Tag: Banking

Hatton National Bank (HNB) Q1 2025 Financial Performance

Review of Hatton National Bank PLC (HNB) Financial Performance for the Three Months Ended 31st March 2025 1. Executive Summary: Hatton National Bank (HNB) demonstrated strong financial performance in the first quarter of 2025, setting a solid foundation for future growth. The Bank and Group reported significant increases in Profit After Tax (PAT), primarily driven

NDB delivers solid profits amidst gradually reviving economic conditions

Analysis of financial performance Income and Profitability: NDB recorded a net operating income of Rs. 21.5 Bn for the period under review covering the nine months ended 30 September 2024, a 9% increase over the comparative period of 2023 (YoY). The notable reduction in impairment charges by 21% YoY augured well in maintaining the healthy

Sampath Bank reported a profit before tax (PBT) of Rs 29.9 Bn for the nine-months of 2024

Key financial highlights for the period ended 30th September 2024 Fund based incomeThe Bank reported a total interest income of Rs 139 Bn for the nine-month period, reflecting a 9.6% decline compared to the same period last year, primarily due to a decrease in the AWPLR while interest expense for the period amounted to Rs

ComBank accelerates lending in Q3 as strong fundamentals spur growth

The Commercial Bank of Ceylon Group has achieved impressive growth at the end of the third quarter of 2024 by banking on judicious portfolio management and continued improvement of its CASA ratio to counteract the impacts of reduced interest income in prevailing market conditions. Comprising of Sri Lanka’s biggest private sector bank, its subsidiaries and

HNB Group recorded a PAT of Rs 23.7 Bn growing by 26% YoY

HNB Group recorded a PAT of Rs 23.7 Bn growing by 26% YoY, while the Bank’s Profit After Tax increased by 34% YoY to Rs 22.2 Bn for the nine months ended September 2024. Decline in AWPLR by nearly 50% compared to last year and remaining at an average level of 10% for the first 9 months

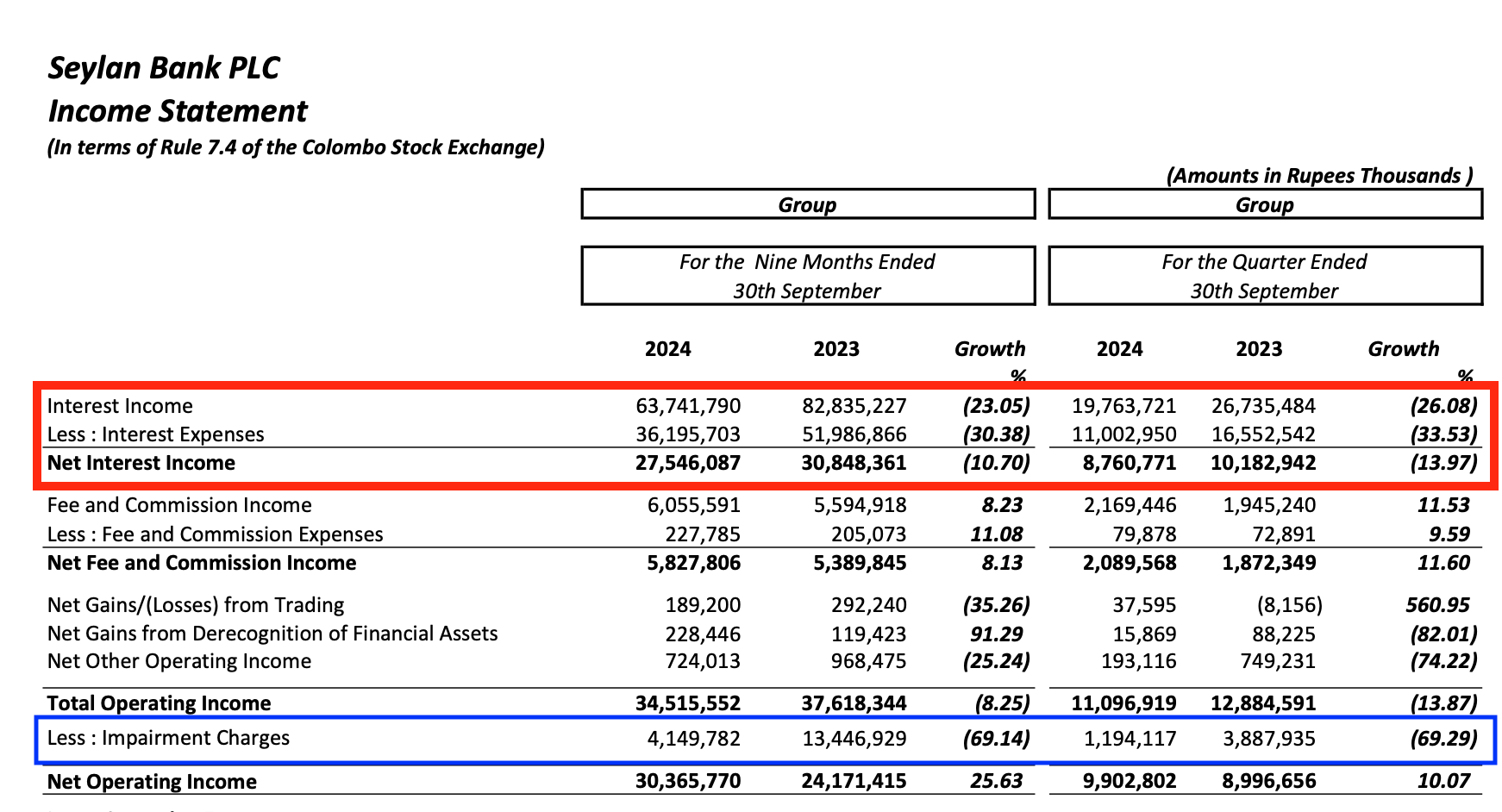

Seylan Bank PLC reports 10.7% reduction in Net Interest Income (NII) for 9 months ended 30th September 2024

Colombo, Oct 31 (LankaBIZ) -The reduction in impairment charges by such a huge amount seems to be somewhat questionable. This move by the bank could be viewed as an attempt to offset the decline in interest income, possibly using impairment adjustments to present an improved financial picture. Financial Highlights Download Full Research Report

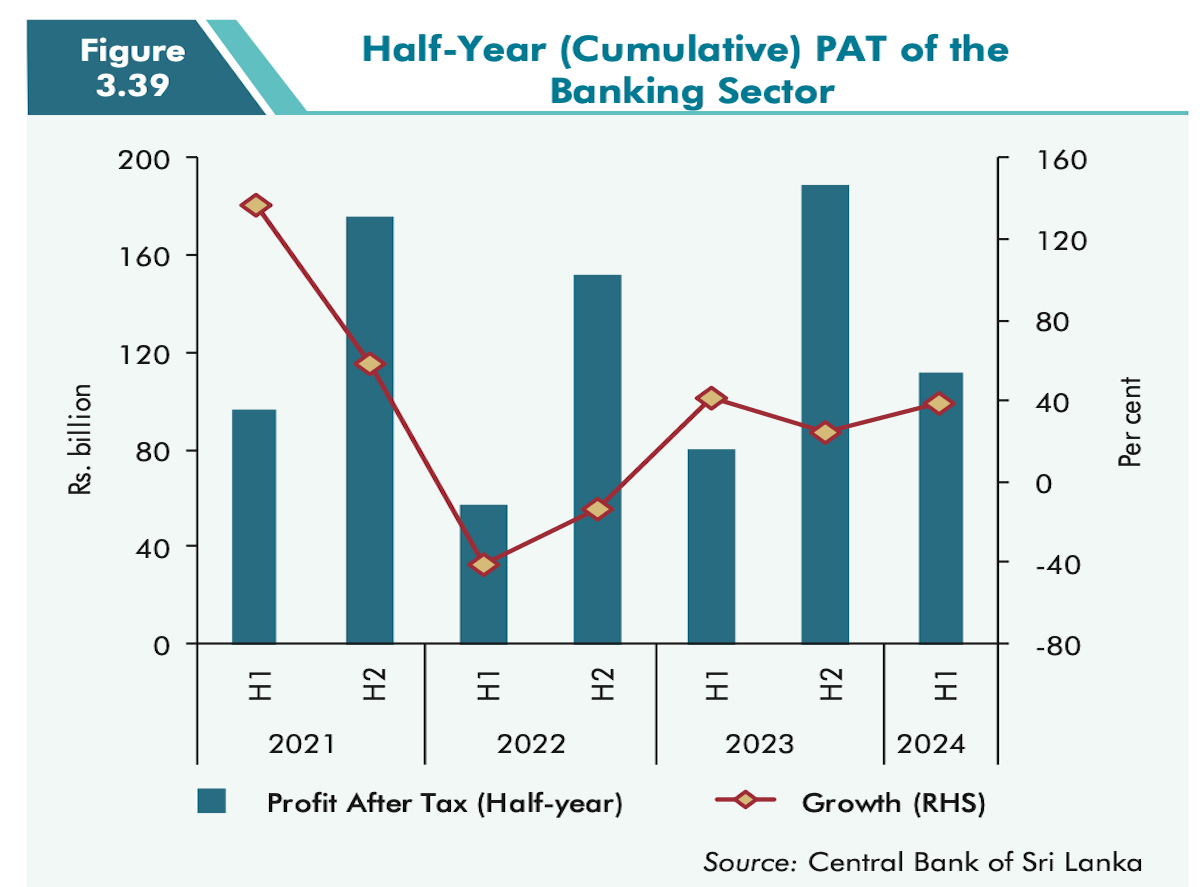

Banking Sector Profitability at what cost?

Banks have a critical role to play in Sri Lanka’s economic recovery, not only by securing their own financial positions but by fostering conditions for business growth. High interest rates and aggressive foreclosures do little but suppress growth, while more inclusive and flexible financial support will create sustainable profitability across industries. A responsible banking sector

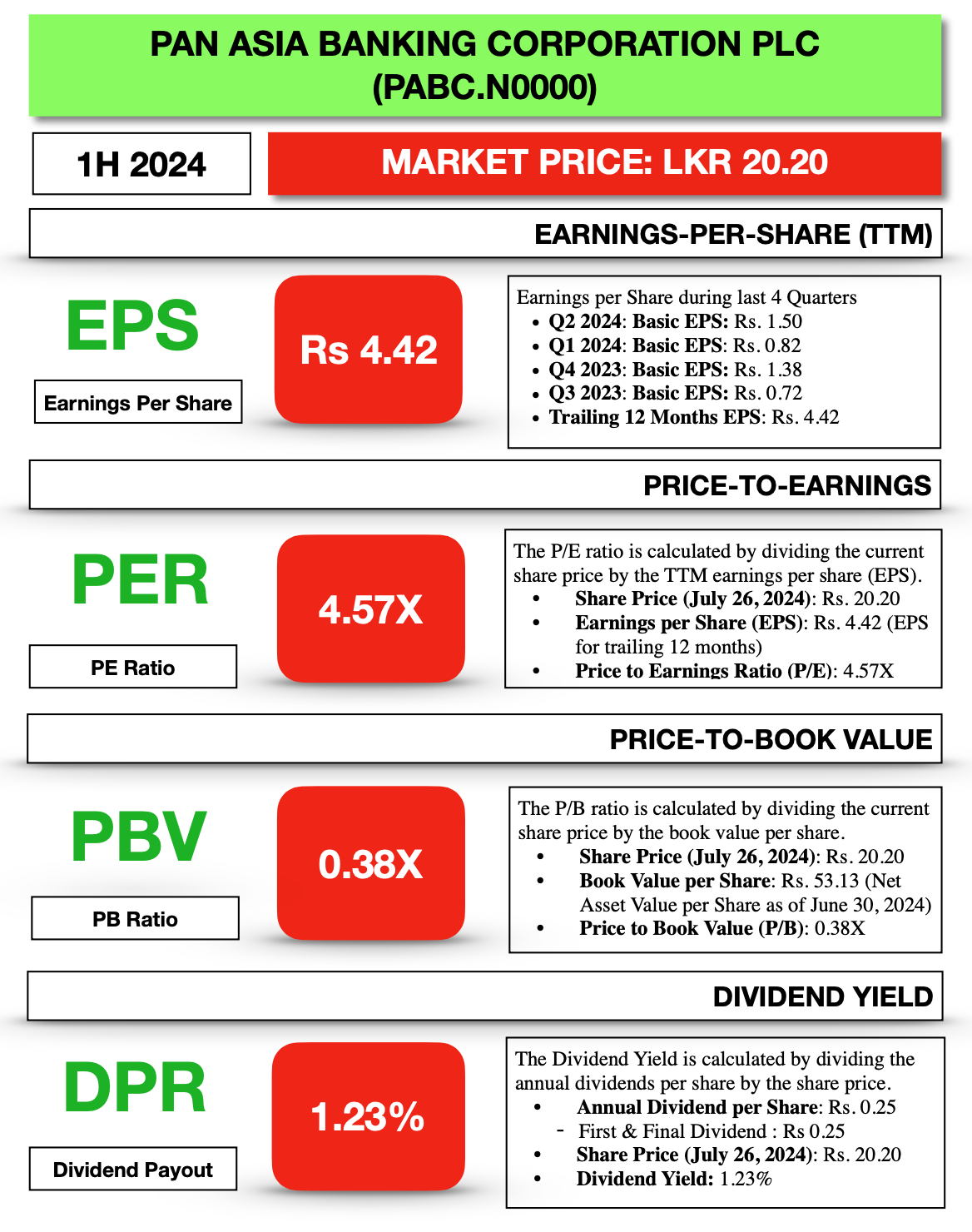

Pan Asia Banking Corporation (PABC) Profit After Tax Increased by 11% in 1H 2024

Pan Asia Banking Corporation PLC (PABC.N0000) showcased a robust overall performance during the first half of 2024. The bank achieved significant growth in its core income streams, driven by a substantial increase in net interest income and fee-based income, demonstrating effective management of interest margins and fee generation. The strategic focus on cost management led to

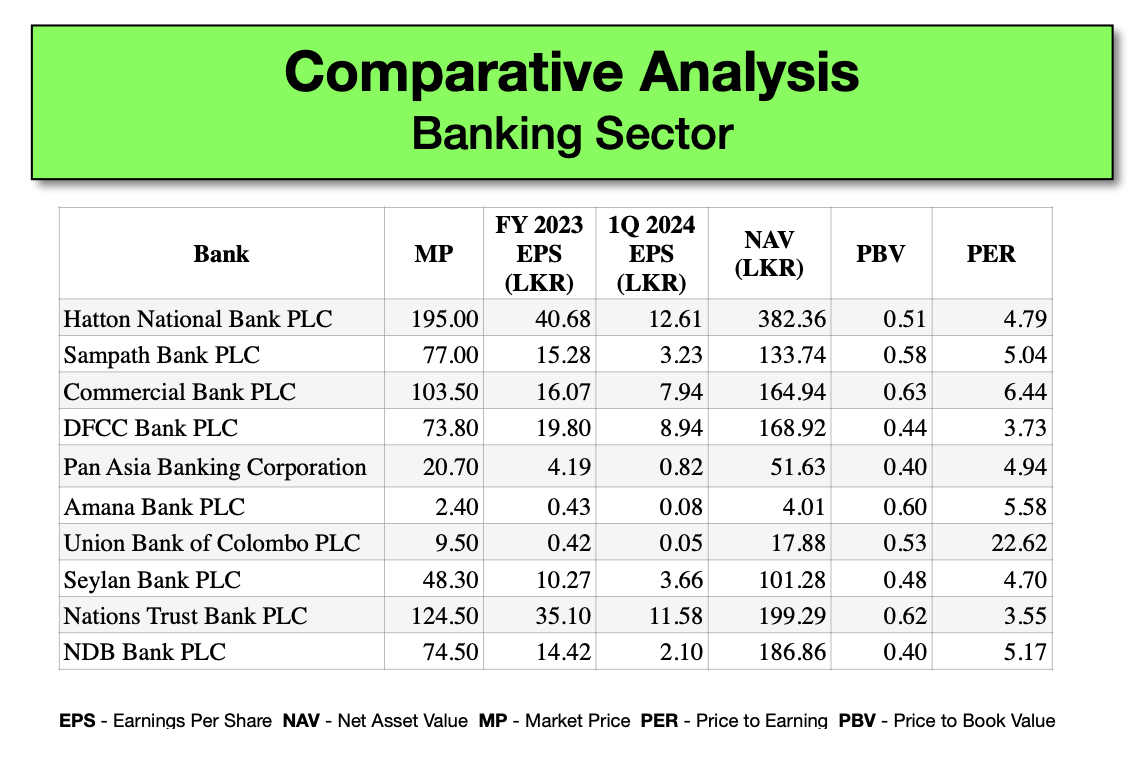

Comparative Analysis of Banks

Highlights and Observations• Hatton National Bank: Strong performance with the highest EPS and NAV, indicating robust profitability and a solid equity base.• Commercial Bank: Exceptional growth in NII and net profit, showcasing effective interest rate management and operational efficiency.• Nations Trust Bank: Leading in ROE and ROA, reflecting high profitability and efficient asset utilization. Trading

Pan Asia Bank posts Steady Performance in 1Q 2024

Pan Asia Banking Corporation PLC reported a steady performance reflecting improved macro-economic conditions as the Bank reported its financial performance during 1Q 2024, which showed judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality in challenging times. The Bank reported a Pre-tax Profit of Rs. 796 Mn for the

Hatton National Bank PLC recorded a Profit Before Tax of Rs 9.8 Bn for 1Q2024

Hatton National Bank PLC (HNB) recorded a Profit Before Tax (PBT) of Rs 9.8 Bn during the first quarter of 2024 while Profit After Tax (PAT) amounted to Rs 6.2 Bn. At Group level, PBT and PAT were at Rs 11.2 Bn and Rs 7.4 Bn, respectively. The substantial monetary policy loosening adopted by the

Amana Bank surges ahead with aggressive outlook for 2024

Amana Bank continued its robust performance trend as it completed a successful first quarter recording a notable 73% YoY increase in Profit Before Tax to reach LKR 734.5 million compared to LKR 423.5 million booked a year back while Profit After Tax surged by 91% YoY to post LKR 422.2 million as against LKR 220.7

Strong strategic alignment enables resilient performance for NDB in 1Q2024

National Development Bank PLC, Sri Lanka’s fourth largest listed bank commenced the financial year on a positive note, with resilient performance for the first quarter of the year ended 31 March 2024. NDB’s Director/ Chief Executive Officer Mr. Kelum Edirisinghe commented that the Bank continued to face challenges on relatively low credit demand due to

ComBank begins FY2024 with impressive growth

The Commercial Bank of Ceylon Group has ended the first quarter of 2024 with a loan book of Rs 1.316 trillion, continuing the Bank’s focus on lending in a period where the appreciation of the Rupee negatively impacted the value of the loan book and resulted in a contraction of the balance sheet. The Group reported

Sampath Bank PLC: Financial performance for 3 months ended 31st March 2024

Financial Performance Sampath Bank posted a profit before tax (PBT) of Rs 6.2 Bn and a profit after tax (PAT) of Rs 3.4 Bn for the three months ended 31st March 2024, notwithstanding an exchange loss of Rs 4.3 Bn due to the appreciation of LKR against USD by Rs 23.70. These figures signify growth

Cargills Bank posts Profit before Tax Rs. 109 Million for the quarter ended 31 March 2024

Financial Highlights There was moderate growth in our Deposit and Loan portfolios amidst stiff competition from our peers. The Bank continued support to its customers to help them meet challenges they faced.Continuous downward revisions of lending rates, with lagged repricing of deposits, eroded net interest margins and exerted considerable pressure on the Bank’s bottom line. This

DFCC Bank Reports Strong Profit Growth in 1Q2024

DFCC Bank demonstrated resilience and continued its commitment to serving customers nationwide, delivering high-quality customer centric banking services amidst the ongoing revival of economic activity. Proactive policy adjustments facilitated a notable reduction in historically high-interest rates aimed at bolstering economic growth and stabilising inflation. This initiative, which started in June 2023, envisaged a substantial and

Union Bank of Colombo PLC: Financial Performance 1Q 2024

Based on the interim financial statements of Union Bank of Colombo PLC for the period ended 31 March 2024, the financial performance, profitability, and key ratios can be summarized as follows: Financial Performance: Profitability: Key Ratios: Asset Quality: Liquidity and Capital Adequacy: Market Performance: These figures indicate that Union Bank PLC has experienced a decrease

Sampath Bank PLC: Robust Financial Performance in FY 2023

Sampath Bank PLC demonstrated a robust financial performance for the fiscal year 2023, as indicated in the annual report. The bank’s total operating income reached Rs 91.0 billion, primarily consisting of net interest income of Rs 72.3 billion and net fee and commission income of Rs 18.9 billion. A significant achievement for the bank was