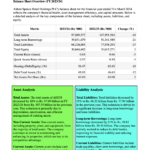

Based on the provided context, Kahawatte Plantations PLC’s latest financial performance and key indicators as at 31st March 2024 can be summarized as follows:

Financial Performance:

- Revenue:

- For the three months ended 31st March 2024, the revenue was Rs. 1,642,851,000.

- This represents an increase of Rs. 52,457,000 compared to the revenue of Rs. 1,590,394,000 for the same period in 2023.

- Cost of Sales:

- The cost of sales for the period was Rs. 1,345,118,000.

- This is a significant decrease from the previous year’s cost of sales of Rs. 1,583,725,000, resulting in a positive change of Rs. 238,607,000.

- Gross Profit:

- The gross profit for the period was Rs. 297,733,000.

- This is a substantial improvement from the gross profit of Rs. 6,669,000 reported for the three months ended 31st March 2023.

- Net Profit Before Taxation:

- The net profit before taxation for the period was Rs. 181,479,000.

- This is a turnaround from the net loss before taxation of Rs. (130,557,000) for the same period in the previous year.

- Cash and Cash Equivalents:

- As at 31st March 2024, the cash and cash equivalents stood at Rs. (722,608,000).

- This is an improvement from the end of the previous period on 31st December 2023, where cash and cash equivalents were Rs. (774,994,000).

Key Indicators:

- Segment Revenue:

- Tea: Rs. 1,481,973,000

- Rubber: Rs. 121,286,000

- Other Crop: Rs. 39,592,000

- Earnings Per Share (EPS):

- The EPS is not directly provided in the context, but it can be calculated if the number of shares is known.

- Statement of Changes in Equity:

- The equity at the beginning of the period (1st January 2024) was Rs. 862,511,000.

- The equity at the end of the period (31st March 2024) was Rs. 1,043,990,000.

- Administrative Expenses:

- The administrative expenses for the period are not fully visible in the context provided.

- Other Income:

- Other income for the period was Rs. 20,594,000, a decrease from Rs. 30,510,000 in the previous year.

- Fair Value Gain on Biological Assets:

- There was no fair value gain on biological assets reported for the period.

This summary provides an overview of the financial performance and key indicators for Kahawatte Plantations PLC as at 31st March 2024. For a more detailed analysis, additional information such as the number of shares for EPS calculation, detailed administrative expenses, and other comprehensive income would be required.

Future Outlook

The future outlook of Kahawatte Plantations PLC should be assessed based on several factors, including its recent financial performance, industry trends, and broader economic conditions. Here are some considerations:

- Recent Financial Performance:

- Kahawatte Plantations PLC has shown a significant turnaround in its financial performance for the quarter ended 31st March 2024, with a notable increase in net profit before taxation compared to the previous year. This positive change suggests an improvement in operational efficiency or market conditions for its products.

- Segment Performance:

- The company has experienced growth in revenue across all segments, with Tea, Rubber, and Other Crops showing increased sales. This diversified growth is a positive indicator for the company’s stability and potential for future growth.

- Market Conditions:

- The demand for tea and rubber, the primary products of Kahawatte Plantations PLC, is influenced by global market conditions. Factors such as international commodity prices, trade agreements, and consumer preferences will play a role in the company’s future performance.

- Operational Improvements:

- The reduction in cost of sales and the increase in gross profit suggest that the company may have implemented cost-saving measures or achieved better economies of scale. Continued operational improvements can contribute to a positive outlook.

- Economic and Political Factors:

- The economic environment in Sri Lanka, including inflation rates, interest rates, and government policies related to agriculture and exports, will impact the company’s operations. Political stability and favorable policies can enhance the company’s prospects.

- Sustainability and Innovation:

- With increasing global focus on sustainability, the company’s efforts in sustainable farming practices, innovation in crop cultivation, and value-added products can open new markets and improve its competitive edge.

- Investment in Infrastructure:

- Future investments in plantation infrastructure, technology, and human capital can lead to improved productivity and quality, further enhancing the company’s market position.

- Risks and Challenges:

- The company must navigate risks such as climate change, which can affect crop yields, and market risks from fluctuating commodity prices. Additionally, labor issues and regulatory changes can pose challenges.

Given these factors, the future outlook for Kahawatte Plantations PLC appears cautiously optimistic, provided the company continues to build on its recent performance improvements and effectively manages the risks associated with its operations and the broader market. Investors and stakeholders should monitor the company’s strategic initiatives and the external environment to make informed decisions.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net