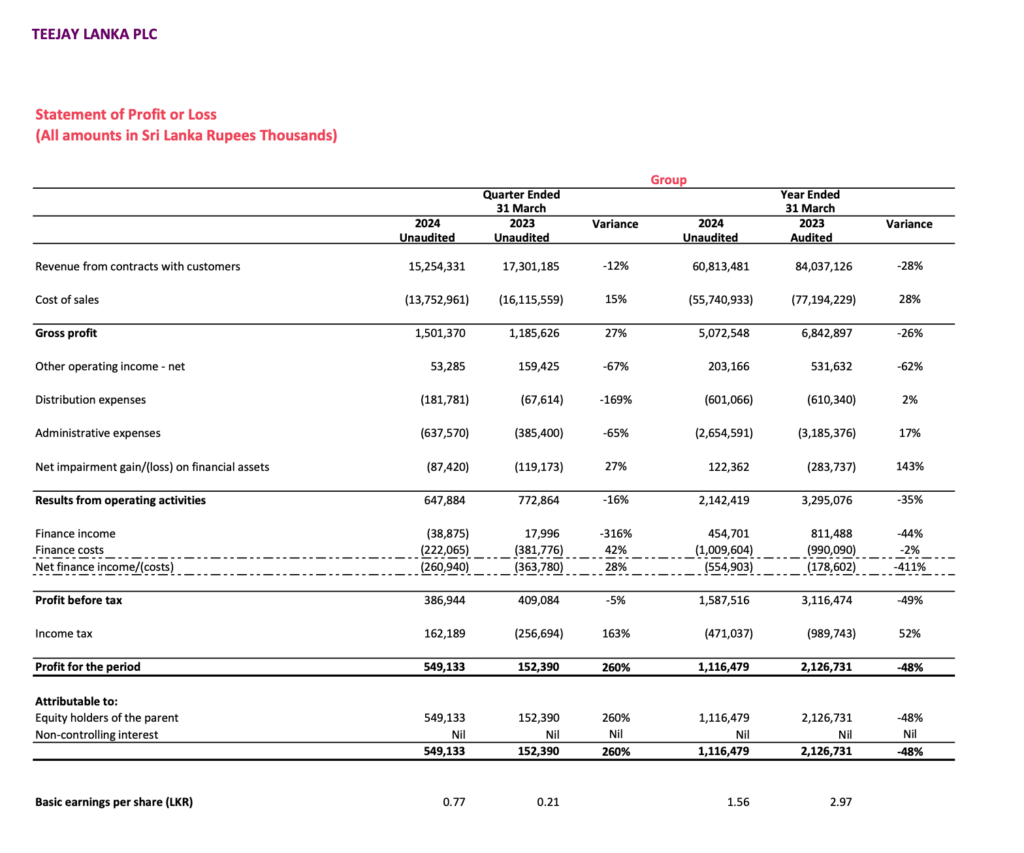

Teejay Group closed the fourth quarter of FY 2023/24 with an outstanding Profit After Tax improvement of 260% YoY, and 15% improvement QoQ, signifying a positive end to the financial year under review. The positive improvements were achieved due to timely execution of strategic initiatives implemented during the period under review, including stringent inventory management initiatives and efficient cost reduction strategies.

Group revenue for the period was reported as LKR 15.3 Bn, a 12% decrease when compared same period of the previous financial year, and 4% decrease QoQ. Despite the decrease, the Group has reported a Gross Profit of LKR 1.5 Bn, representing a 27% increase YoY, and a 17% increase when compared to Q3 of the same financial year as a result of the effective utilizing of the Group’s capacity within its two locations. Further optimising capacity utilisation and operational efficiency and the sustained stability in yarn prices has positively contributed to the growth of the Group’s gross profit.

The Profit Before Tax of the Group for the quarter stood at LKR 0.4 Bn, reflecting a 5% decrease when compared to the same period of the previous financial year due the appreciation of the LKR. Further, the administration and distribution costs of the Group for the period under review increased by 44% and 169% respectively.

The Group has concluded the financial year with a strong balance sheet with notable cash and cash equivalents balance of LKR 8.9 Bn and Net Asset Base of LKR 30.1 Bn, with a value of LKR 42 Net Asset Per Share, representing a 6% decrease when compared to the same quarter of the previous financial year. The reason for the change can be cited as the strengthening of the LKR against the USD.

The consistent challenges presented by ongoing industry uncertainties have prompted the Group to respond proactively by entering a recovery phase. This involves implementing strategies such as identifying new customer bases, introducing novel product segments, investing in advanced infrastructure, and enhancing skills to adapt to evolving industry dynamics. These initiatives position Teejay Group effectively to meet the evolving needs of a dynamic market.

The Group’s long-term priorities include digitalization, establishing and executing a robust ESG framework, reducing costs, developing new products, enhancing synthetic capacity, and uplifting and empowering human capital to enhance resourcefulness. These strategies are expected to come into effect in the upcoming financial year, indicating promising prospects for the future thus enabling the Group to mitigate the impact of identified pressures, volatilities, and challenges.

The financial performance of Teejay Lanka PLC for the year ended 31st March 2024 can be analyzed based on the data extracted from the interim financial statements. Here are the key points:

- Revenue: The company’s revenue from contracts with customers for the year ended 31st March 2024 was LKR 60,813,481,000, which represents a decrease of 28% compared to the previous year’s revenue of LKR 84,037,126,000.

- Cost of Sales: The cost of sales for the year ended 31st March 2024 was LKR 55,740,933,000, which is a 28% decrease from the previous year’s LKR 77,194,229,000.

- Gross Profit: The gross profit for the year ended 31st March 2024 was not explicitly stated, but it can be calculated by subtracting the cost of sales from the revenue, which would result in a gross profit of LKR 5,072,548,000.

- Profit for the Period: The profit for the year ended 31st March 2024 was LKR 2,759,191,000, which is a 20% decrease from the previous year’s profit of LKR 3,453,412,000.

- Basic Earnings Per Share (EPS): The basic earnings per share for the year ended 31st March 2024 was LKR 3.85, which is a decrease from the previous year’s EPS of LKR 4.82.

- Cash and Cash Equivalents: The cash and cash equivalents at the end of the period on 31st March 2024 were LKR 7,219,085,000, slightly lower than the previous year’s LKR 7,351,402,000.

- Total Comprehensive Income: The total comprehensive income for the year ended 31st March 2024 was not provided in the context provided. However, it would typically include the profit for the period and other comprehensive income such as actuarial gains or losses on defined benefit obligations and deferred tax relating to those items.

- Non-Current Assets: The non-current assets as at 31st March 2024 were LKR 18,231,778,000 for property, plant, and equipment, LKR 703,360,000 for capital work-in-progress, and LKR 606,389,000 for intangible assets.

- Dividends: Information regarding dividends for the year ended 31st March 2024 was not provided in the context.

The decrease in revenue and profit indicates that Teejay Lanka PLC faced challenges during the year ended 31st March 2024. The reduction in cost of sales in line with the decrease in revenue suggests that the company managed its costs proportionately. However, the overall decrease in profitability as evidenced by the lower EPS and profit figures would be a concern for stakeholders and could impact the company’s share price and investment attractiveness. It is important for potential investors to consider these factors and also look at the broader economic and industry-specific conditions that may have influenced the company’s performance during this period.