Category: Stock market

Market Confidence Wavers as Sri Lanka Faces Severe Infrastructure Damage and Escalating Debt Pressures

Sri Lanka’s recent surge in investor optimism is unlikely to last, arguing that the country’s recovery remains “extremely fragile” especially in light of the devastating cyclone and floods that ravaged parts of the island this month. The assessment notes that the popular narrative of Sri Lanka being an “undervalued investment opportunity” stands in stark contrast

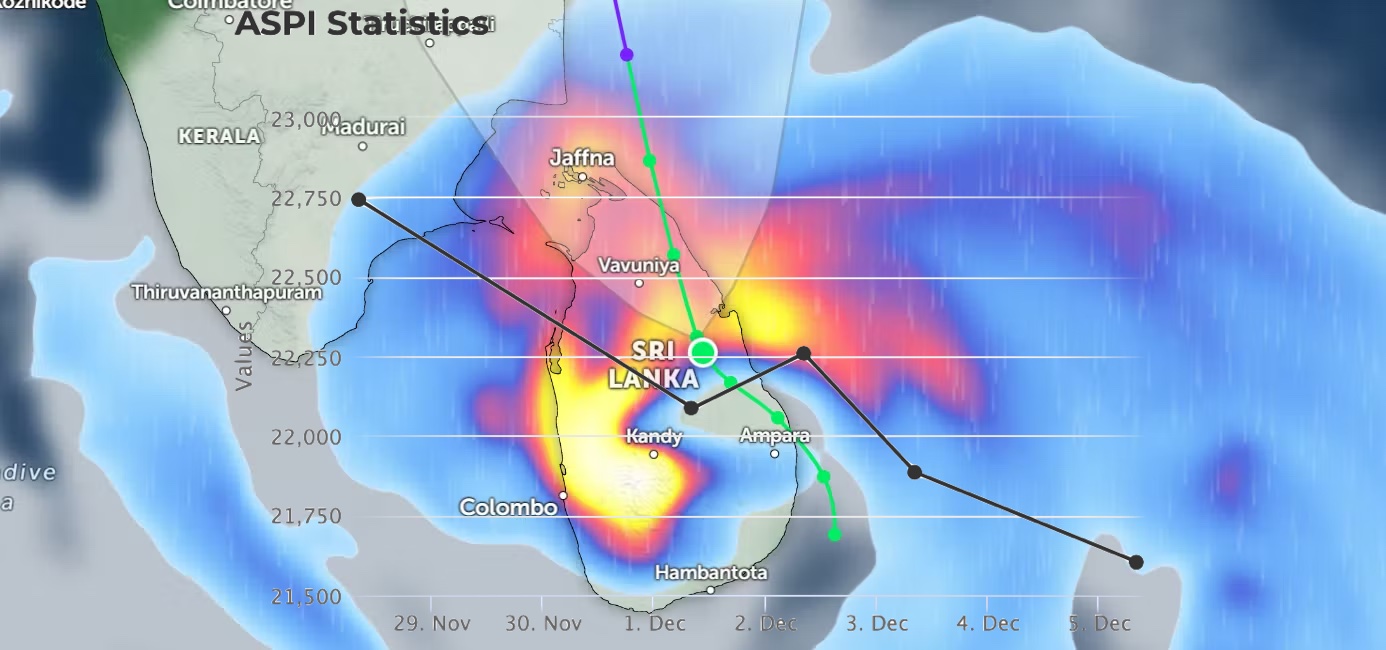

Sri Lanka’s Listed Sector Outlook Reshaped by Cyclone Ditwah

Sri Lanka’s corporate landscape is set to enter a period of sharply diverging performance as Cyclone Ditwah drives sector-specific disruptions and opportunities. While the disaster has triggered widespread flooding and damaged connectivity across all districts, its economic consequences are expected to produce clear winners and losers within equity markets over the coming year. Insurance: Claims

Arpico Insurance PLC – 1Q 2025 Performance Review

Review of Arpico Insurance PLC Interim Financial Statements – Quarter 1 – 2025. 1. Executive Summary: Arpico Insurance PLC’s performance in the first quarter of 2025 shows a significant decrease in profitability compared to the same period in 2024. While total net revenue saw a reduction primarily driven by lower gross written premium, total benefits,

Hatton National Bank (HNB) Q1 2025 Financial Performance

Review of Hatton National Bank PLC (HNB) Financial Performance for the Three Months Ended 31st March 2025 1. Executive Summary: Hatton National Bank (HNB) demonstrated strong financial performance in the first quarter of 2025, setting a solid foundation for future growth. The Bank and Group reported significant increases in Profit After Tax (PAT), primarily driven

Asia Capital Eyes Turnaround Amid Rs 783 Mn Inflow and New Leadership

March 30, 2025 Colombo Sri Lanka (LankaBIZ) – Asia Capital PLC on of the oldest listed companies in Sri Lanka established in 1991 is set for a remarkable financial turnaround in the upcoming fiscal year, buoyed by a significant Rs 783 million capital inflow from the sale of minority shareholdings in three companies. This strategic

Investment Outlook for the Sri Lanka Stock Market Based on Budget 2025

The Sri Lanka Budget 2025 has introduced significant policy changes that will impact different industries in the Colombo Stock Exchange (CSE). Based on the proposed budgetary allocations, government priorities, and economic direction, we can identify sectors that are poised for growth and those that face challenges. This article provides an in-depth analysis of?the top shares

Hayleys PLC Posts Record Profits, But Sustainability Concerns Loom

Colombo, February 15, 2025 (LankaBIZ)– Hayleys PLC, one of Sri Lanka’s largest diversified conglomerates, has reported an impressive financial performance for the nine months ended December 31, 2024, driven by strong revenue growth, operational efficiencies, and strategic cost management. Robust Revenue Growth and Profitability The group’s revenue increased by 12% to Rs. 363.54 billion, compared to Rs.

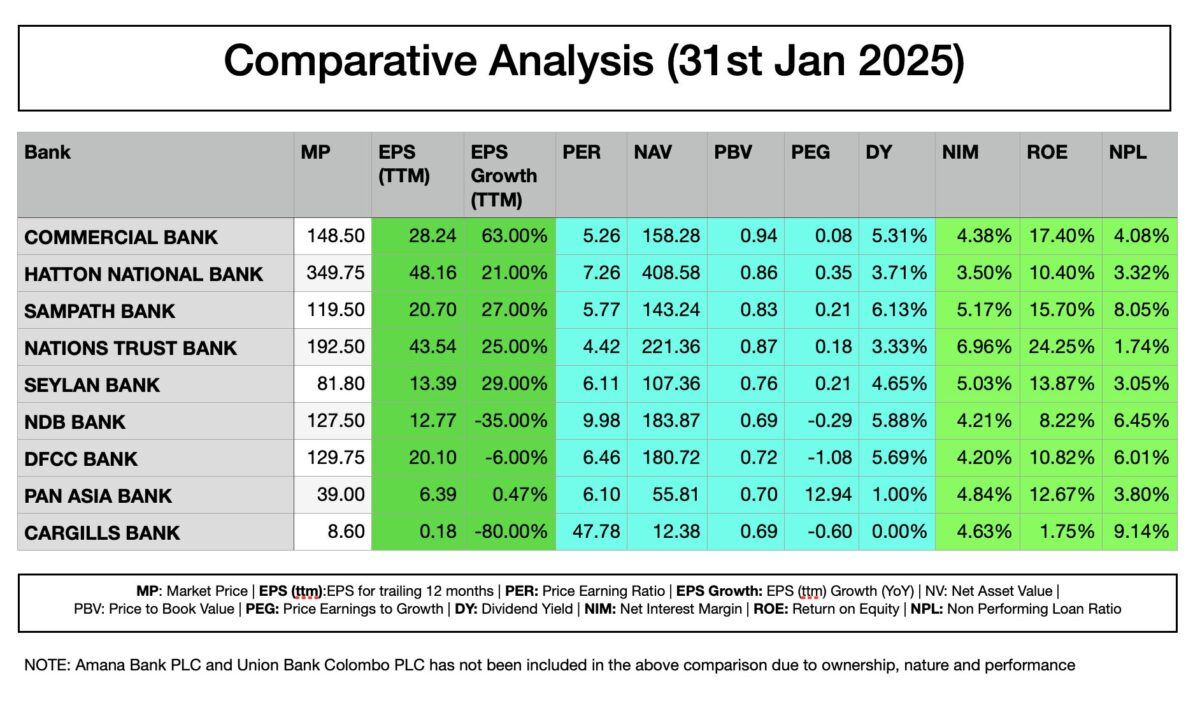

Banking Sector – Comparative Analysis

Based on the Comparative Analysis of the banking sector, investors should consider key financial metrics such as EPS growth, Price-to-Book Value (PBV), Return on Equity (ROE), and Net Interest Margin (NIM) before making investment decisions. Several banks present strong growth potential, while others carry higher risks or limited upside. Among the top investment choices, Nations

Sri Lanka Lifts Vehicle Import Ban: Opportunity for Motor & Finance Sector Companies

The Sri Lankan government has lifted its long-standing ban on motor vehicle imports, a policy originally introduced in 2020 to mitigate the country’s balance of payments crisis. This decision, announced via a gazette issued on January 27, 2025, allows the import of various vehicle categories, including small passenger cars under 1000cc, commercial vehicles, and specialized

Hayleys Leisure PLC Reports Strong Revenue Growth Amid Profitability and Liquidity Challenges

Colombo, January 25, 2025 — Hayleys Leisure PLC has reported a notable financial recovery for the nine months ending December 31, 2024, with revenue climbing 20% year-on-year to Rs. 786.3 million. The growth was driven by heightened customer activity in the leisure sector, supported by improved occupancy rates and favorable market conditions. Gross profit also rose

LB Finance PLC: Navigating Challenges with Resilience

LB Finance PLC, a prominent player in Sri Lanka’s financial services sector, has showcased remarkable resilience in its financial performance during the nine months ended December 31, 2024. Amidst an economic environment fraught with challenges, the company has managed to achieve growth in key areas while addressing notable constraints. Key Financial Highlights: The company reported

Exclusive Online Trading Offer for Colombo Stock Market

Start an Online Trading Account with ACAP Stock Brokers today and enjoy an array of exclusive benefits. Exclusively for Small Investors. Terms and Conditions Initial Deposit To qualify for the offer, investors must deposit a minimum of Rs.500,000/- in cash or an equivalent value in shares. The share portfolio will be valued as of the

Nations Trust Banks PLC becomes the top performer in the Banking Sector in 3Q 2024

Colombo, Sri Lanka (LankaBIZ) Nov 19, 2024 -According to latest comparative analysis of all banking sector companies, Nations Trust Bank PLC has become the top-performing bank for the 9 months ended 30th September 2024 based on its strong profitability, low Price-to-Earnings Ratio, high Return on Equity, excellent Net Interest Margin, and superior credit quality. These

NDB delivers solid profits amidst gradually reviving economic conditions

Analysis of financial performance Income and Profitability: NDB recorded a net operating income of Rs. 21.5 Bn for the period under review covering the nine months ended 30 September 2024, a 9% increase over the comparative period of 2023 (YoY). The notable reduction in impairment charges by 21% YoY augured well in maintaining the healthy

Sampath Bank reported a profit before tax (PBT) of Rs 29.9 Bn for the nine-months of 2024

Key financial highlights for the period ended 30th September 2024 Fund based incomeThe Bank reported a total interest income of Rs 139 Bn for the nine-month period, reflecting a 9.6% decline compared to the same period last year, primarily due to a decrease in the AWPLR while interest expense for the period amounted to Rs

ComBank accelerates lending in Q3 as strong fundamentals spur growth

The Commercial Bank of Ceylon Group has achieved impressive growth at the end of the third quarter of 2024 by banking on judicious portfolio management and continued improvement of its CASA ratio to counteract the impacts of reduced interest income in prevailing market conditions. Comprising of Sri Lanka’s biggest private sector bank, its subsidiaries and

HNB Group recorded a PAT of Rs 23.7 Bn growing by 26% YoY

HNB Group recorded a PAT of Rs 23.7 Bn growing by 26% YoY, while the Bank’s Profit After Tax increased by 34% YoY to Rs 22.2 Bn for the nine months ended September 2024. Decline in AWPLR by nearly 50% compared to last year and remaining at an average level of 10% for the first 9 months

‘Buy the Rumour, Sell the News’

Given the alignment of political reality with the “Buy the Rumour, Sell the News” strategy, the current market high represents an opportune time to exit positions. The rally fueled by speculative optimism is unlikely to sustain in the absence of immediate economic improvement. Investors should consider taking profits now, before the market undergoes a potential

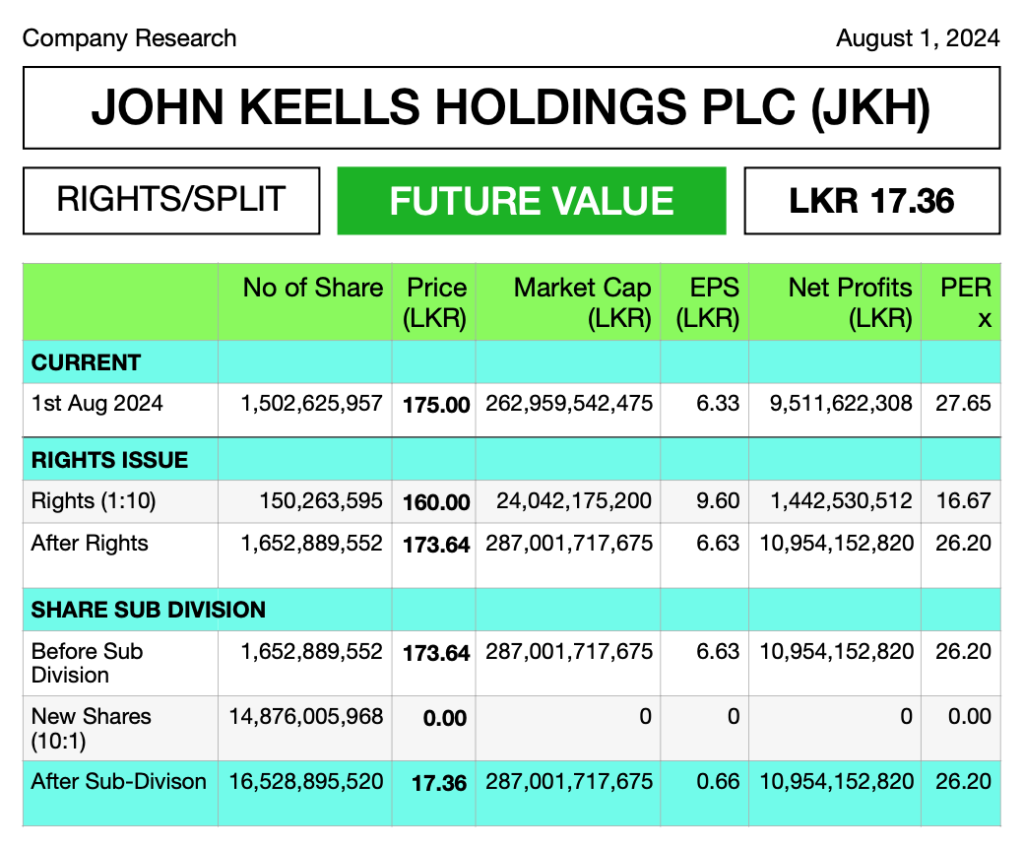

John Keells Holdings PLC share Price is likely to fall after Capital Restructure

Share Price of John Keells Holding PLC (JKH.N000) after the proposed Rights Issue and Subdivision of Shares expected to be around LKR 17/= per share according theoretical (Ex Rights. Ex Sub-division) calculation. Download the full report. Download Report: https://lankabizz.net/product/john-keells-holdings-plc-undefined-future/ Current Market Status (as of August 1, 2024):John Keells Holdings PLC (JKH) is a leading player in

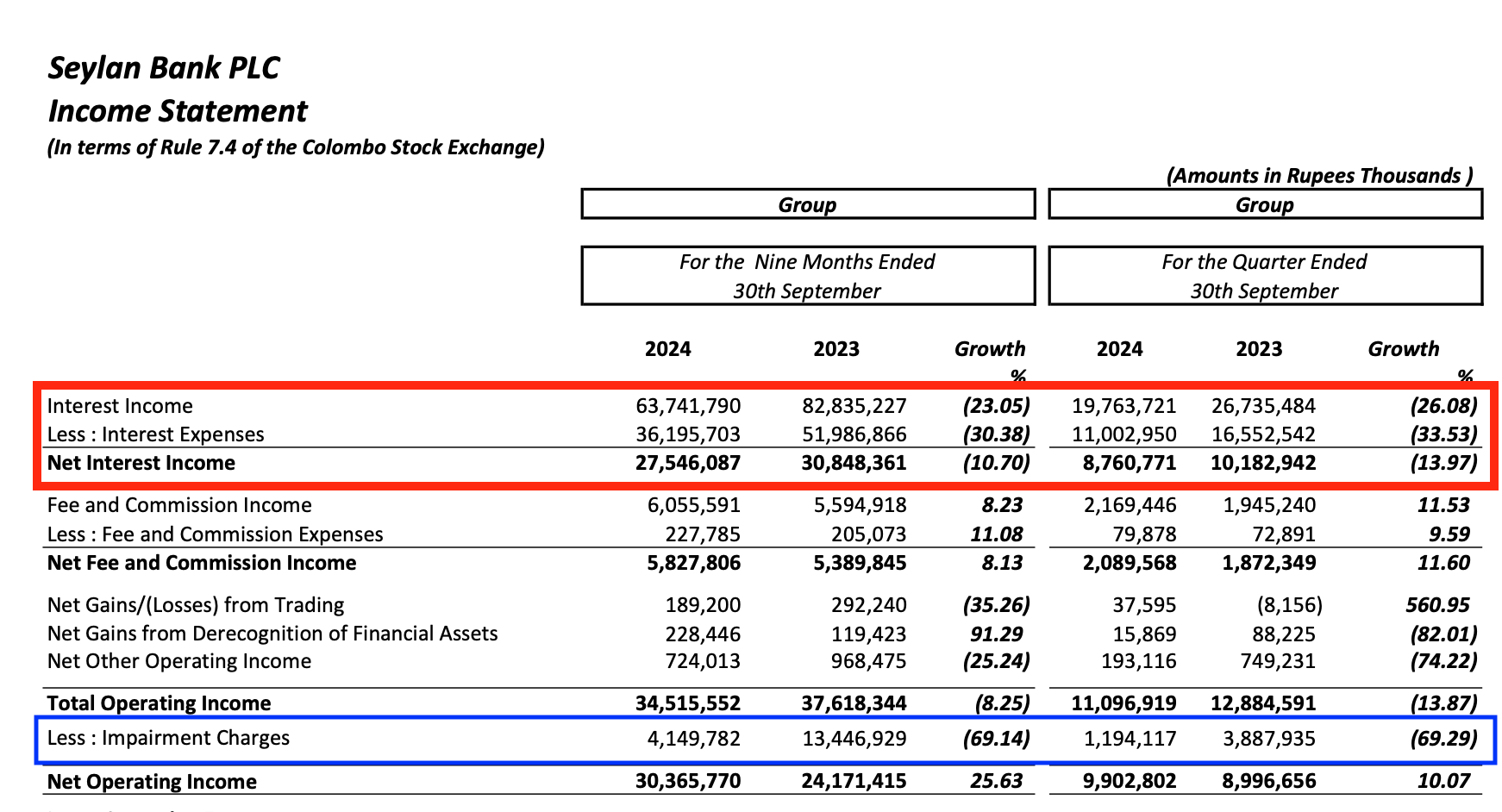

Seylan Bank PLC reports 10.7% reduction in Net Interest Income (NII) for 9 months ended 30th September 2024

Colombo, Oct 31 (LankaBIZ) -The reduction in impairment charges by such a huge amount seems to be somewhat questionable. This move by the bank could be viewed as an attempt to offset the decline in interest income, possibly using impairment adjustments to present an improved financial picture. Financial Highlights Download Full Research Report

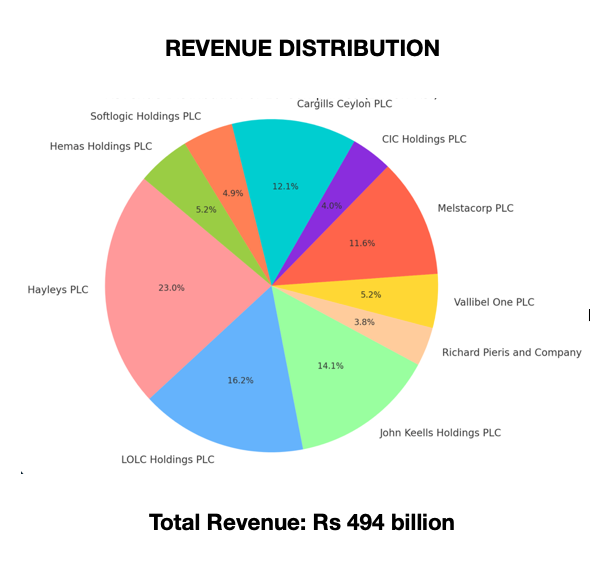

Diversified Conglomerates: Performance Analysis 1Q FY2024/25

Analysis and determination of best-performing company for investment among the top conglomerates based on diversification, revenue growth, profitability, net assets, and valuation (Price-to-Earnings Ratio (PER) and Price-to-Book Value (PBV)) during quarter ended 30th June 2024 Companies Analyzed 1. Diversification Overview: Diversification is a critical metric for reducing risk and ensuring stable returns across different economic

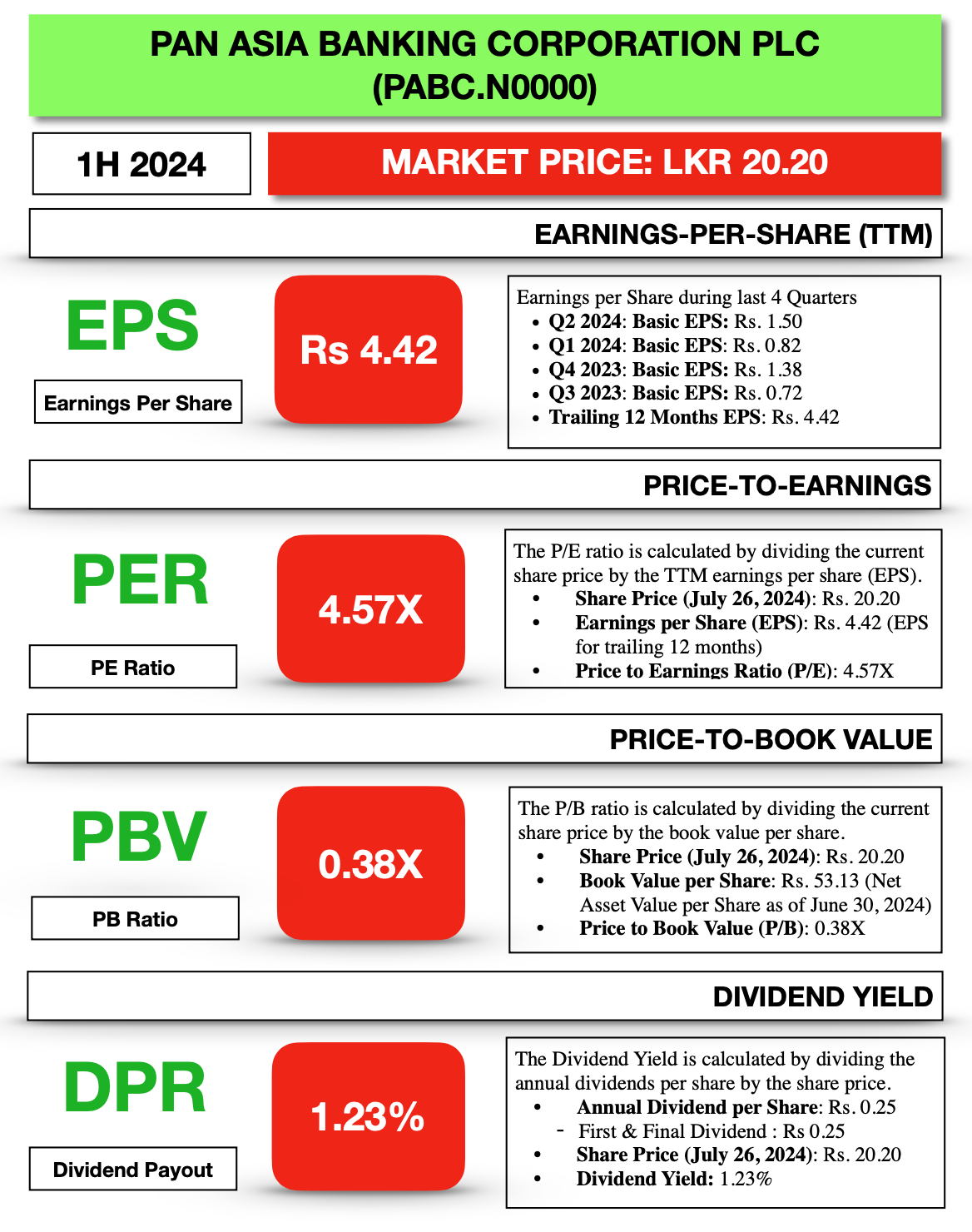

Pan Asia Banking Corporation (PABC) Profit After Tax Increased by 11% in 1H 2024

Pan Asia Banking Corporation PLC (PABC.N0000) showcased a robust overall performance during the first half of 2024. The bank achieved significant growth in its core income streams, driven by a substantial increase in net interest income and fee-based income, demonstrating effective management of interest margins and fee generation. The strategic focus on cost management led to

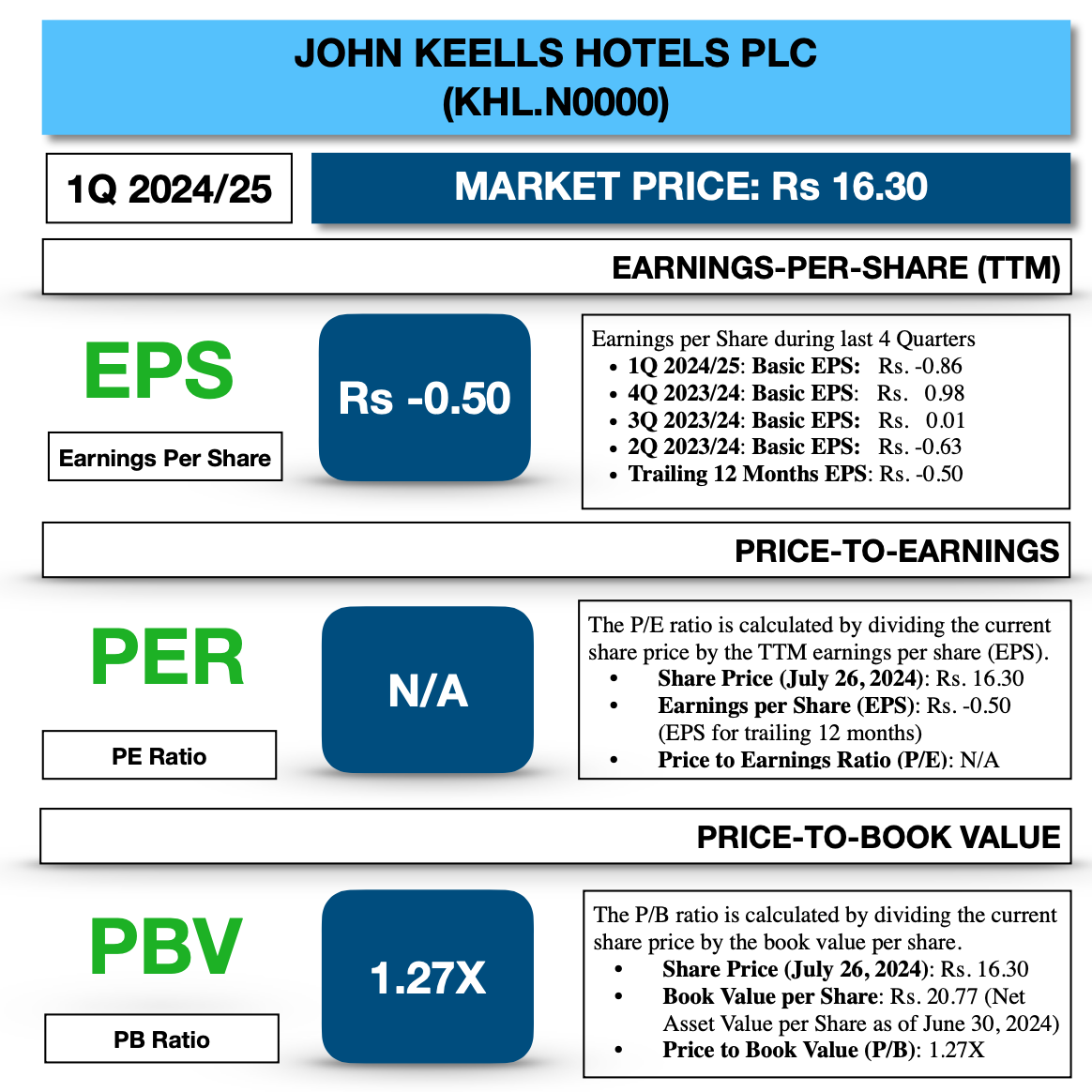

John Keells Hotels (KHL) Reports a loss of Rs. 0.86 per share in 1Q 2024/25

John Keells Hotels PLC (KHL.N0000) overall financial performance for the three months ended 30 June 2024 was challenging, marked by a decline in revenue and gross profit, coupled with high operating expenses. Despite efforts to manage costs, the company reported a significant operating loss, further exacerbated by substantial finance costs. This led to an increased

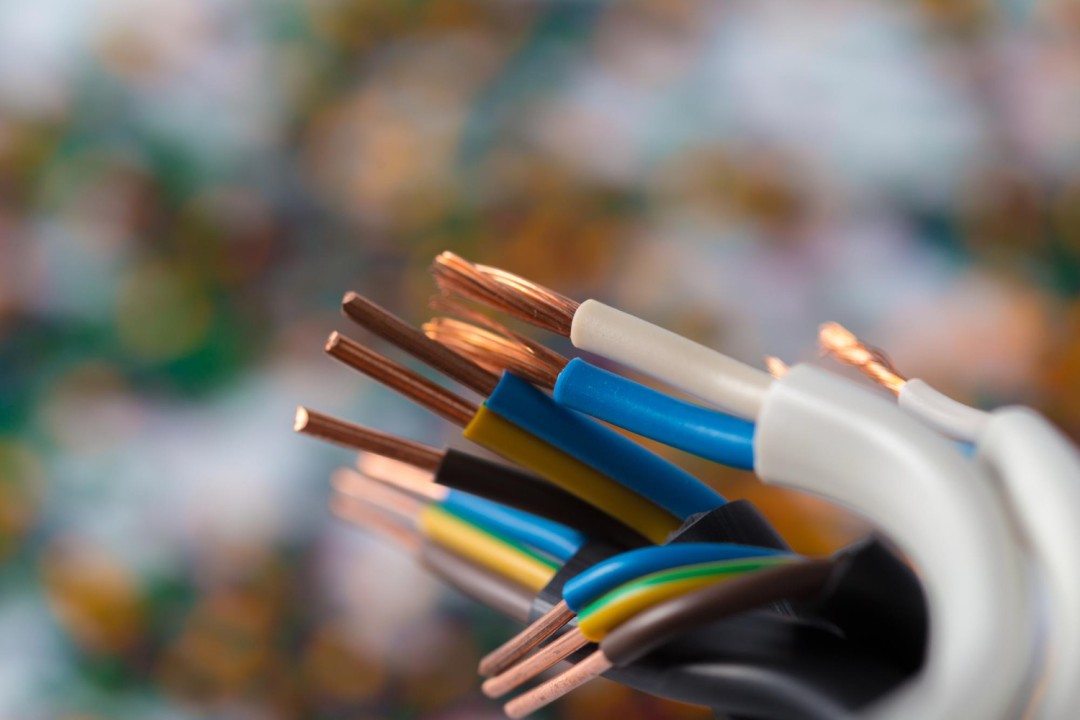

Wire & Cable Sector Analysis (FY 2023/24)

Comparative Analysis of Wire & Cable Sector Companies listed on the Colombo Stock Exchange for year ended 31st March 2024. ACL Cables PLC ACL Cables PLC (ACL.N0000) experienced a challenging year, marked by a decline in revenue and profitability. The company’s gross and operating profits saw significant reductions due to increased costs and expenses, which