LB Finance PLC, a prominent player in Sri Lanka’s financial services sector, has showcased remarkable resilience in its financial performance during the nine months ended December 31, 2024. Amidst an economic environment fraught with challenges, the company has managed to achieve growth in key areas while addressing notable constraints.

Key Financial Highlights:

- Revenue Performance: Total income declined by 7% year-on-year to Rs. 34.9 billion, driven by a 10% drop in interest income to Rs. 31.7 billion.

- Net Interest Income: Increased by 3% to Rs. 19.1 billion, supported by a 25% reduction in interest expenses.

- Fee and Commission Income: A significant growth of 37%, reaching Rs. 3.1 billion, highlighted the company’s success in diversifying its revenue streams.

- Profitability: Profit after tax rose by 5% to Rs. 7.2 billion, reflecting effective cost management despite a 12% rise in operating expenses.

- Asset Base Growth: Total assets expanded by 8% to Rs. 219.3 billion, driven by a 15% increase in loans and receivables.

The company reported a total income of Rs. 34.9 billion for the period, a 7% decline from the Rs. 37.7 billion recorded in the same period of 2023. This drop was largely attributed to a 10% reduction in interest income, which fell to Rs. 31.7 billion. However, LB Finance countered this decline with a 37% surge in fee and commission income, reaching Rs. 3.1 billion. This growth signifies a strategic pivot toward non-interest income streams, ensuring revenue diversification amidst fluctuating interest rates.

Net interest income rose marginally by 3% to Rs. 19.1 billion, driven by a sharp 25% reduction in interest expenses. Meanwhile, profit after tax increased by 5% to Rs. 7.2 billion, reflecting the company’s strong focus on cost management despite a 12% rise in operating expenses due to higher personnel and depreciation costs.

The company also reported an 8% growth in total assets, which reached Rs. 219.3 billion, buoyed by a notable 15% increase in loans and receivables. Deposits rose by 7% to Rs. 132.6 billion, strengthening the company’s funding base. However, liquidity challenges emerged, with cash and cash equivalents falling by 34% to Rs. 6.3 billion, underscoring the need for enhanced liquidity management strategies.

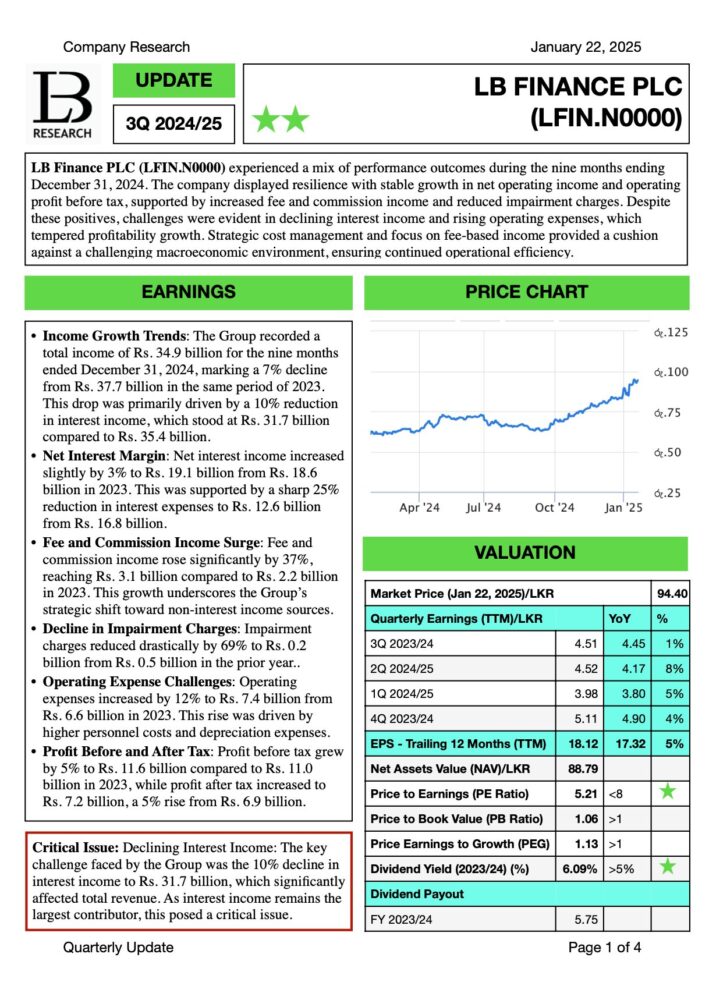

Shareholder confidence remained strong, with the company’s share price climbing significantly from Rs. 62.30 in December 2023 to Rs. 89.50 in December 2024. Key performance indicators, such as a price-to-earnings ratio of 5.21 and a dividend yield of 6.09%, further highlighted the company’s financial appeal.

Looking ahead, LB Finance PLC aims to sustain growth through strategic initiatives such as enhancing non-interest income, expanding its lending portfolio, and stabilizing interest margins. The company’s ability to navigate liquidity challenges and manage operational costs effectively will be critical in maintaining its financial resilience.

While macroeconomic headwinds, including inflation and regulatory changes, remain concerns, LB Finance PLC’s proactive measures and strategic focus position it well for continued growth and stability.

LB Finance PLC: A Valuation Perspective

LB Finance PLC’s strong financial performance and robust operational strategies have underscored its attractiveness in the equity market. The company’s valuation metrics further reinforce its status as a promising investment, offering both stability and growth potential to shareholders.

The company’s Price-to-Earnings (P/E) ratio stands at 5.21, reflecting a significant undervaluation compared to the market average. This suggests that investors are currently paying just 5.21 times the company’s earnings, offering an opportunity to capitalize on its earnings potential.

Similarly, the Price-to-Book (P/B) ratio of 1.06 highlights that the company’s market price is closely aligned with its book value. This indicates a fair valuation, providing assurance to investors that they are acquiring shares at a price that reflects the company’s net asset value.

The Price-to-Earnings Growth (PEG) ratio of 1.13 suggests that the company’s growth is reasonably priced. This metric, which accounts for earnings growth, positions LB Finance as a well-balanced investment option with a sustainable growth trajectory.

Dividend investors are also likely to find LB Finance appealing, as the company boasts a dividend yield of 6.09%. This is significantly higher than the market average, offering a consistent and attractive return for income-focused investors.

In addition, LB Finance’s Net Asset Value (NAV) per share increased by 11.9% year-on-year to Rs. 88.79 as of December 31, 2024. This growth reflects the company’s ability to enhance shareholder equity through improved profitability and retained earnings.

The company’s share price performance has mirrored its financial success, rising from Rs. 62.30 in December 2023 to Rs. 89.50 in December 2024, a testament to investor confidence. This increase is backed by consistent earnings growth and strategic focus on operational efficiency, further solidifying its position as a top pick in the financial services sector.

In conclusion, LB Finance PLC presents an attractive valuation story, characterized by low P/E and P/B ratios, high dividend yields, and steady growth in NAV. Coupled with its strong operational performance and strategic initiatives, the company remains well-positioned to deliver long-term value to its shareholders.

Download Research Report