- Loan book grows by Rs 20 bn. in 3 months, amidst FX impacts

- CASA ratio improves to 40.51%, positively supporting NII

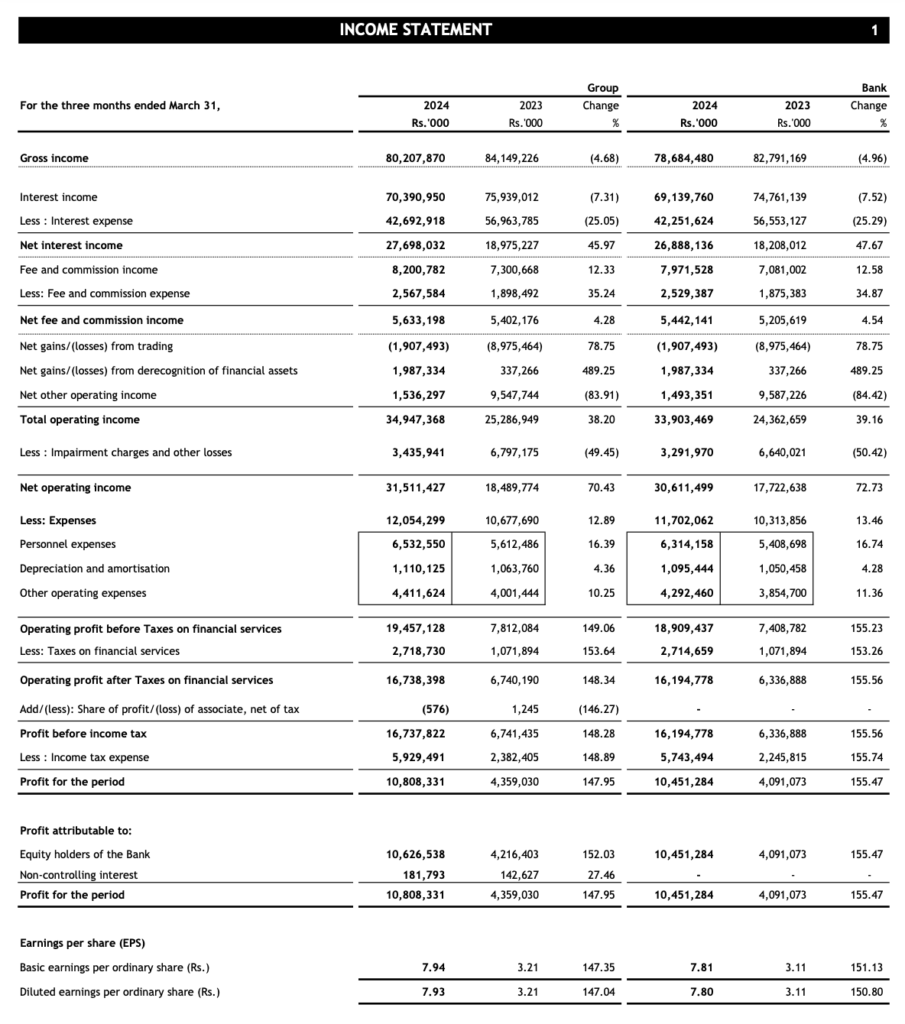

- Net interest income up 45.97% to Rs 27.7 bn.

- Total taxes increase by over 150% to Rs 8.6 bn.

The Commercial Bank of Ceylon Group has ended the first quarter of 2024 with a loan book of Rs 1.316 trillion, continuing the Bank’s focus on lending in a period where the appreciation of the Rupee negatively impacted the value of the loan book and resulted in a contraction of the balance sheet.

The Group reported a net increase of Rs 20 billion in its loan book in the first three months of the year and Rs 129 billion in the 12 months ending 31st March 2024, averaging Rs 10.75 billion per month and achieving YoY growth of 10.87% in gross loans and advances.

Comprising of Sri Lanka’s biggest private sector bank, its subsidiaries and an associate, the Group reported in a filing with the Colombo Stock Exchange (CSE) that the value of deposits declined by a marginal 0.33% to Rs 2.141 trillion in the first quarter of 2024 largely due to the appreciation of Rupee against the Dollar, but had grown by Rs 117 billion or 5.80% over 12 months. However, the total Rupee deposits of the Group recorded a growth of Rs 41.256 billion or 2.94% during the first quarter of 2024.

Total assets stood at Rs 2.616 trillion as at 31st March 2024, a decrease of 1.48% consequent to a revaluation of the Group’s assets in foreign currency in line with the appreciation of the Rupee in the period under review.

The Group posted gross income of Rs 80.208 billion for the quarter under review, down 4.68% over the corresponding period of 2023 primarily due to a decrease in interest income to Rs 70.391 billion, which reflected a YoY decline of 7.31% due to the considerable reduction in market interest rates on loans and government securities.

However, a noteworthy improvement of over 3% in the CASA ratio of the Bank from 37.08% a year ago to 40.51% as at 31st March 2024 coupled with a repricing of deposits in keeping with market movements, saw interest expenses reducing by 25.05% to Rs 42.693 billion for the quarter under review. Consequently, net interest income for the three months improved by 45.97% to Rs 27.698 billion.

Total operating income of the Group for the quarter grew by 38.20% to Rs 34.947 billion. The Group made provisions of Rs 3.436 billion for impairment charges and other losses, a reduction of 49.45% from the corresponding quarter’s figure of Rs 6.797 billion in 2023 which included a substantial provision made for foreign currency bonds. As a result, net operating income increased by 70.43% to Rs 31.511 billion.

With total operating expenses for the three months amounting to Rs 12.054 billion which reflected a growth of 12.89%, the Group reported operating profit before taxes on financial services of Rs 19.457 billion for the quarter, achieving a growth of 149.06%.

Taxes on financial services increased by 153.64% to Rs 2.719 billion, leading to a profit before tax of Rs 16.738 billion for the three months at Group level, an improvement of 148.28%. Income tax for the three months increased by 148.89% to Rs 5.929 billion, resulting in a net profit of Rs 10.808 billion for the quarter, reflecting a growth of 147.95%.

Taken separately, Commercial Bank of Ceylon PLC reported a profit before tax of Rs 16.195 billion and profit after tax of Rs 10.451 billion for the quarter, posting growths of 155.56% and 155.47%, respectively, for the reviewed quarter.

The Bank reported its Tier 1 and Total Capital Ratios at 11.366% and 14.873% respectively as at 31st March 2024, both above the statutory minimum ratios of 10% and 14% respectively. The Bank’s interest margin improved to 4.22% for the quarter compared to 3.32% for 2023. The Bank’s return on assets (before tax) stood at 2.54% compared to 1.27% for 2023 while its return on equity grew to 19.53% from 9.78% for 2023.

In terms of asset quality, the Bank’s impaired loans (Stage 3) ratio stood at 5.59% compared to 5.85% at end 2023, while its impairment (Stage 3) to Stage 3 loans ratio improved to 44.60% as at 31st March 2024 compared to 43.22% at end 2023. In terms of liquidity, the Bank’s consolidated liquid assets ratio (Sri Lankan Operations) stood at 43.52% compared to 46.06% at the end of 2023. The minimum statutory requirement for liquid asset ratio is 20%.

The largest private sector bank in Sri Lanka and the first Sri Lankan bank to be listed among the Top 1000 Banks of the World, Commercial Bank operates a strategically-located network of branches and 964 automated machines island-wide, and is the largest lender to Sri Lanka’s SME sector. Commercial Bank has the widest international footprint among Sri Lankan banks, with 20 outlets in Bangladesh, a Microfinance company in Myanmar, and a fully-fledged Tier I Bank with a majority stake in the Maldives.