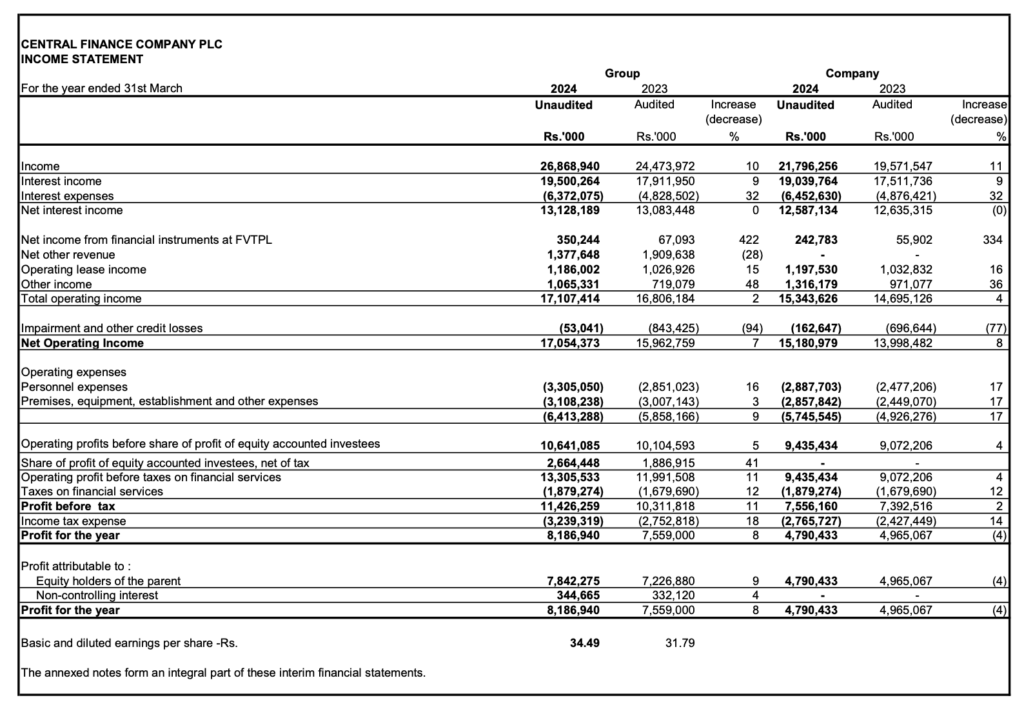

For the year ended 31st March 2024, Central Finance Company PLC reported the following profitability metrics:

- Profit for the year: Rs. 8,186,940,000, which is an 8% increase from the previous year’s profit of Rs. 7,559,000,000.

- Basic and diluted earnings per share (EPS): Rs. 34.49, up from Rs. 31.79 in the previous year, indicating a growth in profitability on a per-share basis.

- Return on Average Assets after tax (annualized): 5.02%, a slight decrease from the previous year’s 5.22%. Return on Average Equity after tax (annualized) is 9.96% for the year 2024.

- Capital Adequacy: The company’s regulatory capital adequacy ratios are well above the minimum requirements, with a Tier 1 Capital Adequacy Ratio of 54.52% and a Total Capital Adequacy Ratio of 54.88% in 2024.

- Loan Ratios: The Gross Stage 3 Loans Ratio, which indicates the quality of the loan portfolio, improved to 6.46% in 2024 from 10.21% in 2023, suggesting better asset quality.

- Equity Changes: The Statement of Changes in Equity shows that the company has maintained its capital structure, with the stated capital remaining constant at Rs. 2,230,286,000 from 2022 through 2024.

These figures suggest that Central Finance Company PLC has improved its absolute profit figures, although there has been a slight decrease in the return on assets and equity, which could be due to a variety of factors including an increase in the asset base or equity. The increase in earnings per share indicates that the company has become more profitable in terms of earnings generated per share of stock, which is generally a positive sign for investors.

As of 31st March 2024, Central Finance Company PLC reported total assets amounting to Rs. 121,534,113,000. This represents an increase from the previous year’s total assets, which were Rs. 106,728,885,000 as of 31st March 2023.

The asset composition for the year ended 31st March 2024 includes the following key items:

- Cash and cash equivalents: Rs. 905,389,000

- Fair value through profit or loss financial assets: Rs. 3,908,515,000

- Securities bought under repurchase agreements: Rs. 6,200,535,000

- Financial assets at amortised cost – Debt and other financial instruments: Rs. 28,971,594,000

- Financial assets at amortised cost – Loans and receivables from customers: Rs. 5,958,437,000

- Investments in equity accounted investees: Rs. 14,532,496,000

- Unallocated assets: Rs. 1,025,342,000

- The Net Asset Value (NAV): The Net Asset Value (NAV) of Central Finance Company PLC as of 31st March 2024 is Rs 299.32

The increase in total assets reflects the company’s growth and its ability to expand its asset base over the financial year. The detailed breakdown of assets provides insight into the company’s investment strategies and the areas where it has allocated its resources.