Based on the provided interim financial statements for Union Assurance PLC for the quarter ended 31st March 2024, the company has shown a positive financial performance with several indicators of profitability improving compared to the same period in the previous year. Here’s an analysis of the key financial metrics:

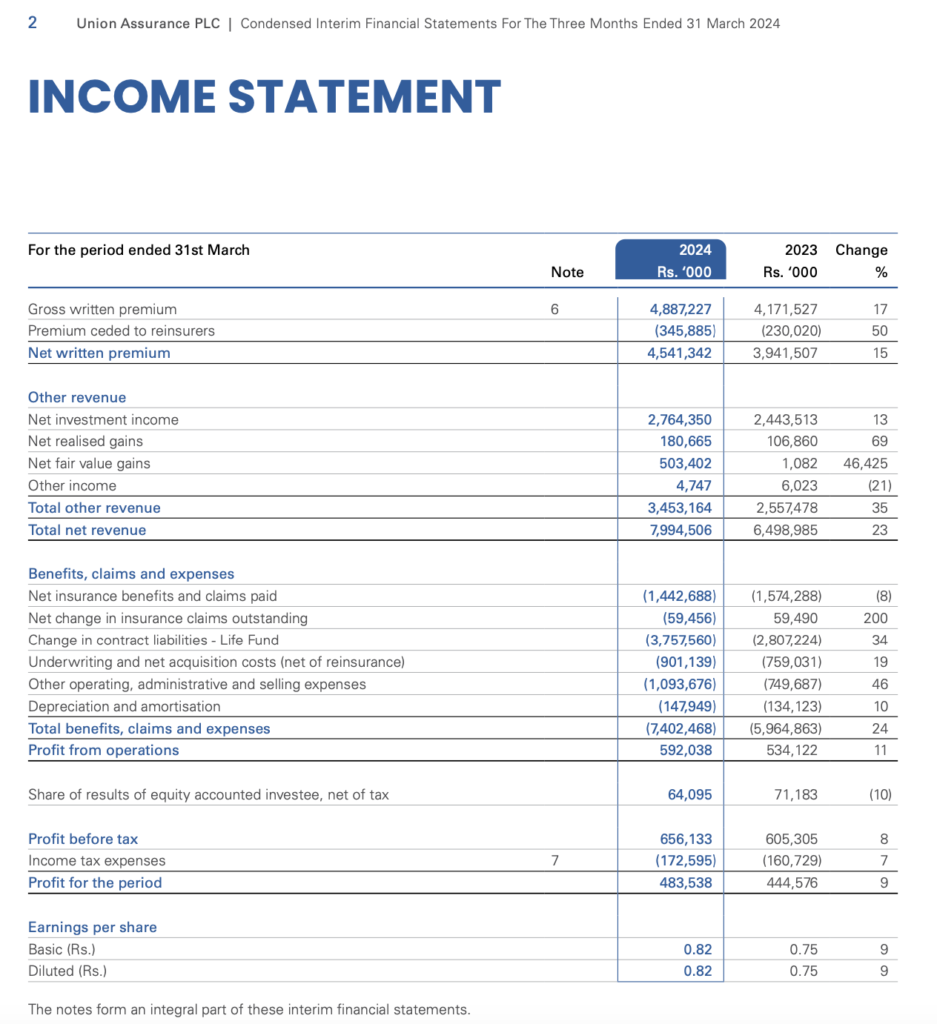

- Gross Written Premium (GWP): The GWP increased by 17% to Rs. 4,887,227,000 in Q1 2024 from Rs. 4,171,527,000 in Q1 2023. This suggests that the company has been successful in generating more business, which is a positive sign for growth.

- Premium Ceded to Reinsurers: There was a 50% increase in the premiums ceded to reinsurers, which could indicate a strategic decision to manage risk exposure by transferring more risk to reinsurers.

- Net Written Premium: After accounting for the ceded premiums, the net written premium grew by 15% to Rs. 4,541,342,000 in Q1 2024 from Rs. 3,941,507,000 in Q1 2023. This growth is slightly lower than the GWP growth rate due to the higher increase in ceded premiums.

- Net Investment Income: The company’s net investment income increased by 13% to Rs. 2,764,350,000 in Q1 2024 from Rs. 2,443,513,000 in Q1 2023, indicating effective investment strategies and possibly favorable market conditions.

- Net Realised Gains: There was a significant 69% increase in net realised gains, from Rs. 106,860,000 in Q1 2023 to Rs. 180,665,000 in Q1 2024, which could be attributed to the company’s successful realization of investments.

- Fair Value Reserve: The fair value reserve for available-for-sale financial assets increased by 29% to Rs. 206,561,000 in Q1 2024 from Rs. 160,507,000 in Q1 2023, indicating an appreciation in the value of the company’s investment portfolio.

- Profit for the Period: The profit for the period increased by 9% to Rs. 483,538,000 in Q1 2024 from Rs. 444,576,000 in Q1 2023, reflecting overall profitability growth.

- Earnings Per Share: The earnings per share (EPS) of Union Assurance PLC for the year Q12024 was Rs. 0.82. The EPS represents an increase from 1Q2023 of Rs. 0.75.

- Net Asset Value: The net assets per share of Union Assurance PLC as at 31st March 2024 were Rs. 34.21. This a decrease from the Rs 41.00 reported as at 31st December 2023.

The financial performance of Union Assurance PLC in the first quarter of 2024 demonstrates a solid growth trajectory in terms of premium collection, investment income, and overall profitability. The company’s strategic decisions in managing its investment portfolio and risk exposure through reinsurance appear to be contributing positively to its financial health. Investors and stakeholders might view these results favorably, as they suggest a robust business model capable of generating increased revenue and profits.

Strength and Weaknesses

Based on the provided context from the Union Assurance PLC Annual Report for December 2023, here are some strengths and weaknesses of Union Assurance PLC compared to other insurance companies in the Sri Lankan market:

Strengths:

- Market Position: Union Assurance PLC is one of the top players in the Sri Lankan life insurance market, with a significant market share. The company is part of the John Keells Group, which is one of the largest listed conglomerates on the Colombo Stock Exchange, providing it with a strong backing and reputation.

- Distribution Channels: The company has a robust performance of its distribution channels, particularly the agency channel, which is the primary engine of growth, contributing to 74% of its Gross Written Premium (GWP).

- Digital Presence: Union Assurance PLC is focusing on becoming a fully-fledged digital and customer-centric insurer, which is a competitive advantage in the evolving insurance landscape.

- Product Offering: The company offers a well-crafted portfolio of life insurance products and has taken measures to offer differentiated products to cater to the latent and emergent needs of customers.

- Customer Base: The company has a substantial customer base, insuring over 280,000 Sri Lankans, and has expanded its footprint by relocating branches and improving customer experience.

Weaknesses:

- Competition: The Sri Lankan life insurance market is intensely competitive, with the top five players, including Union Assurance, accounting for 77% of GWP. High price competition and low industry penetration present challenges.

- Market Penetration: Despite being a major player, the overall low industry penetration in the Sri Lankan market indicates that there is still a significant portion of the population that is uninsured or underinsured.

- Innovation and Differentiation: While the company is working on offering differentiated products, the intense competition requires continuous innovation to stay ahead, which can be a challenge in a market with high price sensitivity.

- External Factors: The company operates in a challenging macroeconomic environment, which can affect consumer spending power and investment returns, potentially impacting the company’s profitability and growth.

- Regulatory Environment: As with any insurance company, Union Assurance PLC must navigate a complex regulatory environment that can impact its operations and strategic decisions.

It’s important to note that these strengths and weaknesses are relative and can change over time as the company adapts to market conditions, regulatory changes, and competitive pressures. Additionally, the company’s strategic initiatives, such as expanding its agency channel and optimizing bancassurance partnerships, are designed to leverage its strengths and address its weaknesses.