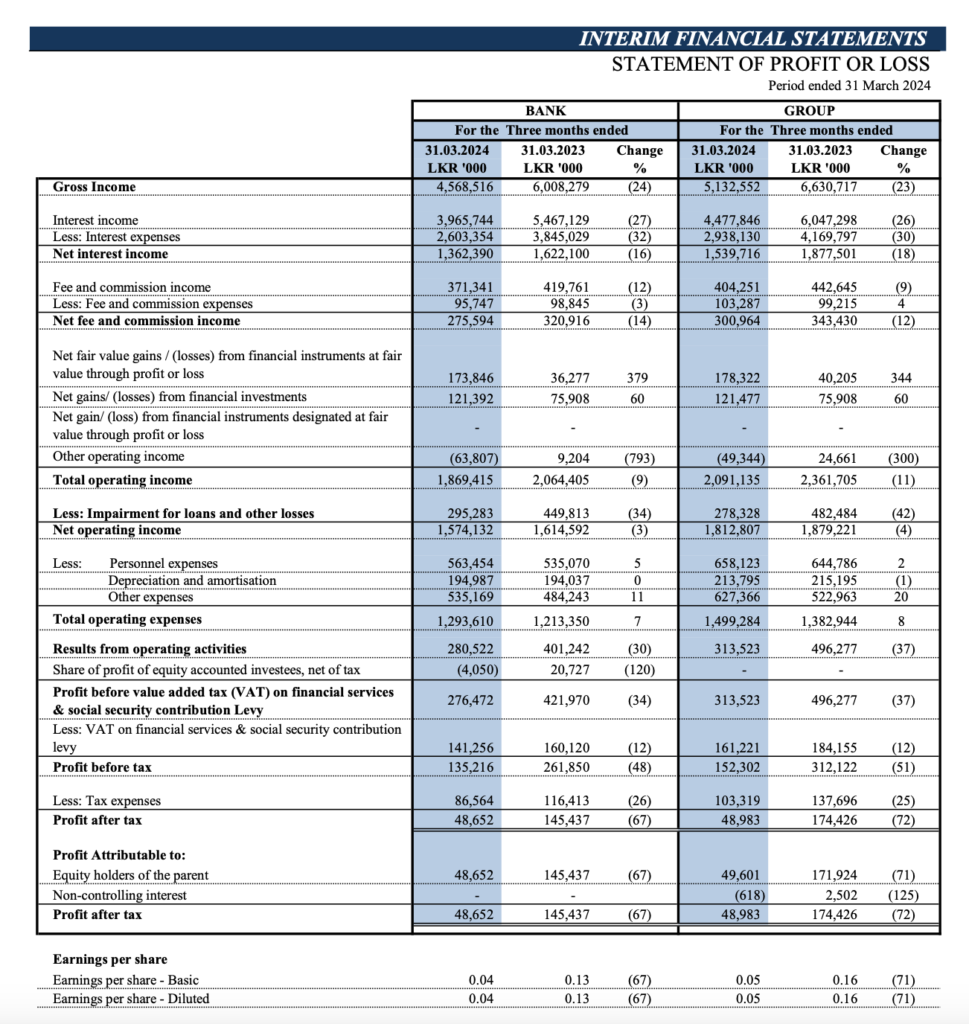

Based on the interim financial statements of Union Bank of Colombo PLC for the period ended 31 March 2024, the financial performance, profitability, and key ratios can be summarized as follows:

Financial Performance:

- Gross Income: LKR 4,568,516,000, a decrease of 24% from LKR 6,008,279,000 in the same period in 2023.

- Interest Income: LKR 3,965,744,000, a decrease of 27% from LKR 5,467,129,000 in the previous year.

Profitability:

- Net Profit for the period: LKR 48,652,000, which represents a significant decrease compared to the previous year’s same period.

Key Ratios:

- Interest Margin: 4.07%, a decrease from 4.68% in the previous year.

- Return on Assets (Before Tax): 0.40%, down from 0.58%.

- Return on Assets (After Tax): 0.15%, a decrease from 0.28%.

- Return on Equity (After Tax): 1.01%, a decrease from 1.99%.

Asset Quality:

- Impaired Loans (Stage 3) Ratio: 11.35%, an improvement from 12.51%.

- Impairment (Stage 3) to Stage 3 Loans Ratio: 36.68%, an increase from 35.26%.

Liquidity and Capital Adequacy:

- Statutory Liquid Assets Ratio: 42.77%, an improvement from 37.93%.

- Liquidity Coverage Ratio (Rupee): 1028.70%, a significant increase from 795.41%.

- Net Stable Funding Ratio: The document does not provide a specific figure for 2024, but the minimum requirement is mentioned.

Market Performance:

- Last traded share price as of 31 March 2024: LKR 9.40, compared to LKR 9.00 on 31 March 2023.

- Highest price for the quarter: LKR 10.10, an increase from LKR 10.00 in the previous year.

- Lowest price for the quarter: LKR 9.00, an increase from LKR 6.70 in the previous year.

These figures indicate that Union Bank PLC has experienced a decrease in profitability and some key performance indicators, such as return on assets and return on equity, as of the end of the first quarter of 2024 compared to the same period in the previous year. However, there have been improvements in asset quality and liquidity ratios. It is important for stakeholders to consider these trends in the context of the overall economic environment and the bank’s strategic initiatives when evaluating the bank’s performance.