Namunukula Plantations PLC

Based on the provided context, Namunukula Plantations PLC has shown a strong financial performance in the fiscal year 2022/23. Here are some key highlights from the data:

- Revenue Growth:

- Namunukula Plantations PLC achieved a record revenue of Rs. 5.4 billion in 2022/23, which is a significant increase from the previous year’s revenue of Rs. 3.9 billion. This represents a growth rate of approximately 38.5% year-over-year.

- Segment Performance:

- The revenue growth has been attributed to efficient management strategies and favorable market conditions, particularly in the oil palm and tea segments. These segments have been significant contributors to the company’s revenue.

- Net Assets Per Share:

- The net assets per share of Namunukula Plantations PLC stood at Rs. 331.70 as of March 31, 2023, which is a substantial increase from Rs. 229.44 in the previous year. This indicates a strong balance sheet and an increase in the company’s intrinsic value per share.

- Profitability:

- The company’s gross profit margin has seen a remarkable increase, with the gross profit growing by 794% in 2022/23 compared to the previous year. This suggests that the company has been able to significantly increase its profitability.

- Investment in Joint Venture:

- Namunukula Plantations PLC has also reported a share of profit after tax from its investment in a joint venture amounting to Rs. 237,867,000 for the year 2022/23, which is an increase from Rs. 224,590,000 in the previous year.

- Asset Growth:

- The company’s non-current assets have also grown, with leasehold property, plant, and equipment valued at Rs. 424,238,000 and freehold property, plant, and equipment at Rs. 481,506,000 in 2022/23.

Watawała Plantations PLC

Based on the provided context, Watawala Plantations PLC has demonstrated a mixed financial performance in recent periods. Here are some key points derived from the financial documents:

- Revenue:

- The Group concluded the financial year 2022-23 with a revenue growth of 35% year-over-year (YoY), primarily driven by increased earnings from palm oil. The dairy sector also experienced a revenue growth of 72% compared to the previous year, although this was influenced by the escalation in cattle feed costs.

- Profitability:

- There has been a fluctuation in profitability, with profit for the period showing a decline of 13% to 15% in the interim period ending December 2023 compared to the same period in the previous year. This is evident from the profit figures of Rs. 574,071,000 in the current period versus Rs. 660,822,000 in the prior period.

- Earnings Per Share (EPS):

- The basic earnings per share (EPS) decreased from Rs. 3.36 in the interim period of the previous year to Rs. 2.54 in the interim period ending December 2023, indicating a decrease in profitability on a per-share basis.

- Dividends:

- The company has paid dividends, which is reflected in the transactions with owners of the company. For example, dividends paid amounted to Rs. 2,439,704,000 as of the balance at the end of the period.

- Liquidity Ratios:

- The liquidity ratios, such as the current ratio and quick asset ratio, indicate a healthy liquidity position, with the company being able to meet its short-term obligations. The debt-to-equity ratio was reported as 0.04 times, suggesting a strong financial position with low leverage.

- Comprehensive Income:

- The total comprehensive income for the period also saw a decline, mirroring the decrease in profit for the period.

- Segment Performance:

- The company’s principal activities, including the cultivation, manufacture, and sale of crude palm oil and dairy farming, have contributed to the overall financial performance, with palm oil being a significant revenue driver.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

When comparing and contrasting Namunukula Plantations PLC with Watawala Plantations PLC, we can look at various aspects of their financial performance and operations based on the information provided in their annual and interim reports for the fiscal year 2022/23.

Revenue Growth:

- Namunukula Plantations PLC experienced significant revenue growth, with total revenue increasing by 122% in 2022/23 compared to the previous year.

- Watawala Plantations PLC also concluded the year with a revenue growth of 35% year-over-year, mainly due to increased earnings from palm oil.

Profitability:

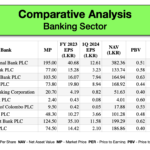

- Watawala Plantations PLC’s profitability seems to have fluctuated, with a decrease in basic earnings per share from LKR 3.36 in the previous interim period to LKR 2.54 in the interim period ending December 2023, indicating a decline in profitability.

- Namunukula Plantations PLC’s profitability specifics are not provided in the context, but the company has been highlighted for achieving success surpassing previous achievements, which could imply positive profitability trends.

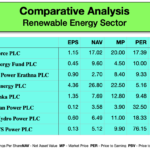

Earnings Per Share (EPS):

- Watawala Plantations PLC’s EPS was LKR 11.49 as of March 2023, which is a decrease from the previous year’s LKR 16.87.

- Namunukula Plantations PLC’s EPS details are not provided, but the company’s overall financial fitness and success suggest a potentially strong EPS.

Dividend Policy:

- Watawala Plantations PLC has a dividend payout of 122% as of March 2023, which is significantly higher than the previous year’s 53%.

- Namunukula Plantations PLC’s dividend policy or payout ratios are not mentioned in the provided context.

Liquidity and Financial Position:

- Watawala Plantations PLC has a healthy liquidity position with a current ratio of 3.38 times and a quick asset ratio of 1.86 times as of March 31, 2023. The debt-to-equity ratio was 0.04 times, indicating low leverage.

- Namunukula Plantations PLC’s liquidity ratios and financial position are not detailed in the context provided.

Segment Performance:

- Watawala Plantations PLC’s principal activities include the cultivation, manufacture, and sale of crude palm oil and dairy farming.

- Namunukula Plantations PLC’s operational highlights include production volumes, sales volumes, and average selling prices for tea, rubber, and oil palm, but specific performance metrics are not provided.

Market Performance:

- Namunukula Plantations PLC recorded its highest share price in the year as a company listed on the Colombo Stock Exchange (CSE), marked as Rs. 1,150.00.

- Watawala Plantations PLC’s share performance in relation to market indices is not provided in the context.

Awards and Recognition:

- Namunukula Plantations PLC was the winner of the Gold award for the best-presented Annual Report awarded by the South Asian Federation of Accounts (SAFA) for the year 2019/20.

In summary, both companies operate in the plantation sector with different focuses, Watawala on palm oil and dairy, and Namunukula on tea, rubber, and oil palm. Watawala Plantations PLC has shown a strong revenue growth driven by palm oil and maintains a healthy liquidity position, although it has experienced a decline in profitability in the interim period ending December 2023. Namunukula Plantations PLC has shown impressive revenue growth and has been recognized for its financial reporting, suggesting strong operational performance. However, without complete data, a comprehensive comparison is limited.

SWOT ANALYSIS

To conduct a SWOT analysis for Watawala Plantation PLC and Namunukula Plantations PLC, we would need to look at the Strengths, Weaknesses, Opportunities, and Threats for each company. Please note that the following analysis is based on general knowledge and would require more detailed and current financial and strategic information for a precise evaluation.

Watawala Plantation PLC:

Strengths:

- Diversified product portfolio: Watawala may have a range of plantation crops, including tea, rubber, and palm oil, which can help mitigate risks associated with market fluctuations.

- Strong brand presence: Watawala might have established brands, particularly in the tea segment, which can command premium pricing.

- Backing of a strong parent company: If Watawala is part of a larger conglomerate, it can benefit from shared resources and expertise.

Weaknesses:

- Vulnerability to climate change: As a plantation company, Watawala could be susceptible to adverse weather conditions affecting crop yields.

- Labor issues: Plantation companies often face challenges related to labor, including strikes and demands for higher wages.

- Commodity price volatility: The prices of tea, rubber, and palm oil can be highly volatile, impacting revenue and profitability.

Opportunities:

- Expansion into new markets: Watawala could explore opportunities to export to new regions, increasing its customer base.

- Sustainable practices: By adopting more sustainable farming practices, Watawala can appeal to environmentally conscious consumers and reduce its environmental impact.

- Value-added products: Developing value-added products can help Watawala increase its margins and reduce dependence on raw commodity sales.

Threats:

- Competition: Intense competition from other plantation companies can lead to price wars and reduced market share.

- Regulatory changes: Changes in land use policies, environmental regulations, or export tariffs can negatively impact operations.

- Economic downturns: Global economic slowdowns can reduce demand for luxury items like premium teas.

Namunukula Plantations PLC:

Strengths:

- Specialization: If Namunukula specializes in a particular crop, it may benefit from expertise and efficiency in production.

- Quality reputation: A reputation for high-quality produce can allow for premium pricing and customer loyalty.

- Strategic locations: Owning plantations in prime locations can result in higher yields and better quality crops.

Weaknesses:

- Limited diversification: Specialization in fewer crops can be a risk if there is a downturn in demand for that particular crop.

- Smaller scale: If Namunukula is smaller in scale compared to competitors, it may have less bargaining power with buyers and suppliers.

- Infrastructure challenges: Plantations located in remote areas may face difficulties with transportation and logistics.

Opportunities:

- Organic and fair-trade markets: There is growing demand for organic and fair-trade certified products, which Namunukula could capitalize on.

- Agri-tourism: Developing agri-tourism can provide an additional revenue stream and diversify income sources.

- Technological advancements: Implementing modern agricultural technologies can improve efficiency and yields.

Threats:

- Pests and diseases: Outbreaks of pests or plant diseases can significantly impact crop production.

- Exchange rate fluctuations: As an exporter, Namunukula may be affected by currency exchange rate volatility.

- Political instability: Changes in the political landscape can affect the stability and predictability of the business environment.

For a more accurate and current SWOT analysis, it would be necessary to review the latest financial statements, market reports, and strategic plans of Watawala Plantation PLC and Namunukula Plantations PLC.