Profitability and Financial outlook of Overseas Realty PLC as of 31st March 2024

As of 31st March 2024, the latest financial data for Overseas Realty PLC indicates the following: The financial outlook for Overseas Realty PLC as of 31st March 2024 shows a mixed performance with a decrease in profitability but improvements in liquidity and a reduction in debt relative to equity. The decrease in PAT and EPS…

Compare Corporate Performance between Companies

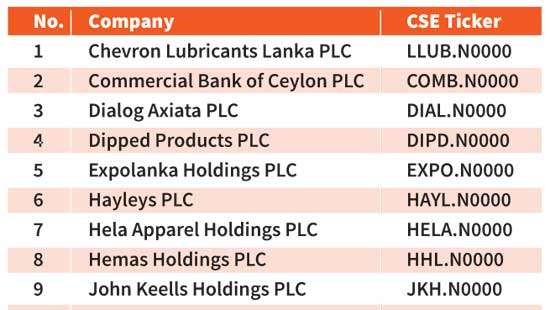

JKH Vs Melstacorp When comparing the future prospects of John Keells Holdings PLC (JKH) with Melstacorp PLC, it’s important to consider their respective business segments, market positions, and strategies for growth. Both companies are diversified conglomerates with different focuses, which can impact their future performance. John Keells Holdings PLC (JKH): Melstacorp PLC: This Analysis was…

SWOT Analysis of Three Acre Farms PLC

Based on the provided context from the Three Acre Farms PLC Annual Report for December 2023, a SWOT analysis can be conducted as follows: Strengths: Weaknesses: Opportunities: Threats: This SWOT analysis provides a snapshot of the internal and external factors that could affect Three Acre Farms PLC’s business. It should be noted that for a…

Ceylon Grain Elevators PLC: Financial Performance and Future Outlook

Ceylon Grain Elevators PLC’s latest financial performance for the year ending 31 December 2023, as reported in their annual report, shows a significant improvement in profitability and financial strength. Here are the key highlights and future outlook based on the provided data: Financial Performance and Profitability: Key Ratios: Future Outlook: The company has demonstrated remarkable…

Capital Alliance PLC (CALT) declares a phenomenal Interim dividend of LKR 15/= per share

As of the latest available information, Capital Alliance PLC (CALT) has demonstrated a strong financial performance during the FY 2023/24 and announced a phenomenal interim dividend of LR 15 per share, whilst all key indicators reflecting a solid financial position and future growth prospects. Here are the details based on the provided context: Dividend: Dividend…

Ceylon Tobacco Company PLC: Latest Financial Performance and future outlook

Ceylon Tobacco Company PLC’s latest financial performance for the year ended 31 December 2023, as reported in their annual report, indicates the following: Financial Performance and Profitability: Key Ratios: Future Outlook:The company’s future developments are discussed in the reviews by the Chairman, the Managing Director & CEO, and the Finance Director. The Sri Lankan economy…

Sri Lanka Telecom: Latest Financial Performance and Future Outlook

The financial performance of Sri Lanka Telecom PLC for the year ending 31 December 2023, as detailed in their annual report, indicates a challenging economic environment. The company faced a contraction in the Sri Lankan economy, rising costs, and fluctuations in exchange and interest rates, which created a complex business environment. Key financial highlights from…

eChanneling PLC: Financial Performance and Future Outlook

The latest financial performance of eChannelling PLC, as per the provided context from the Annual Report for December 2023, indicates the following key figures: The company faced economic headwinds and market volatility, which led to increased operating costs and impacted profitability. Despite these challenges, eChannelling PLC managed to increase its revenue and maintain a strong…

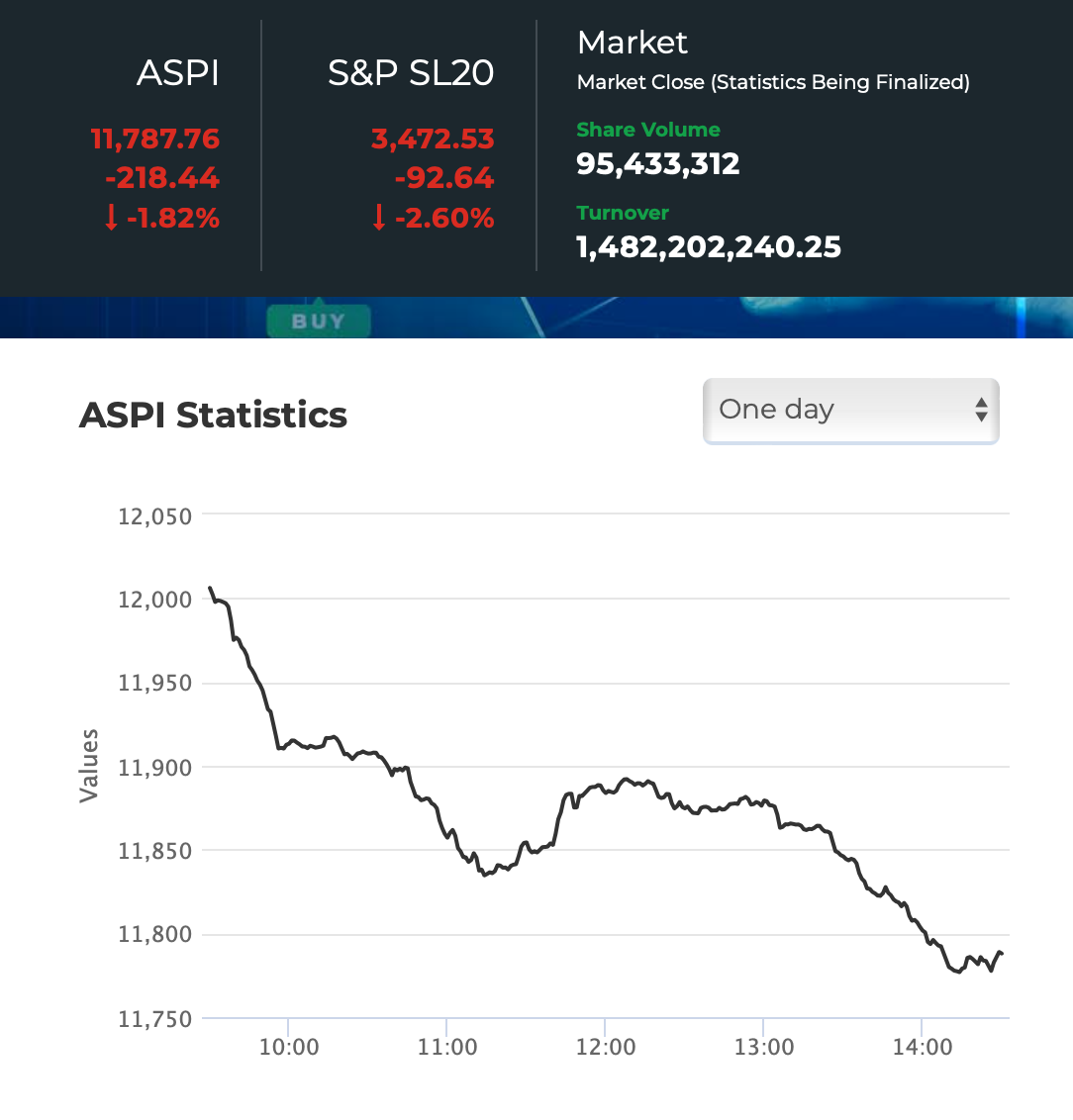

Sri Lanka : Early Warning Signals of possible economic downturn

Colombo Stock Market reported sharp decline on April 16, 2024 signalling Early Warning Signal (EWS) of a possible economic downturn due to following factors reported by Sri Lanka Press. Sri Lanka fails to reach deal on restructure terms with bondholders Sri Lanka has failed to strike an agreement on restructuring about $12 billion of debt…

Sri Lanka Tourism: Future Prospects and Challenges

The future outlook for Sri Lanka’s tourism sector is cautiously optimistic, with growth scenarios indicating potential increases in international tourist arrivals. The “Tourism Growth Scenario 2024”, a time series analysis conducted by the Tourism Development Authority of Sri Lanka in February 2024 outlines two primary scenarios for 2024: These figures are based on a time…

Sampath Bank PLC: Robust Financial Performance in FY 2023

Sampath Bank PLC demonstrated a robust financial performance for the fiscal year 2023, as indicated in the annual report. The bank’s total operating income reached Rs 91.0 billion, primarily consisting of net interest income of Rs 72.3 billion and net fee and commission income of Rs 18.9 billion. A significant achievement for the bank was…

Sri Lanka: Palm Oil Industry Outlook

The outlook for the palm oil plantation industry in Sri Lanka is complex and subject to various economic, environmental, and policy factors. Here are some key points to consider based on the provided context: Given the dynamic nature of the industry and the evolving policy landscape, stakeholders in the palm oil industry in Sri Lanka…

Rights Issue of shares

A Rights Issue is a method by which a company raises additional capital by offering existing shareholders the opportunity to purchase additional shares directly from the company in proportion to their existing holdings within a fixed time period. The procedure for a Rights Issue, as outlined in the context provided, involves several key steps: This…

Sub division of shares

Sub-division of shares, also known as a stock split, is a process by which a company increases the number of its outstanding shares by dividing each share into multiple shares, without changing the company’s stated capital. This means that while the number of shares increases, the total value of the shares held by each shareholder…

TAL lanka Hotel PLC: Latest Financial position and profitability

latest financial position and profitability of TAL Lanka Hotels PLC (formerly known as Taj Lanka Hotels PLC) can be summarized from the interim financial statements for the year ended 31st March 2024: These figures indicate that TAL Lanka Hotels PLC has experienced a substantial increase in revenue and has turned around its profitability from a…

Learn CSE Rules and Regulations with the help of AI Assistant

LankaBIZZ helps you find answers and to be knowledgeable about the Stock Market Rules and Regulations through AI. Listing & Trading Rules, CDS & Clearing House Rules, Dispute resolution Rules. Ask many questions as you like. www.lankabizz.net Example Questions & Answers How to list a company on CSE? To list a company on the Colombo Stock…

Future Outlook and current Financial Performance of Prime Residencies PLC (PLR)?

Based on the context provided, here is the current financial performance and future outlook for Prime Lands Residencies PLC (PLR): Current Financial Performance: Above analysis and information is compiled by LankaBIZ (GPT) – Sri Lanka’s First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any listed company in Sri…

Financial performance of Dipped Products plc

The financial performance of Dipped Products PLC can be analyzed based on the interim financial data provided in the context. Here are some key points derived from the documents: These points provide an overview of the financial performance of Dipped Products PLC based on the interim financial statements for the period ending 31/12/2023. The data…

Technical outlook of CSE all share index?

The technical outlook for the CSE All-Share index, as of April 10, 2024, 12:20 PM GMT, is as follows: Below Technical analysis and information is compiled by LankaBIZ (GPT) – Sri Lanka’s First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any listed company in Sri Lanka.www.lankabizz.net The specific…

Get Research Papers of any listed Company in Sri Lanka for free

Now you can get research papers based on financial performance of any listed company in Sri Lanka instantly through LankaBIZ AI Simply type the prompt: “Research Report on the Financial Performance and future outlook of COMPANY NAME” on LankaBIZ AI Chat interface and get your research paper instantly. You can also ask questions about future…

Top AI Tools in Sri Lanka

Find below the Top GPT’s and AI Tools for Sri Lanka listed on the basis of skill and knowledge. Top GPT’s | ChatGPT Apps General Chat Reviews ChatGPT ChatGPT is an AI-powered language model developed by OpenAI. It has been trained on a massive amount of text data from the internet and can generate human-like…

Access Engineering PLC current financial status and future outlook

Access Engineering PLC (AEL.N0000) has shown an improvement in revenue and profitability in the period ended 31st December 2023 compared to the previous year. The company has also managed to reduce its debt to equity ratio significantly, indicating a stronger balance sheet. The interest cover ratio has improved, suggesting better earnings relative to interest expenses.…

Latest financial status and future outlook of Arpico Insurance PLC

Arpico Insurance PLC has Reported as loss of LKR 625mn for the FY2023 (Unaudited). This Loss of LKR 9/= per share has eroded the shareholders equity by massive 23% to LKR 1,470mn. Poor performance mainly attributable to high Actuarial Provisions and Inefficient Management of Insurance Funds. Latest Financial Status as of December 2023: Latest Accounts…

Cargills Bank PLC: Financial Status and Future Outlook

Cargills Bank PLC’s annual and interim financial statements for December 2023, we can analyze the bank’s latest profitability, financial status, and future growth prospects. Profitability: Financial Status: This analysis and information is compiled by LankaBIZ (GPT) – Sri Lanka’s First ever AI Assistant for Stock Market and Research. Click below link to ask questions about any…