Based on the provided context from the annual report for the year ended 31st March 2024, Asian Hotels and Properties PLC has shown a significant improvement in financial performance and profitability compared to the previous year.

Here are some key financial highlights:

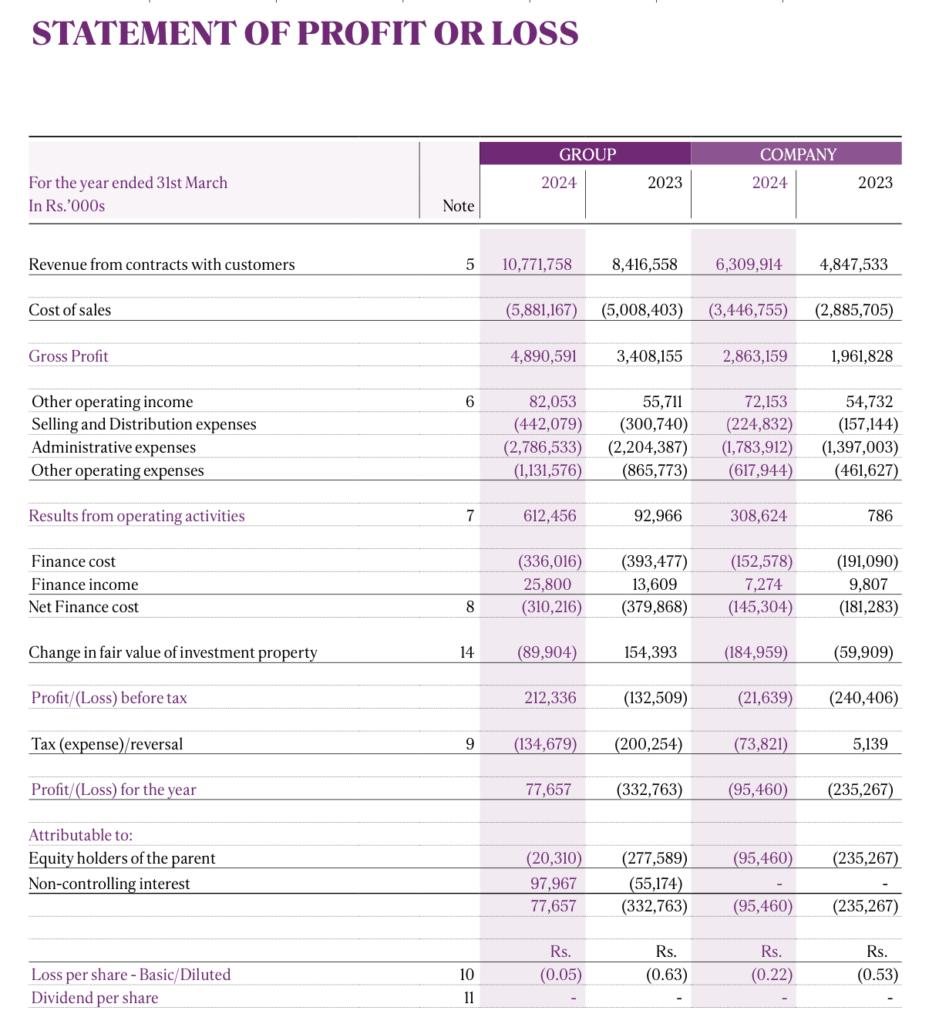

- Revenue increased to Rs. 10,771,759,000 in 2024 from Rs. 8,416,558,000 in 2023, which is a substantial growth of approximately 28%.

- Profit after taxation for the year 2024 was Rs. 77,657,000, which is a turnaround from a loss after taxation of Rs. (332,763,000) in 2023.

- The profit/(loss) attributable to equity owners improved from a loss of Rs. (277,589,000) in 2023 to a loss of Rs. (20,310,000) in 2024, indicating a significant reduction in losses.

- The company did not pay dividends in 2024, similar to the previous years, which could be a strategy to retain earnings for reinvestment and growth.

- The group’s operational performance also improved with an operating profit of Rs. 612,000,000 in 2024 compared to Rs. 93,000,000 in 2023.

- Profit before tax was Rs. 212,000,000 in 2024, recovering from a loss before tax of Rs. (133,000,000) in 2023.

The improvement in profitability can be attributed to increased revenue and effective cost management. The company’s strategy to navigate through challenging times and its commitment to constant improvement seem to have yielded positive results.

When evaluating the financial performance of Asian Hotels and Properties PLC, it is important to consider these figures in the context of the company’s long-term strategy, market conditions, and operational efficiency. The data suggests that the company has managed to improve its financial health and is on a path to recovery after a challenging period.

Future Outlook

The future outlook for Asian Hotels and Properties PLC appears to be positive based on the information provided in the annual report for the year ended 31st March 2024. Here are some key points that contribute to the company’s optimistic future prospects:

- Global Tourism Recovery: According to the United Nations World Tourism Organisation (UNWTO), there is an expected full recovery to pre-pandemic levels in the calendar year 2024, with an estimated 2% growth above 2019 levels. This bodes well for Asian Hotels and Properties PLC, which operates in the tourism sector.

- Economic Contribution: The World Travel and Tourism Council (WTTC) projects that tourism will contribute an all-time high of USD 11.1 trillion to the global economy in 2024. As a player in this industry, Asian Hotels and Properties PLC is well-positioned to benefit from this growth.

- Strategic Initiatives: The company has rolled out strategic initiatives focused on talent management, including attractive remunerations, continued training and development, and initiatives to enhance employee engagement. This is aimed at cultivating a motivated and productive team, which is crucial for long-term success.

- Investment in Technology: Asian Hotels and Properties PLC has invested in new IT platforms, advanced analytics, and business intelligence. This investment in technology is expected to lead to swifter customer interactions, internal efficiencies, and information-driven decisions that align with the company’s strategic aspirations.

- Corporate Governance: The company has a comprehensive corporate governance framework, which provides a solid foundation to navigate through various challenges and achieve sustainable economic growth and corporate success.

- Group Structure and Support: The company benefits from its industry leadership, the support of its ultimate parent company, John Keells Holdings PLC, and its capacity to innovate novel experiences for guests.

- Awards and Recognition: The company has received accolades such as the Gold Award for the Leading Food and Beverage Hotel of South Asia 2023, which affirms its excellence in performance and can enhance its reputation and attract more customers.

However, the company also acknowledges potential headwinds, including a challenged global economy with persistent inflation, high interest rates, volatile oil prices, and geopolitical conflicts. These factors could impact the global tourism industry and, by extension, the company’s performance.

Overall, the company’s strategic focus on talent management, embracing technology, and leveraging its strong corporate governance structure, combined with the projected growth in global tourism, suggests a favorable outlook for Asian Hotels and Properties PLC. However, it will be important for the company to remain adaptable and responsive to external economic and geopolitical challenges.