Category: Analysis

Market Confidence Wavers as Sri Lanka Faces Severe Infrastructure Damage and Escalating Debt Pressures

Sri Lanka’s recent surge in investor optimism is unlikely to last, arguing that the country’s recovery remains “extremely fragile” especially in light of the devastating cyclone and floods that ravaged parts of the island this month. The assessment notes that the popular narrative of Sri Lanka being an “undervalued investment opportunity” stands in stark contrast

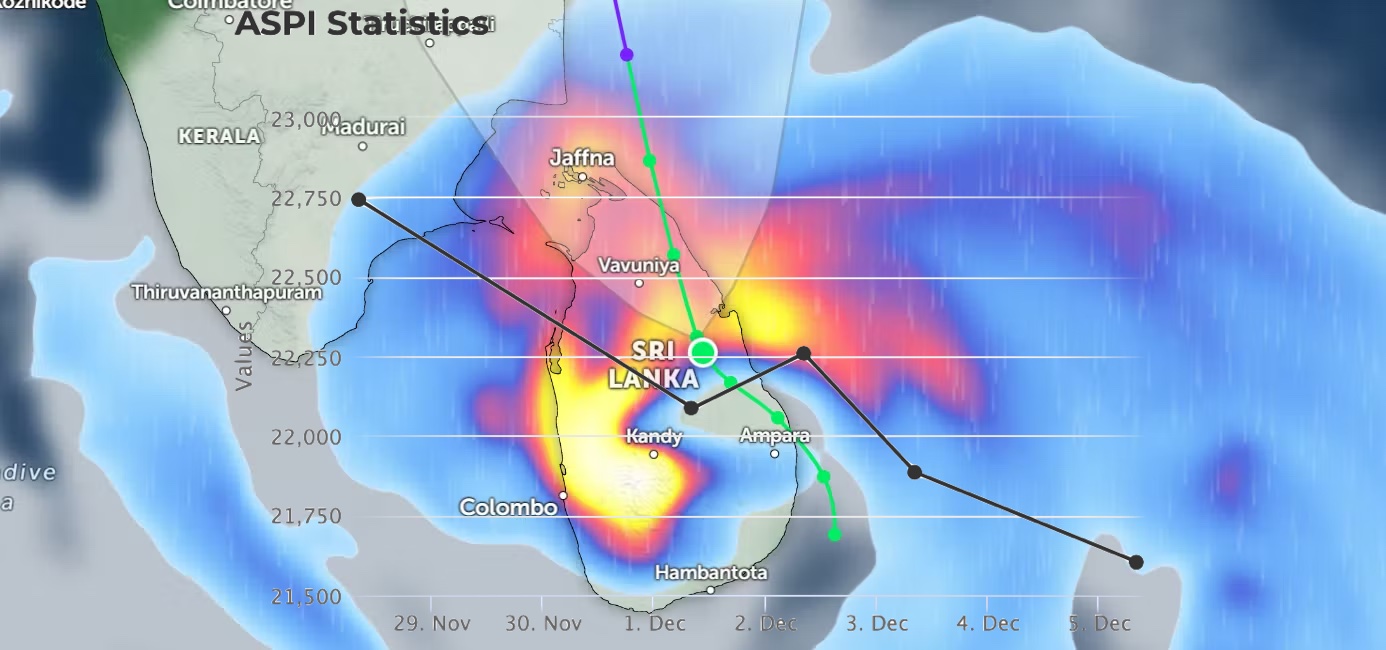

Sri Lanka’s Listed Sector Outlook Reshaped by Cyclone Ditwah

Sri Lanka’s corporate landscape is set to enter a period of sharply diverging performance as Cyclone Ditwah drives sector-specific disruptions and opportunities. While the disaster has triggered widespread flooding and damaged connectivity across all districts, its economic consequences are expected to produce clear winners and losers within equity markets over the coming year. Insurance: Claims

Asia Capital Eyes Turnaround Amid Rs 783 Mn Inflow and New Leadership

March 30, 2025 Colombo Sri Lanka (LankaBIZ) – Asia Capital PLC on of the oldest listed companies in Sri Lanka established in 1991 is set for a remarkable financial turnaround in the upcoming fiscal year, buoyed by a significant Rs 783 million capital inflow from the sale of minority shareholdings in three companies. This strategic

Vallibel Finance Shows Strong Profitability Amid Mixed Revenue Trends

January 19, 2025 – Colombo: Vallibel Finance PLC has reported a robust surge in net profitability despite challenges in revenue generation during the quarter ended December 31, 2024. The company’s net profit climbed 51.1% year-on-year to LKR 718.6 million, underpinned by reduced impairment charges and cost discipline. However, gross income fell by 2.6% to LKR 4.82

Nations Trust Banks PLC becomes the top performer in the Banking Sector in 3Q 2024

Colombo, Sri Lanka (LankaBIZ) Nov 19, 2024 -According to latest comparative analysis of all banking sector companies, Nations Trust Bank PLC has become the top-performing bank for the 9 months ended 30th September 2024 based on its strong profitability, low Price-to-Earnings Ratio, high Return on Equity, excellent Net Interest Margin, and superior credit quality. These

‘Buy the Rumour, Sell the News’

Given the alignment of political reality with the “Buy the Rumour, Sell the News” strategy, the current market high represents an opportune time to exit positions. The rally fueled by speculative optimism is unlikely to sustain in the absence of immediate economic improvement. Investors should consider taking profits now, before the market undergoes a potential

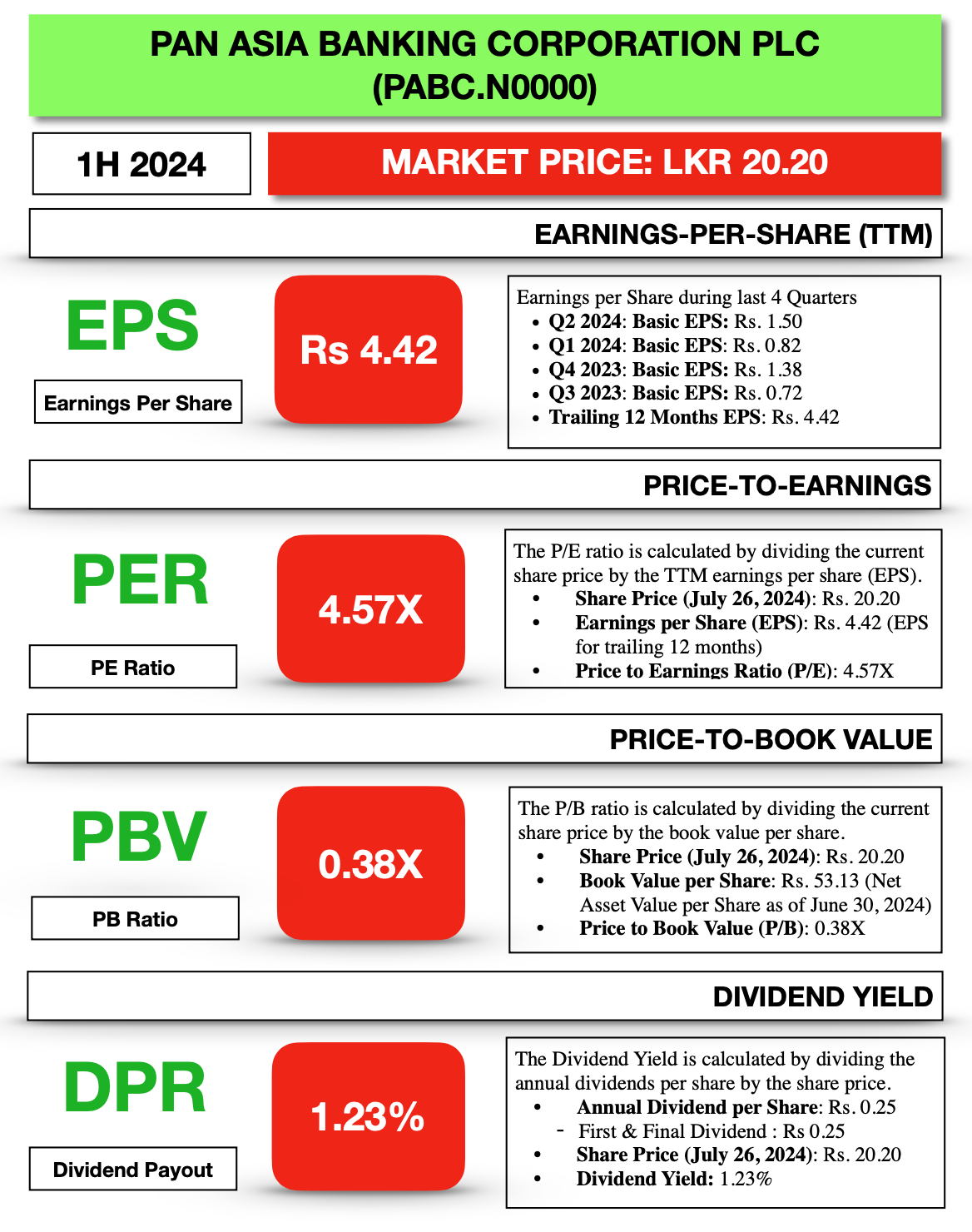

Pan Asia Banking Corporation (PABC) Profit After Tax Increased by 11% in 1H 2024

Pan Asia Banking Corporation PLC (PABC.N0000) showcased a robust overall performance during the first half of 2024. The bank achieved significant growth in its core income streams, driven by a substantial increase in net interest income and fee-based income, demonstrating effective management of interest margins and fee generation. The strategic focus on cost management led to

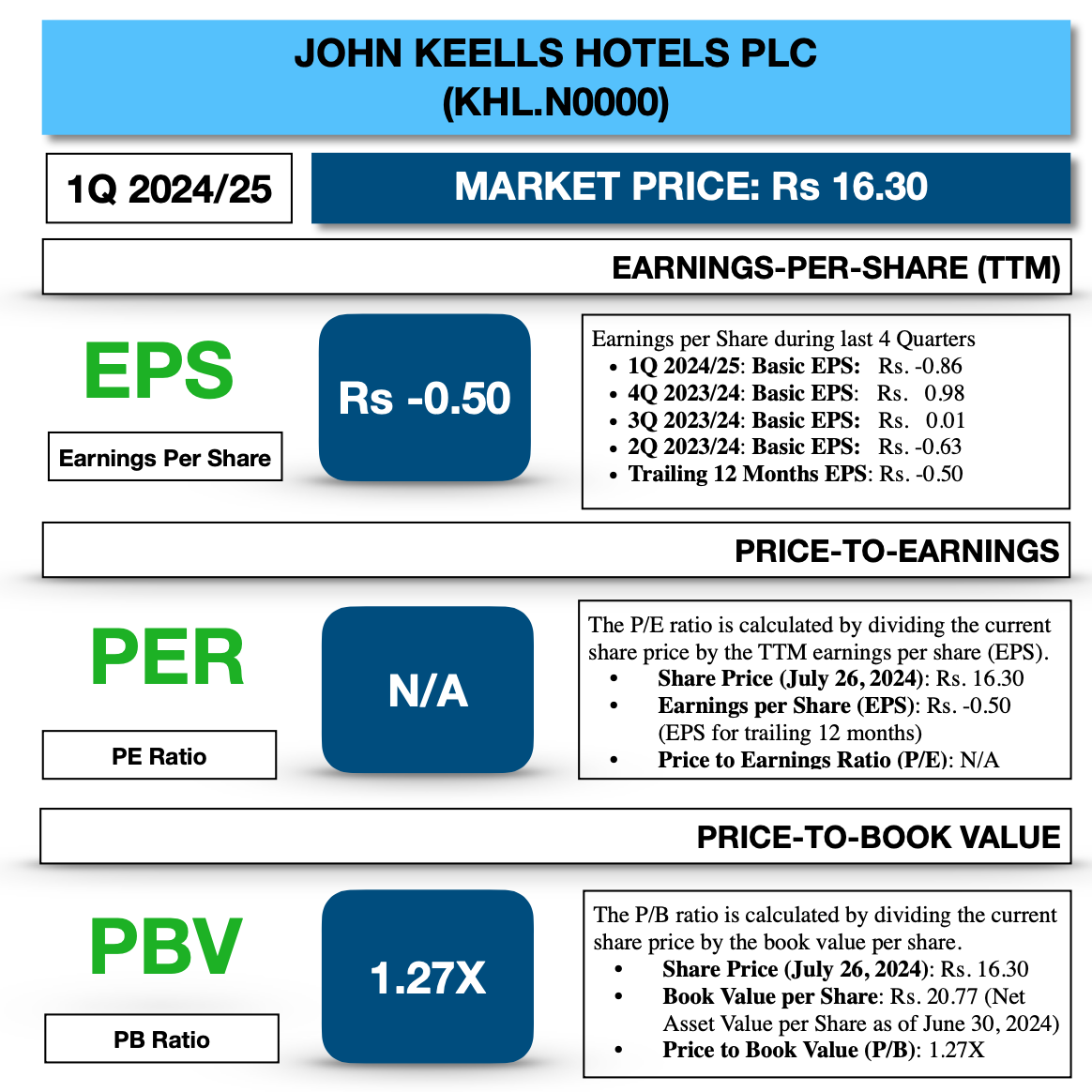

John Keells Hotels (KHL) Reports a loss of Rs. 0.86 per share in 1Q 2024/25

John Keells Hotels PLC (KHL.N0000) overall financial performance for the three months ended 30 June 2024 was challenging, marked by a decline in revenue and gross profit, coupled with high operating expenses. Despite efforts to manage costs, the company reported a significant operating loss, further exacerbated by substantial finance costs. This led to an increased

Wire & Cable Sector Analysis (FY 2023/24)

Comparative Analysis of Wire & Cable Sector Companies listed on the Colombo Stock Exchange for year ended 31st March 2024. ACL Cables PLC ACL Cables PLC (ACL.N0000) experienced a challenging year, marked by a decline in revenue and profitability. The company’s gross and operating profits saw significant reductions due to increased costs and expenses, which

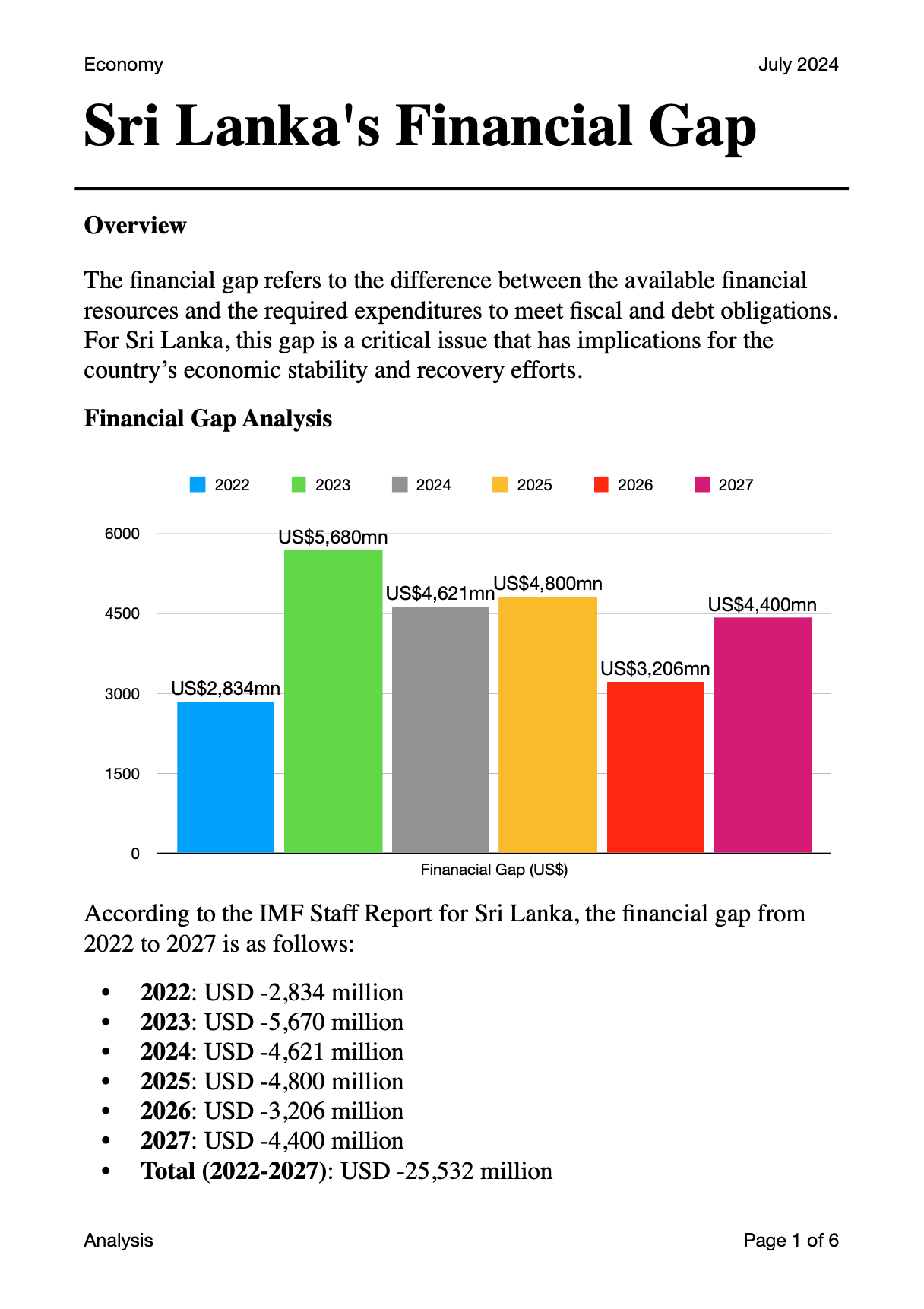

Sri Lanka’s Financial Gap

Sri Lanka’s financial gap from 2022 to 2027 and summary of IMF staff Review on June 13, 2024 The financial gap refers to the difference between the available financial resources and the required expenditures to meet fiscal and debt obligations. For Sri Lanka, this gap is a critical issue that has implications for the country’s

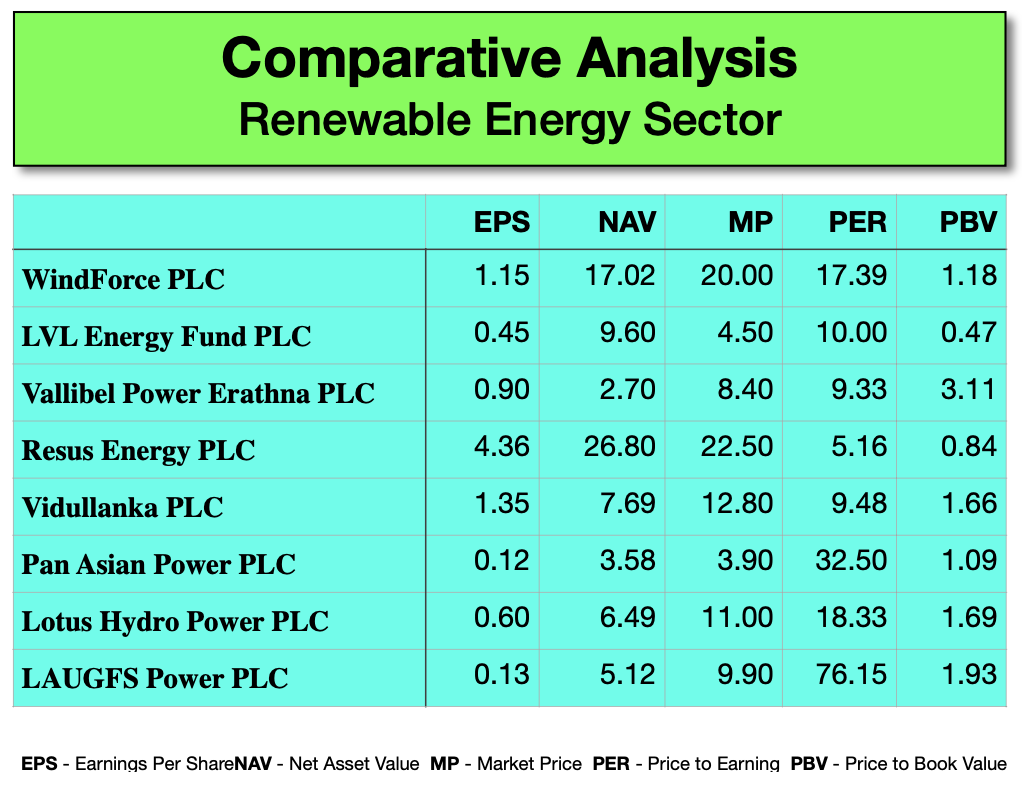

Sri Lanka: Energy Sector

Highlights and Observations Download Full Report: https://lankabizz.net/product/energy-sector/

Impact of Elections on Colombo Stock Market Sentiment

Elections play a crucial role in shaping investor sentiment in stock markets, including the Colombo Stock Exchange (CSE). Here are some ways elections are expected to affect market sentiment: Download Full Report on Stock Market Outlook for 2024, which highlights the key factors that determines the direction of the market in 2024. Key Content: Analysis

Do your own Stock Market Research using AI

Why depend on Third party Research Reports? Now you can do your own research and analysis of the financial performance of listed companies in Sri Lanka by using AI Tools available with LankaBIZ. Simply upload Annual reports or any other PDF document to ChatPDF and get instant answers to your research queries. Chat with PDF

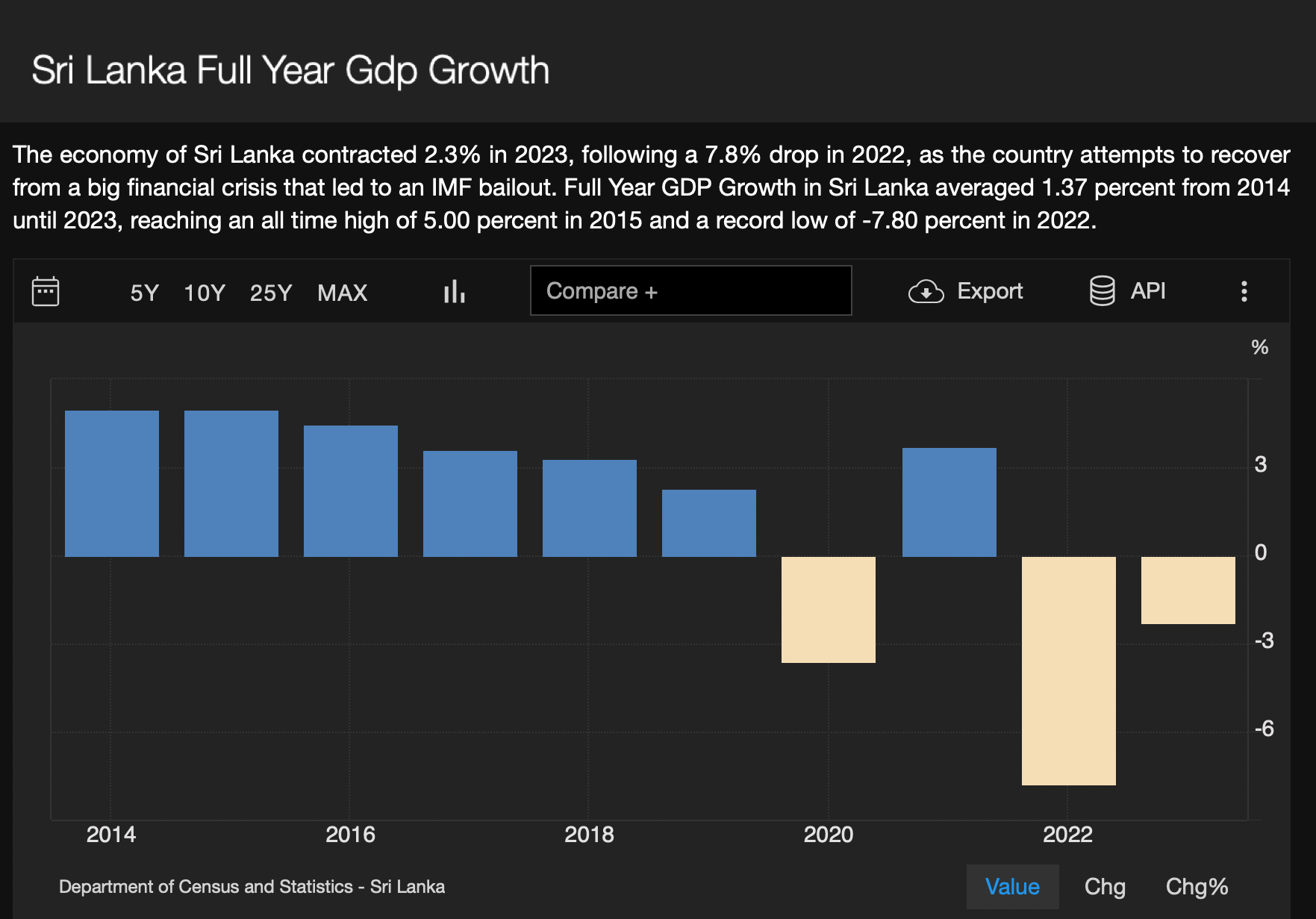

Sri Lanka key Economic Indicators and Future Outlook for 2024

Get update on Sri Lanka’s latest economic indicators and future outlook via LankaBIZ backed by Artificial Intelligence. Ask any question relating to economy of Sri Lanka and get instant answers based on latest information. www.lankabizz.net The latest economic outlook for Sri Lanka, as of May 2024, indicates a challenging economic environment. The country has been

Access Engineering PLC: Financial Performance as at 31st March 2024

Analysis of the financial status and performance of Access Engineering PLC for the fiscal year ended 31st March 2024. The analysis is based on the interim financial statements provided and includes a review of key financial ratios. Financial Performance Summary: Key Financial Ratios: The financial performance of Access Engineering PLC for the year ended 31st

Sampath Bank PLC: Financial performance for 3 months ended 31st March 2024

Financial Performance Sampath Bank posted a profit before tax (PBT) of Rs 6.2 Bn and a profit after tax (PAT) of Rs 3.4 Bn for the three months ended 31st March 2024, notwithstanding an exchange loss of Rs 4.3 Bn due to the appreciation of LKR against USD by Rs 23.70. These figures signify growth

Watawała Plantation PLC Vs Namunukula Plantations PLC: SWOT Analysis

Namunukula Plantations PLC Based on the provided context, Namunukula Plantations PLC has shown a strong financial performance in the fiscal year 2022/23. Here are some key highlights from the data: Watawała Plantations PLC Based on the provided context, Watawala Plantations PLC has demonstrated a mixed financial performance in recent periods. Here are some key points

Sri Lanka Telecom Vs Dialog Axiata

To provide a comparative analysis between Dialog Axiata PLC and Sri Lanka Telecom PLC, we will look at various aspects such as market performance, financial health, strategic direction, and technological advancements based on the latest available data. Market Performance:As of the latest data, Dialog Axiata PLC’s stock price remained unchanged, indicating stability in investor sentiment.

Ceylinco Insurance PLC: Latest financial Performance, Ratio Analysis and future outlook

Financial Performance: Ceylinco Insurance PLC’s latest financial performance for the year ended 31st December 2023, as reported in their Integrated Annual Report, shows the following highlights: These figures indicate that Ceylinco Insurance PLC has experienced growth in premium income and other revenues, although there was a slight decrease in profit before the share of associates.

Compare Corporate Performance between Companies

JKH Vs Melstacorp When comparing the future prospects of John Keells Holdings PLC (JKH) with Melstacorp PLC, it’s important to consider their respective business segments, market positions, and strategies for growth. Both companies are diversified conglomerates with different focuses, which can impact their future performance. John Keells Holdings PLC (JKH): Melstacorp PLC: This Analysis was

SWOT Analysis of Three Acre Farms PLC

Based on the provided context from the Three Acre Farms PLC Annual Report for December 2023, a SWOT analysis can be conducted as follows: Strengths: Weaknesses: Opportunities: Threats: This SWOT analysis provides a snapshot of the internal and external factors that could affect Three Acre Farms PLC’s business. It should be noted that for a

Ceylon Tobacco Company PLC: Latest Financial Performance and future outlook

Ceylon Tobacco Company PLC’s latest financial performance for the year ended 31 December 2023, as reported in their annual report, indicates the following: Financial Performance and Profitability: Key Ratios: Future Outlook:The company’s future developments are discussed in the reviews by the Chairman, the Managing Director & CEO, and the Finance Director. The Sri Lankan economy

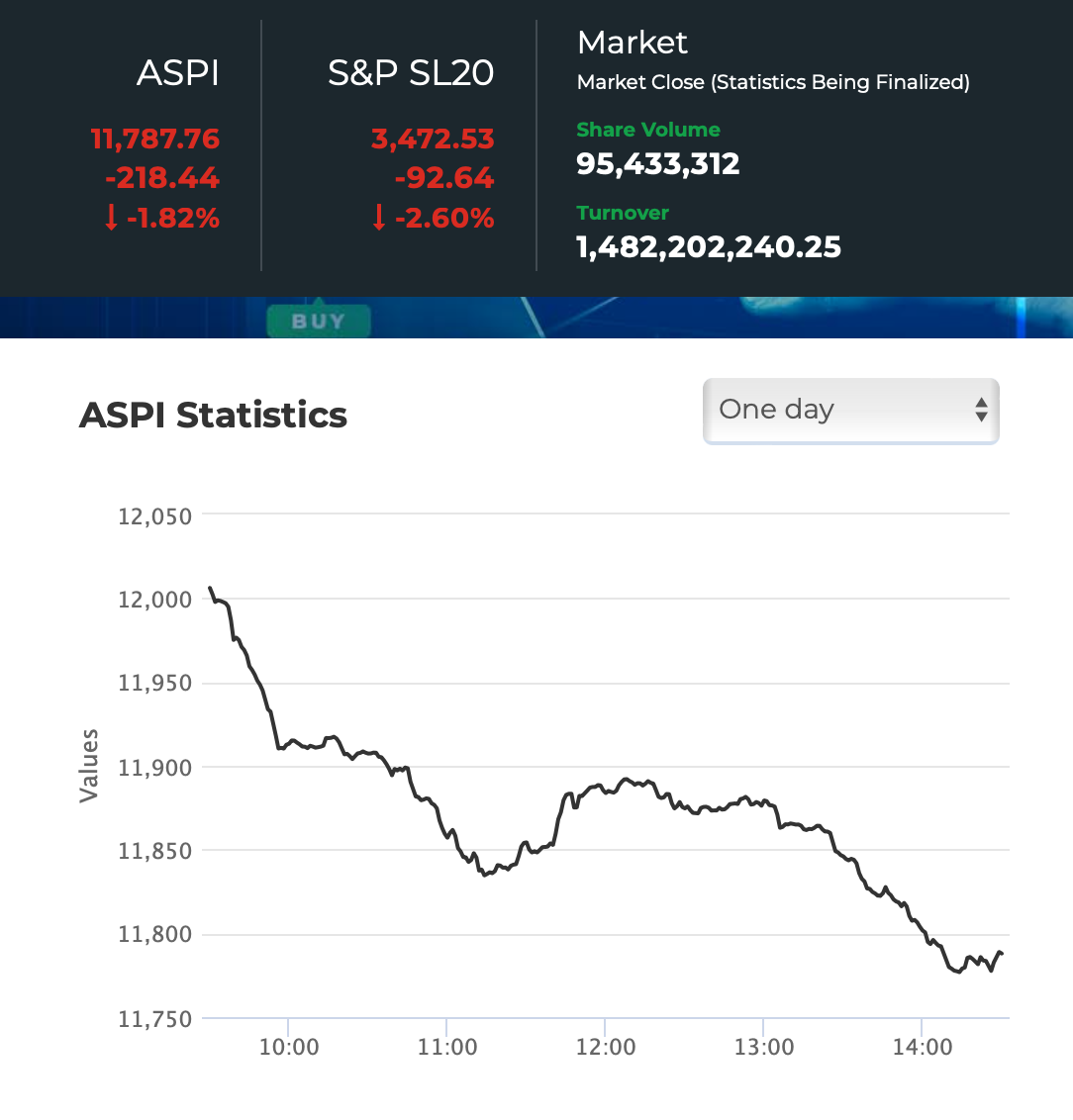

Sri Lanka : Early Warning Signals of possible economic downturn

Colombo Stock Market reported sharp decline on April 16, 2024 signalling Early Warning Signal (EWS) of a possible economic downturn due to following factors reported by Sri Lanka Press. Sri Lanka fails to reach deal on restructure terms with bondholders Sri Lanka has failed to strike an agreement on restructuring about $12 billion of debt

Sri Lanka Tourism: Future Prospects and Challenges

The future outlook for Sri Lanka’s tourism sector is cautiously optimistic, with growth scenarios indicating potential increases in international tourist arrivals. The “Tourism Growth Scenario 2024”, a time series analysis conducted by the Tourism Development Authority of Sri Lanka in February 2024 outlines two primary scenarios for 2024: These figures are based on a time