of LKR 942.1 million.

hSenid Business Solutions PLC (hBS) reported total revenue of LKR 433.0 million for the three months ending on March 31, 2024 recording a year-over-year growth of 10.7 percent (21.1 percent in USD constant currency terms) compared to LKR 391.0 million in the corresponding quarter of the previous financial year. For the full year FY24, hBS generated a total revenue of LKR 1,645.3 million, recording a 12.4 percent year-over-year growth (19.6 percent in USD constant currency terms).

hBS recorded a net loss of LKR 155.3 million for the quarter which was inclusive of c. LKR 102 million in one-off non-cash items comprising LKR 57 million in forex losses, LKR 22 million in gratuity provisions and LKR 23 million in deferred tax expenses on account of reversals in debtor provisions. As a result, during the quarter, our normalised EBITDA margins (earnings before depreciation, amortisation, interest and taxes) declined to –7.8 percent from –3.9 percent in 3Q FY24 and –2.5 percent in 4Q FY23.

The PeoplesHR Cloud business continues to be the primary driver of the company’s top line, generating a revenue of LKR 249.7 million and recording a year-over-year growth of 36.0 percent (50.8 percent in USD constant currency terms) during the quarter. This was supported by recurring subscription revenues in the segment, which accounted for 40.3 percent of total revenues, contributing to the overall recurring revenue base of the company. Total company recurring revenues accounted for approximately 54.0 percent of the total revenue for the fourth quarter, while for the full year, total recurring revenues stood at 57.0 percent of total revenues.

From a regional standpoint, Sri Lanka and Middle East & Africa (MEA) region contributed to the topline growth during the quarter. MEA region revenues included both new projects and revenues from the Ugandan Government project, which entered its third and final phase of implementation.

During the quarter, the company’s core exit ARR (Annualized Recurring Revenue) recorded a figure of USD 3.1 million which amounts to a year-over-year growth of 39 percent in constant currency terms. The core exit ARR generated by the PHR Cloud business recorded a robust 53 percent year-over-year growth demonstrating the strength of the key segment of the business that has been driving growth.

New deals for the quarter recorded a very strong USD 1.6 million with demand driven by MEA and South Asia regions. MEA new deals witnessed strong demand for PeoplesHR On-Premise product, which accounted for 62.7 percent of total new deals. For the full year however, PeoplesHR Cloud accounted for 61.5 percent of new deals compared to 47.2 percent in the previous year. The average deal value for the full financial year continued to increase significantly in line with the strategy to focus on a smaller number of larger deals.

With the company having fully utilized the IPO funds allocated for product and market development during 3Q FY24, hBS is currently assessing multiple options for the utilization of the remaining IPO funds worth LKR 350.0 million, earmarked for pursuing inorganic growth opportunities.

The quarter saw hBS continue to invest in events aimed at positioning the PeoplesHR brand and also to drive cloud adoption among On-Premise clients. We continue to close monitor event spend on track the impact generated to the business.

Looking at FY25, our key focus remains on building further traction in the APAC region by positioning our brand as a leading HR Technology player. We continue to reap benefits from our investments over the past year in the region, and believe it will be a key contributor to the PeoplesHR cloud business, driving recurring revenues of the company. Furthermore, the year will also see further collaborations with our partner network to broaden our customer reach and increase market footprint. With a majority of our

talent acquisition in place, these efforts will be supported by our product development, engineering and implementation functions, with a renewed focus on maintaining a strong ARR growth trajectory.