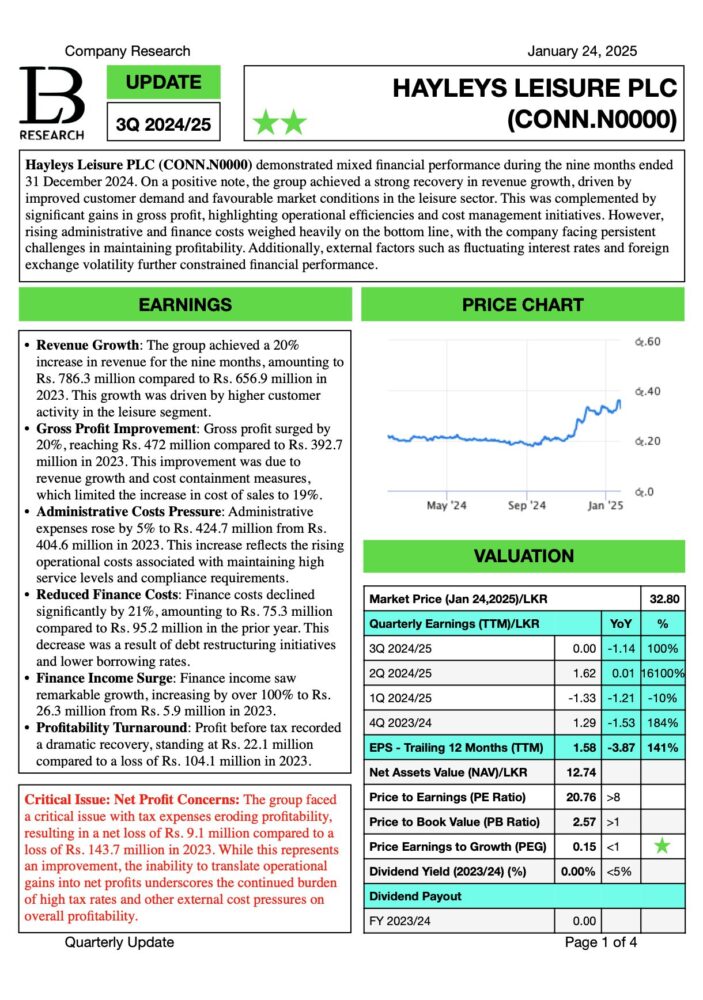

Colombo, January 25, 2025 — Hayleys Leisure PLC has reported a notable financial recovery for the nine months ending December 31, 2024, with revenue climbing 20% year-on-year to Rs. 786.3 million. The growth was driven by heightened customer activity in the leisure sector, supported by improved occupancy rates and favorable market conditions.

Gross profit also rose by 20%, reaching Rs. 472 million, reflecting the company’s ability to manage costs effectively despite escalating operational pressures. Administrative expenses increased by a modest 5% to Rs. 424.7 million, attributed to efforts to maintain service quality and adhere to regulatory requirements.

The company achieved a significant milestone, reporting a profit before tax of Rs. 22.1 million, a dramatic turnaround from a loss of Rs. 104.1 million during the same period in 2023. However, high tax expenses of Rs. 31.2 million overshadowed operational gains, leading to a net loss of Rs. 9.1 million for the quarter.

Key Highlights

- Finance Costs: A sharp 21% reduction in finance costs to Rs. 75.3 million, resulting from debt restructuring initiatives and lower borrowing rates.

- Finance Income: Over 100% growth in finance income to Rs. 26.3 million, providing a boost to profitability.

- Gross Profit Margin: Improved slightly to 60%, up from 59.7% in the previous year.

- Liquidity Challenges: Net cash and cash equivalents worsened to a negative Rs. 580.4 million, underscoring the group’s reliance on overdrafts and strained short-term financial flexibility.

Strategic Moves and Market Confidence

Despite challenges, Hayleys Leisure PLC continues to implement measures to improve its financial standing. The group repaid significant portions of long-term debt, reducing its debt-to-equity ratio to 1.34x from 1.60x at the start of the year. Additionally, current assets rose by 30% due to improved revenue streams and expanded customer credit facilities.

Market confidence in Hayleys Leisure PLC remains high, with its share price reaching Rs. 32.80 as of January 24, 2025, up from Rs. 21.00 in the prior year. The Price-to-Earnings (PE) ratio stood at 20.76, reflecting investor optimism about the company’s growth trajectory.

Future Outlook

The global tourism recovery is expected to further bolster the company’s performance, with increasing tourist arrivals anticipated to drive revenue and occupancy rates. Management’s emphasis on operational efficiency, cost containment, and debt reduction aims to strengthen profitability in the long term. However, persistent challenges such as high tax rates, rising trade receivables, and liquidity constraints will require close attention.

While Hayleys Leisure PLC is on the path to recovery, external factors, including fluctuating interest rates and foreign exchange volatility, pose potential risks to its financial performance.

As the company navigates these hurdles, its strategic focus on growth and efficiency underscores its resilience and commitment to long-term value creation.

Download Research Report