Richard Pieris & Company Reports Strong Q3 Growth with 161% Profit Surge

Colombo, February 15, 2025 – Richard Pieris and Company PLC (RICH.N0000) has posted an impressive financial performance for the nine months ending December 31, 2024, with a 161% increase in net profit, reaching Rs. 3.73 billion, compared to Rs. 1.43 billion in the previous year. Revenue and Profitability on the Rise The group’s total revenue rose by 4% to Rs.…

Adani Withdraws from $1 Billion Sri Lanka Wind Power Project

Colombo, February 12, 2025 – LankaBIZ: In a major development, Adani Green Energy Limited (AGEL) has announced its withdrawal from the proposed $1 billion renewable wind power project in Sri Lanka. The decision comes after over two years of negotiations with the Ceylon Electricity Board (CEB) and various government bodies regarding the establishment of 484…

Hunas Holdings PLC: A Promising Diversified Investment with Strong Growth Potential

Hunas Holdings PLC (HUNA.N0000) is emerging as one of Sri Lanka’s most strategically diversified conglomerates, establishing a robust presence in hospitality, real estate, renewable energy, and agriculture. The company has garnered significant attention from foreign investors, particularly from Japan, due to its high-growth business model and undervalued market position. While the company presents significant upside potential, investors should remain cautious, as…

Sri Lanka Stock Market: FAT LADY SINGS!

The Sri Lankan stock market, much like a grand opera, seemed to be hitting all the right notes before its dramatic fall. Investors were euphoric, indices were soaring, and trading volumes surged, creating an illusion of unstoppable growth. “It ain’t over ’til (or until) the fat lady sings” is a colloquialism which is often used as…

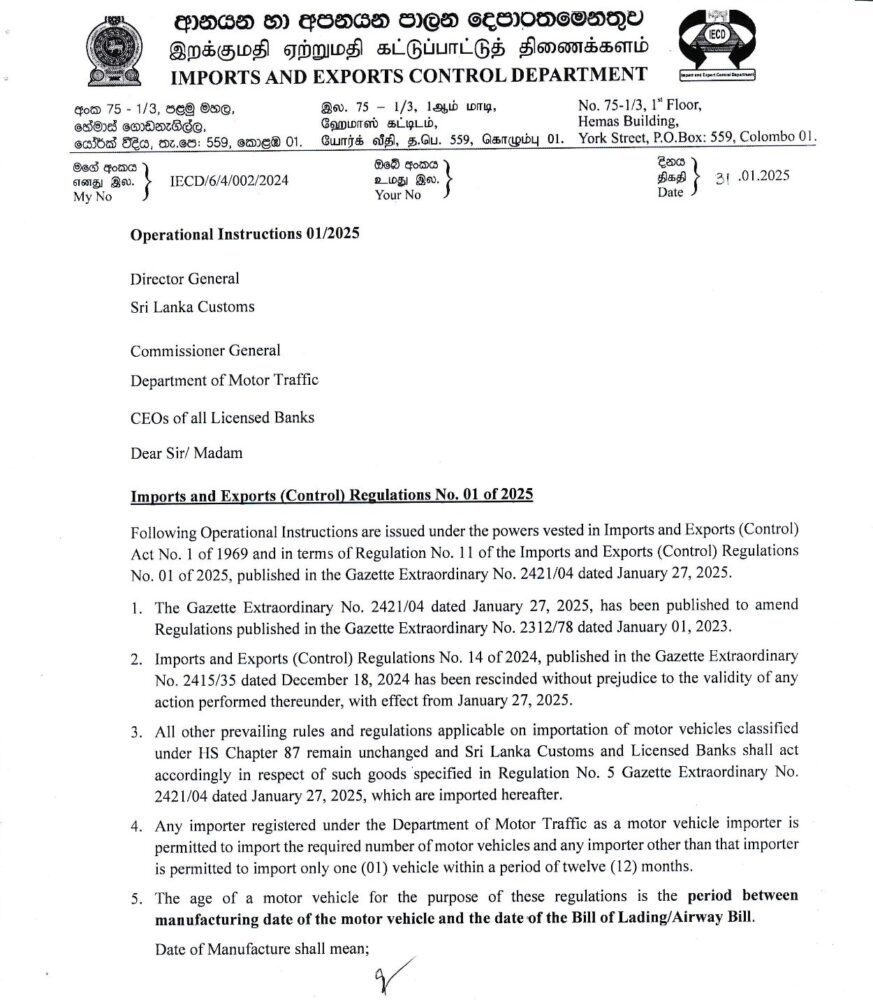

Sri Lanka Updates Motor Vehicle Import Regulations

The Sri Lankan government has introduced new operational instructions under the Imports and Exports (Control) Regulations No. 01 of 2025, significantly affecting motor vehicle importation. These changes, detailed in the Gazette Extraordinary No. 2421/04 dated January 27, 2025, are aimed at regulating vehicle imports while maintaining existing policies under HS Chapter 87. Under the new…

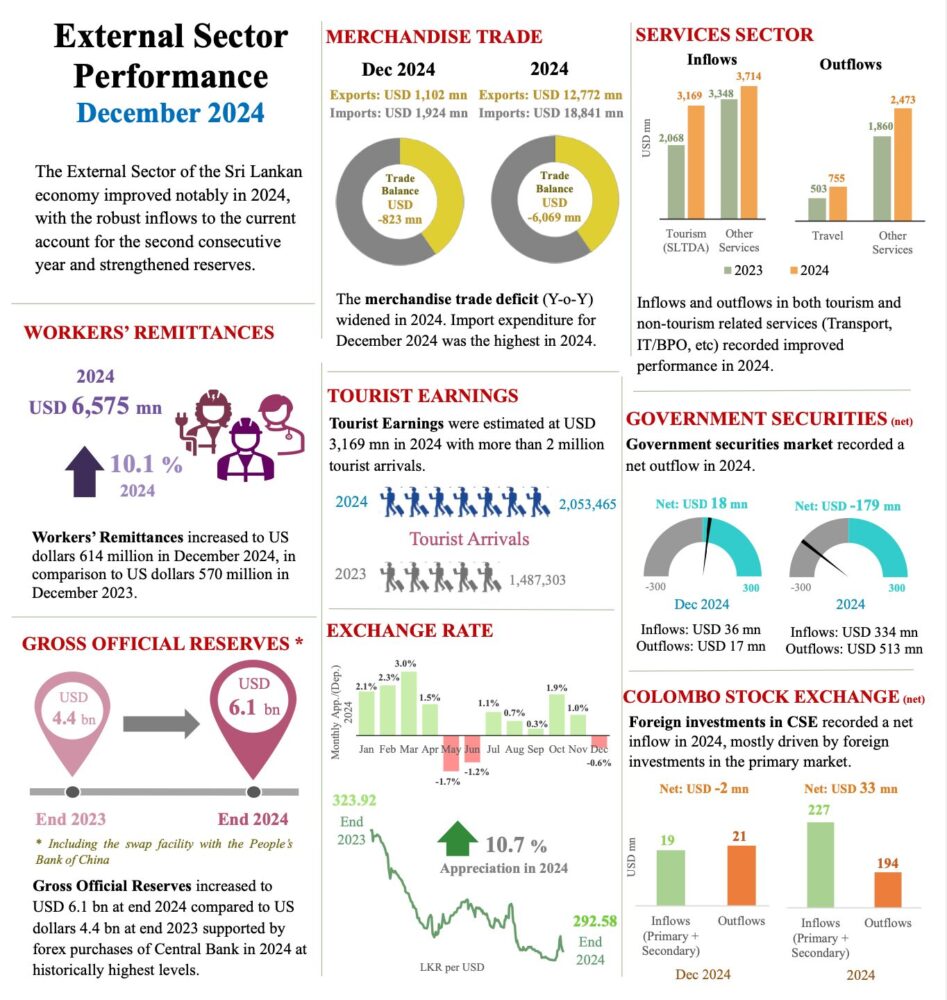

Sri Lanka’s External Sector Performance in 2024: A Year of Resilience and Growth

The Sri Lankan economy experienced a notable improvement in its external sector performance in 2024, bolstered by robust inflows into the current account for the second consecutive year. Despite challenges in merchandise trade, substantial growth in tourism earnings, workers’ remittances, and a strengthened foreign reserves position underscored the nation’s economic resilience. Trade Balance and Merchandise…

Sri Lanka’s Tourism Industry: Resurgence, Historical Trends, and Investment Opportunities

Tourism has long been a key pillar of Sri Lanka’s economy, contributing significantly to foreign exchange earnings and employment. Despite facing multiple disruptions—including the 2019 Easter Sunday attacks, the COVID-19 pandemic, and economic instability—the industry is experiencing a strong resurgence, with record-breaking arrivals and revenue growth in 2024. Historical Tourism Revenue Trends The chart below illustrates the fluctuations in Sri Lanka’s tourism…

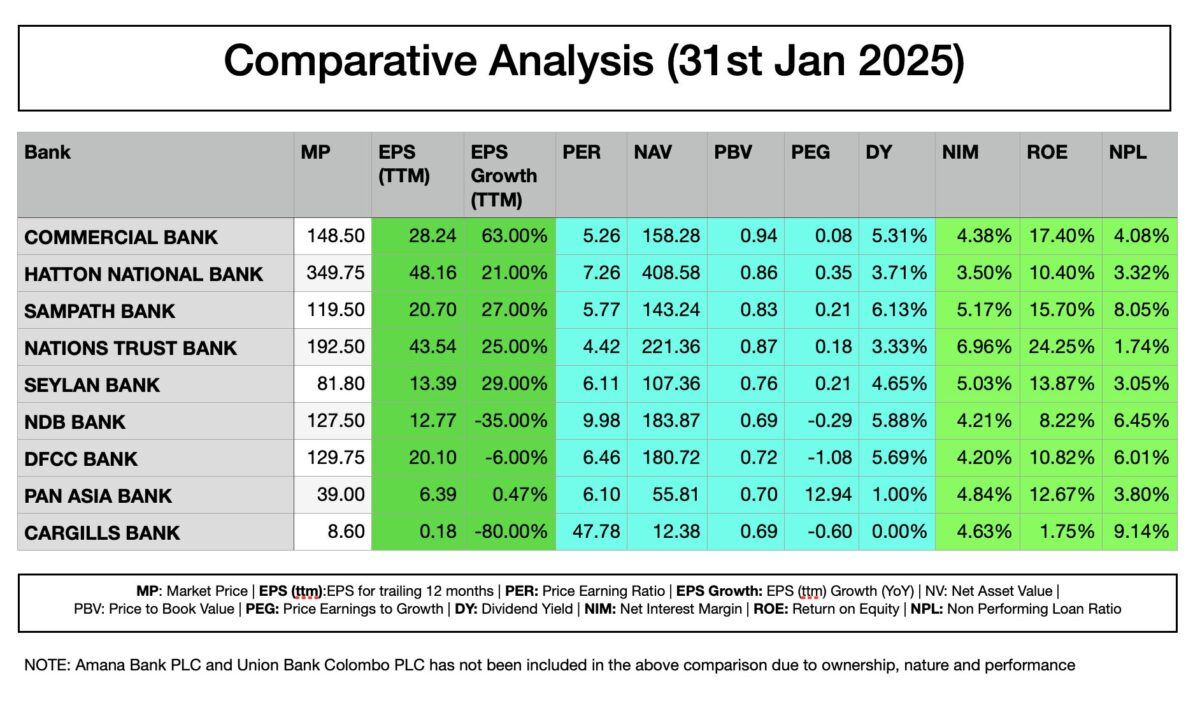

Banking Sector – Comparative Analysis

Based on the Comparative Analysis of the banking sector, investors should consider key financial metrics such as EPS growth, Price-to-Book Value (PBV), Return on Equity (ROE), and Net Interest Margin (NIM) before making investment decisions. Several banks present strong growth potential, while others carry higher risks or limited upside. Among the top investment choices, Nations…

Chat2Find: Revolutionizing AI-Powered Assistance in Sri Lanka

Colombo, January 31, 2025 — Chat2Find, a pioneering AI company specializing in conversational artificial intelligence, has significantly expanded its suite of services tailored for the Sri Lankan market. Building upon its commitment to provide real-time, unbiased information, the company has introduced three specialized AI-driven platforms: LankaTAX, LankaLAW, and LankaBIZ. LankaLAW: AI Legal Advisor LankaLAW serves as…

Sri Lanka Lifts Vehicle Import Ban: Opportunity for Motor & Finance Sector Companies

The Sri Lankan government has lifted its long-standing ban on motor vehicle imports, a policy originally introduced in 2020 to mitigate the country’s balance of payments crisis. This decision, announced via a gazette issued on January 27, 2025, allows the import of various vehicle categories, including small passenger cars under 1000cc, commercial vehicles, and specialized…

Hayleys Leisure PLC Reports Strong Revenue Growth Amid Profitability and Liquidity Challenges

Colombo, January 25, 2025 — Hayleys Leisure PLC has reported a notable financial recovery for the nine months ending December 31, 2024, with revenue climbing 20% year-on-year to Rs. 786.3 million. The growth was driven by heightened customer activity in the leisure sector, supported by improved occupancy rates and favorable market conditions. Gross profit also rose…

LB Finance PLC: Navigating Challenges with Resilience

LB Finance PLC, a prominent player in Sri Lanka’s financial services sector, has showcased remarkable resilience in its financial performance during the nine months ended December 31, 2024. Amidst an economic environment fraught with challenges, the company has managed to achieve growth in key areas while addressing notable constraints. Key Financial Highlights: The company reported…

Vallibel Finance Shows Strong Profitability Amid Mixed Revenue Trends

January 19, 2025 – Colombo: Vallibel Finance PLC has reported a robust surge in net profitability despite challenges in revenue generation during the quarter ended December 31, 2024. The company’s net profit climbed 51.1% year-on-year to LKR 718.6 million, underpinned by reduced impairment charges and cost discipline. However, gross income fell by 2.6% to LKR 4.82…

Impact of Electricity Tariff Reduction in Sri Lanka

Colombo Sri Lanka, January 19, 2025 (LankaBIZ) – Sri Lanka’s Minister of Energy, Kumara Jayakody, has announced the government’s commitment to reducing electricity tariffs as recommended by the Public Utilities Commission of Sri Lanka (PUCSL). The initial phase, implemented on January 17, 2025, features a 20% overall reduction in electricity bills, with a long-term plan…

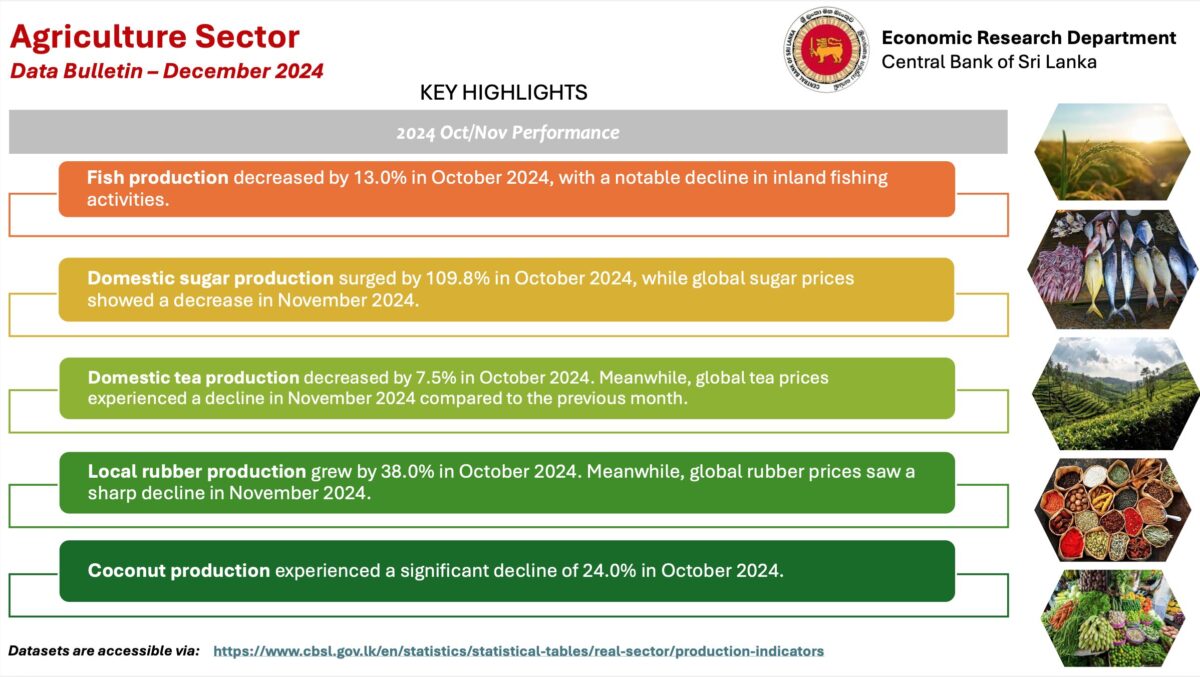

Agriculture Sector Performance and Growth Prospects

The agriculture sector demonstrates resilience amidst global and local challenges, with targeted interventions capable of driving sustainable growth. Innovations, policy support, and market diversification will be pivotal in realizing the sector’s full potential. By 2025, agriculture’s contribution to GDP is expected to expand, reflecting the sector’s critical role in food security and export earnings. Key…

Sri Lanka: External Sector Performance Forecast for 2025

Overview Sri Lanka’s external sector in 2025 is projected to build on the recovery seen in 2024, approaching or surpassing the levels achieved in 2019—a pre-pandemic benchmark of economic stability. The growth will be underpinned by improving reserves, expanding trade and service sector inflows, a robust tourism recovery, and stable remittances. By comparing the performance…

Exclusive Online Trading Offer for Colombo Stock Market

Start an Online Trading Account with ACAP Stock Brokers today and enjoy an array of exclusive benefits. Exclusively for Small Investors. Terms and Conditions Initial Deposit To qualify for the offer, investors must deposit a minimum of Rs.500,000/- in cash or an equivalent value in shares. The share portfolio will be valued as of the…

Sri Lanka’s Crypto Conundrum: A Tale of Two Realities

Colombo Sri Lanka, 17 Jan 2025 (LankaBIZ) – Sri Lanka’s stance on cryptocurrency remains hesitant, reflecting broader national concerns over economic stability, regulatory readiness, and technological infrastructure. Despite a growing global shift toward digital assets, the country’s regulatory framework has yet to establish a cohesive stance on cryptocurrencies. However, within this backdrop of uncertainty, a…

The Colombo Stock Exchange (CSE): Opportunity for foreign investors

Colombo, Sri Lanka, Jan 5, 2024 (LANKABIZ) – The Colombo Stock Exchange (CSE) is poised for potential long-term growth, driven by macroeconomic reforms, structural adjustments, and improved investor sentiment. Despite current challenges, the All Share Price Index (ASPI) is likely to exhibit upward momentum, with a potential to reach 22,000 points in the medium term…

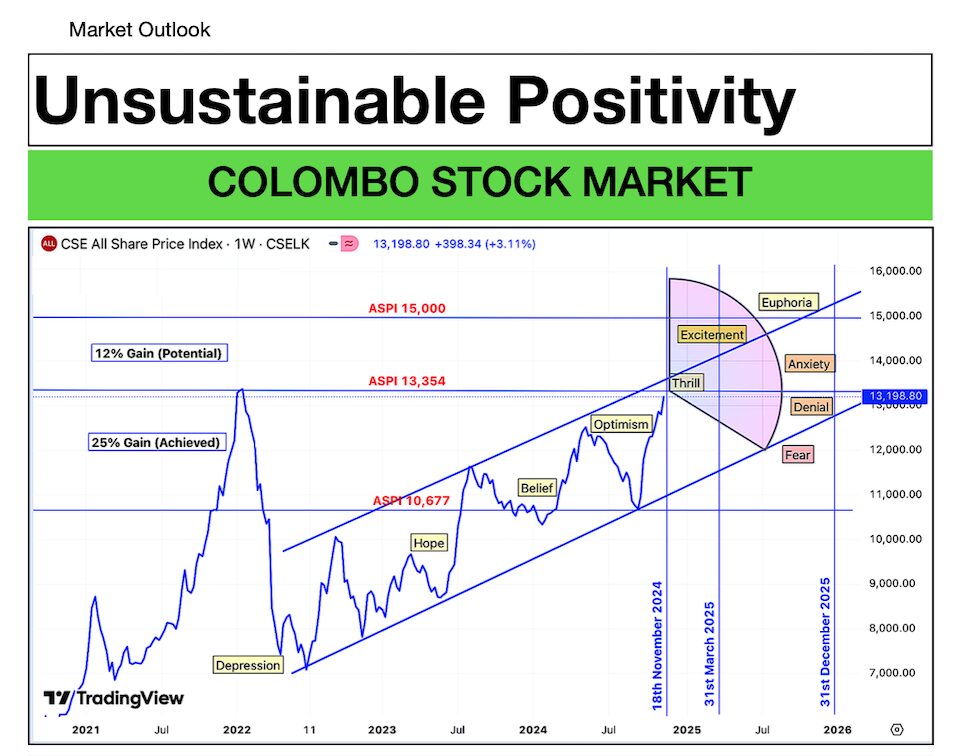

Colombo Stock Market: Unsustainable Positivity

In the wake of President Anura Kumara Dissanayake’s election, the Colombo Stock Exchange (CSE) experienced a notable surge, with the All Share Price Index (ASPI) reaching unprecedented highs. This upward momentum was largely driven by investor optimism surrounding anticipated political reforms and economic recovery. The recent rally was predominantly sentiment-driven, lacking substantial economic improvements to…

LVL Energy Fund PLC faces Financial Constraints due to investments in Bangladesh

Colombo, Sri Lanka (LankaBIZ), Nov 27, 2024 – LVL Energy Fund PLC faced cash flow constraints during the six months ended 30th September 2024 due to delays in receiving dividend from its foreign Investments. These delays stemmed from prolonged dividend payments by key foreign investee companies, exacerbated by currency conversion challenges and regulatory restrictions in…

Sri Lanka Launches Landmark $12.5 Billion Debt Swap to Resolve Default Crisis

Colombo, Sri Lanka (LankaBIZ) Nov 27, 2024 – Sri Lanka has initiated an offer for investors to exchange $12.5 billion in dollar bonds for new reduced debts, marking a pivotal step toward resolving the country’s first-ever external default. The proposal, announced on Tuesday, gives investors until December 12 to decide, with many bondholders signaling support…

Adani controversy to Impact John Keells Holdings PLC’s future Profitability?

Colombo Sri Lanka (LankaBIZ), Nov 25, 2024 -The Colombo West International Terminal (CWIT) project, partially owned by Adani Ports (51%), John Keells Holdings (34%), and the Sri Lanka Ports Authority, has secured $553 million in funding from the U.S. International Development Finance Corporation (DFC). This project aims to develop a deep-water container terminal at the…

Plantation Sector Companies – Comparative Analysis 3Q 2024

Colombo, Sri Lanka (LankaBIZ) Nov 22, 2024 – As per the latest comparative analysis carried out based on financial statements as of 30th September 2024, Talawakelle, Maskeliya, and Udupussellawa lead the plantation sector with their strong returns on equity, low PERs, and efficient profitability. Other strong performers like Balangoda, Bogawantalawa, Agarapatana, Agalawatta, and Watawala plantations…