To provide a comparative analysis between Dialog Axiata PLC and Sri Lanka Telecom PLC, we will look at various aspects such as market performance, financial health, strategic direction, and technological advancements based on the latest available data.

Market Performance:

As of the latest data, Dialog Axiata PLC’s stock price remained unchanged, indicating stability in investor sentiment. Sri Lanka Telecom PLC, however, experienced a slight decrease of -0.23% in its stock price. This could suggest a more cautious approach from investors towards SLT or a reaction to specific market conditions or company news.

Financial Health:

Dialog Axiata PLC reported a capital expenditure (Capex) to Revenue ratio of 14%, with significant investments in High-Speed Broadband infrastructure, which is a strong indicator of the company’s commitment to expanding its market leadership in the broadband sector. The Operating Free Cash Flow (OFCF) for FY 2023 was Rs25.1Bn, showing a substantial year-to-date increase, which is a positive sign of financial health and operational efficiency.

Sri Lanka Telecom PLC’s financial details are not specified in the context provided, but typically, one would compare key financial ratios such as net profit margin, return on equity, debt-to-equity ratio, and earnings per share to get a comprehensive view of financial health.

Strategic Direction:

Sri Lanka Telecom PLC has been recognized for its influence in Sri Lanka’s telecommunications industry and is committed to operational excellence, digital transformation, and customer-centric solutions. The company is focused on driving a smarter Sri Lanka and positioning itself for long-term success.

Dialog Axiata PLC has demonstrated its strategic focus by being the first in the South Asian region to showcase 5G capabilities in 2018 and has since enabled over 200,000 Sri Lankans to experience its 5G trial network. This indicates Dialog’s commitment to leading in technological advancements and preparing for future market demands.

Technological Advancements:

Sri Lanka Telecom PLC is transitioning from a traditional telecommunications provider to a more technology-oriented company (Techco), indicating a strategic shift to compete with global tech giants and start-ups by offering personalized services and embracing digitalization and innovation.

Dialog Axiata PLC has already established a significant presence in the 5G space with its trial network, which is a strong competitive advantage in terms of technological leadership.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

Both companies are key players in the Sri Lankan telecommunications market, with Dialog Axiata PLC showing strong financial performance and technological leadership in 5G, while Sri Lanka Telecom PLC is focusing on digital transformation and operational excellence. Investors and stakeholders would need to consider their individual investment goals, risk tolerance, and the long-term strategic direction of both companies when making decisions. It’s also important to review the most recent and comprehensive financial reports and market analyses for a current and detailed comparison.

FINANCIAL PERFORMANCE

Dialog Axiata PLC

Based on the latest available financial data for Dialog Axiata PLC for the year ended 31st December 2023, the company has shown positive performance across its various business segments, which include Mobile, Fixed, Digital Pay Television, International, Digital Platforms, and Tele-infrastructure businesses.

Revenue:

- The Group’s consolidated revenue was recorded at Rs187.8 billion for FY 2023, demonstrating a growth of 5% Year-to-Date (YTD).

- For the fourth quarter of 2023, the revenue was Rs43.4 billion, which was a decrease of 7% Quarter-on-Quarter (QoQ).

Profitability:

- Dialog Axiata PLC’s entity-level contribution to Group Revenue was 55%, and to Group EBITDA was 62%.

- The company’s revenue was Rs102.9 billion for FY 2023, up 1% YTD, mainly driven by Data and Voice segments.

- EBITDA for the company reached Rs38.4 billion, up 8% YTD, indicating improved profitability due to cost efficiencies.

- Net Profit After Tax (NPAT) for the company, with the support of forex gains of Rs10.0 billion, was recorded at Rs12.0 billion for FY 2023, which is an increase of more than 100% YTD.

Earnings Per Share (EPS):

- Basic earnings per share were Rs2.44 for FY 2023, compared to a loss per share of Rs4.06 for FY 2022.

- Diluted earnings per share were also Rs2.44 for FY 2023, compared to a loss per share of Rs4.04 for FY 2022.

Capital Expenditure:

- The Group’s capital expenditure on High-Speed Broadband and other Infrastructure topped Rs25.5 billion.

Dividends:

- The Board of Directors proposed a dividend to ordinary shareholders, taking into account the financial performance and forward investment requirements for Broadband and Digital services.

Foreign Exchange Impact:

- The YTD NPAT performance was strongly supported by a forex gain of LKR10.2 billion for FY 2023 as the Sri Lankan Rupee appreciated by 11.5% against the US Dollar.

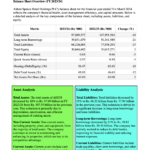

Sri Lanka Telecom PLC

The latest financial performance of Sri Lanka Telecom PLC, as per the Annual Report for December 2023, indicates a challenging year for the company. Here are the key financial highlights:

Revenue:

- Group Revenue decreased by 1.2% to LKR 106,418 million in 2023 from LKR 107,710 million in 2022.

- Revenue from Fixed services increased by 3.1% to LKR 63,637 million.

- Mobile services revenue decreased by 5.5% to LKR 41,103 million.

- Other services saw a significant decrease of 33.3%, down to LKR 1,678 million.

Profitability:

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) dropped by 19.0% to LKR 33,003 million.

- Operating Profit saw a substantial decline of 67.2% to LKR 4,102 million.

- Profit Before Tax turned into a loss of LKR (2,651) million, a significant downturn from a profit of LKR 10,588 million in 2022.

- Profit After Tax also turned negative, with a loss of LKR (3,921) million compared to a profit of LKR 4,765 million in the previous year.

Earnings Per Share (EPS):

- Earnings Per Share plummeted to LKR (2.17), a stark contrast to the LKR 2.64 in 2022.

Workforce:

- The workforce strength of the group increased slightly to over 8,200 from 8,058 in 2022.

Liabilities:

- Total Liabilities were reported at LKR 158.1 billion.

Challenges:

- The company faced increased taxation and higher electricity tariffs, which adversely impacted profitability.

- The Group reported a Loss After Tax of LKR 3.9 billion, with SLT itself recording a loss of LKR 1.1 billion and Mobitel a loss of LKR 3.6 billion.

- SLT’s operations saw a revenue growth of 3.2% during the year, while Mobitel’s revenue decreased by 5.7% year-on-year.

Internal Challenges:

- The ongoing economic crisis has impacted the telecommunications sector, and while some operators have achieved growth, SLT has faced challenges that have affected its financial performance.

Dividends:

- No dividend per share was reported for the year 2023.

The financial data reflects a difficult period for Sri Lanka Telecom PLC, with several key financial metrics showing a downturn. The company’s performance was affected by external economic factors as well as increased costs, leading to a loss for the year 2023.

FUTURE PROSPECTS

Based on the provided context and the latest available financial data, Dialog Axiata PLC and Sri Lanka Telecom PLC have shown different trajectories in their financial performance.

Dialog Axiata PLC:

- Dialog Axiata PLC has demonstrated a positive financial performance for the year ended 31st December 2023, with consolidated revenue growing by 5% Year-to-Date (YTD) to Rs187.8Bn.

- The company has made significant capital expenditures, particularly in High-Speed Broadband infrastructure, which is indicative of its commitment to expanding its leadership in the broadband sector in Sri Lanka.

- Dialog Axiata PLC’s Operating Free Cash Flow (OFCF) saw an increase of over 100% YTD, amounting to Rs25.1Bn for FY 2023.

- The company has also been proactive in the technological front, being the first in the South Asian region to demonstrate 5G capabilities and establishing a large 5G trial network in Sri Lanka.

- The Group’s Net Profit After Tax (NPAT) was strongly supported by a forex gain due to the appreciation of the Sri Lankan Rupee against the USD, with a normalized NPAT of Rs9.9Bn for FY 2023, indicating a significant increase over the previous year.

Sri Lanka Telecom PLC:

- Sri Lanka Telecom PLC, on the other hand, faced a challenging year with a decrease in Group Revenue by 1.2% to LKR 106,418 million in 2023.

- The company’s profitability metrics, such as EBITDA and Operating Profit, saw substantial declines, with the company turning into a loss before and after tax.

- The financial performance was affected by external economic factors and increased costs, leading to a loss for the year 2023.

Summary

- Dialog Axiata PLC’s investment in broadband infrastructure and its early adoption of 5G technology position it well for future growth, especially as demand for high-speed internet and advanced telecommunications services continues to rise.

- The company’s strong cash flow and positive revenue growth suggest a robust financial position that can support further investments and potential dividend payouts.

- Sri Lanka Telecom PLC will need to address the challenges it faced in 2023 and may need to focus on cost optimization, service diversification, and technological upgrades to improve its financial performance.

- The economic environment and regulatory changes will also play a significant role in shaping the future outlook for both companies.

In conclusion, Dialog Axiata PLC appears to have a more favorable outlook based on its recent financial performance and strategic investments in technology. However, both companies operate in a dynamic environment, and their future performance will depend on how they adapt to market demands, technological advancements, and economic conditions.