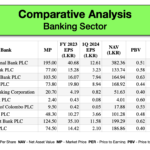

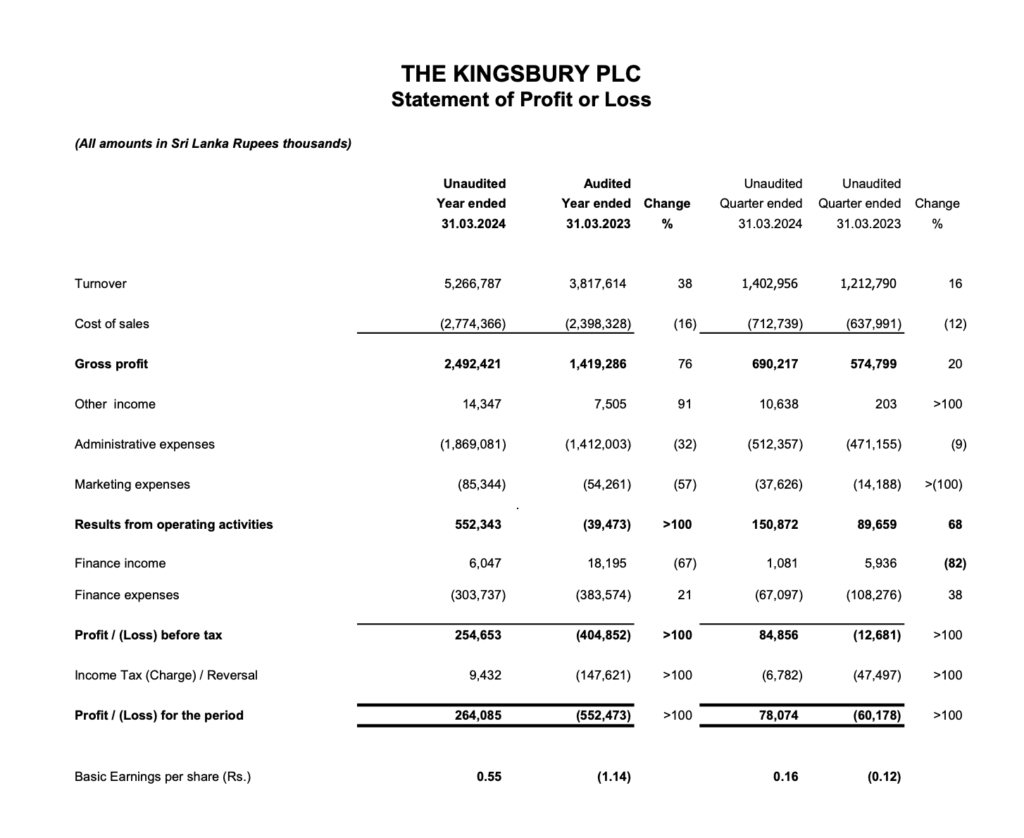

Based on the provided context, Kingsbury PLC’s financial position as at 31st March 2024 can be summarized as follows:

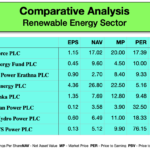

- The Basic Earnings per Share (EPS) as at 31st March 2024 was Rs. 0.55.

- The Net Assets per Share were Rs. 2.79.

- The Price Earning Ratio (P/E ratio) stood at 19.79 times.

- The Stated Capital remained unchanged at 484,000 shares with a total value of Rs. 836,000 (‘000).

- The company generated cash from operations amounting to Rs. 473,626 (‘000).

- Interest received was Rs. 5,774 (‘000), while interest paid was significantly higher at Rs. 85,368 (‘000).

- Lease interest paid was Rs. 2,381 (‘000), and retirement benefits paid were Rs. 13,947 (‘000).

The financial statements also indicate that there were no adjustments required since the Statement of Financial Position date and no material contingent liabilities or assets that needed to be disclosed for the period ended 31st March 2024.

The market value of an ordinary share of Kingsbury PLC saw the highest price at Rs. 11.90 and the lowest at Rs. 10.20 during the quarter ending 31st March 2024. The last traded price was Rs. 10.80.

These figures suggest that Kingsbury PLC has maintained its capital structure over the year and has seen an improvement in its earnings per share from a negative value in the previous year to a positive value in 2024. The net assets per share have also increased, indicating an improvement in the company’s net worth per share. The positive P/E ratio reflects investor confidence in the company’s future earnings potential.

For a more detailed analysis or specific advice, additional information such as the full financial statements, notes to the accounts, and the latest market data would be required.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

Future Prospects

Analyzing the future prospects of Kingsbury PLC within the city hotel sector involves considering several factors, including the company’s financial performance, industry trends, competitive landscape, and broader economic conditions.

Based on the financial data available from the interim financial statements for December 2023 and March 2024, Kingsbury PLC has shown an improvement in cash generated from operations, which is a positive sign for liquidity and operational efficiency. The reduction in interest paid suggests that the company may have decreased its debt levels or refinanced at more favorable rates, which can improve profitability and financial stability.

In terms of the city hotel sector, several industry-specific factors can influence Kingsbury PLC’s future prospects:

- Tourism Trends: The health of the city hotel sector is closely tied to tourism and business travel trends. An increase in tourism, possibly due to government initiatives, improved connectivity, or global economic recovery, could benefit Kingsbury PLC.

- Competition: The level of competition in the city hotel sector, including the entry of new players or the expansion of existing ones, can impact market share and pricing power.

- Consumer Preferences: Changes in consumer preferences, such as a shift towards boutique hotels or alternative accommodations like Airbnb, could affect demand for Kingsbury PLC’s offerings.

- Economic Conditions: The overall economic environment, including disposable income levels, corporate spending, and foreign exchange rates, can influence the performance of the city hotel sector.

- Regulatory Environment: Any changes in regulations, such as taxation policies, environmental laws, or zoning regulations, can have an impact on operational costs and investment decisions.

- Technological Advancements: Adoption of new technologies for hotel management, customer service, and marketing can improve efficiency and guest experiences, potentially giving Kingsbury PLC a competitive edge.

Given the company’s improved financial performance and assuming positive industry trends, Kingsbury PLC could be well-positioned to capitalize on growth opportunities in the city hotel sector. However, it is crucial to monitor the factors mentioned above and conduct a more detailed analysis, including market research and competitive analysis, to make a more informed assessment of the company’s future prospects.