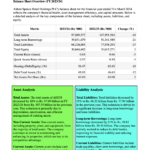

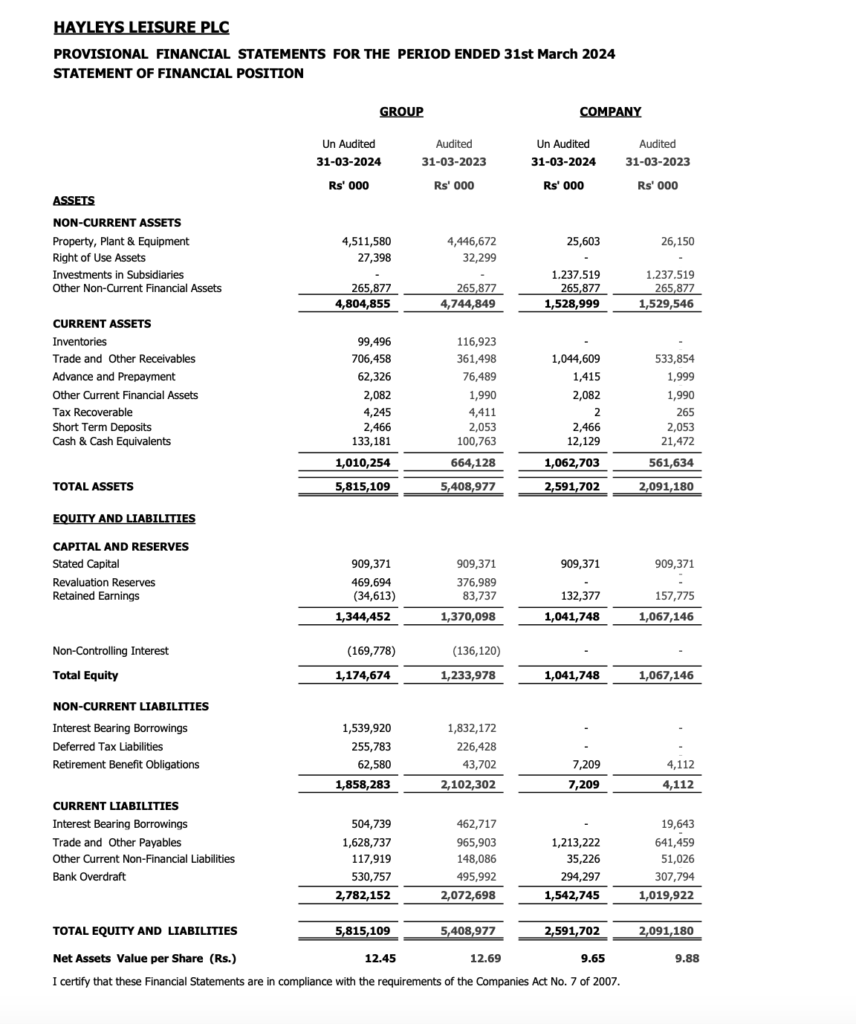

Based on the provided context from the interim financial statements of Hayleys Leisure PLC for the period ended 31st March 2024, we can analyze the company’s profitability as follows:

Revenue Growth:

- The company has shown significant growth in revenue from contracts with customers, with a 52% increase in the quarter ended March 2024 compared to the same quarter in 2023 (from Rs. 545,305,000 to Rs. 828,019,000).

- For the period ended March 2024, the revenue increased by 88% compared to the period ended March 2023 (from Rs. 1,531,664,000 to Rs. 2,877,808,000).

Gross Profit:

- The gross profit for the quarter ended March 2024 was Rs. 512,878,000, a 59% increase from Rs. 322,353,000 in the same quarter of the previous year.

- For the period ended March 2024, the gross profit more than doubled, showing an increase of over 100% from Rs. 811,482,000 in 2023 to Rs. 1,759,259,000.

Profit/Loss per Share (EPS):

- The EPS for the quarter ended March 2024 was Rs. 0.06, which is an improvement from a loss per share of Rs. (0.35) in the same quarter of the previous year.

- For the period ended March 2024, the EPS was Rs. (0.21), which is an improvement from Rs. (0.82) for the period ended March 2023.

Total Comprehensive Income/Expense:

- The total comprehensive income for the quarter ended March 2024 was Rs. 3,354,000, which is a significant improvement from a comprehensive expense of Rs. (37,450,000) in the same quarter of the previous year.

- For the period ended March 2024, the company reported a comprehensive expense of Rs. (25,398,000), which is an improvement from a comprehensive expense of Rs. (87,663,000) for the period ended March 2023.

From the data available, it is evident that Hayleys Leisure PLC has experienced substantial growth in revenue and gross profit, and has improved its profitability in terms of EPS and total comprehensive income/expense for the period ended March 2024 compared to the same period in the previous year. This suggests that the company has been successful in increasing its operational efficiency and possibly benefiting from increased demand or improved market conditions. However, it is important to note that these financial statements are unaudited, and the final audited reports may present a more accurate picture of the company’s financial health.

This Analysis was compiled by LankaBIZ (AI Assistant) based on publicly available information. Click below link to Chat with LankaBIZ AI to find answers to queries relating Sri Lanka economy, Business regulations, Corporate Analysis & Stock Market Research.

www.lankabizz.net

Future Prospects

When evaluating the future prospects of Hayleys Leisure PLC, several factors should be considered, including historical performance, industry trends, and the broader economic environment. Based on the interim financial statements for the period ended 31st March 2024, Hayleys Leisure PLC has shown significant improvement in revenue and profitability compared to the previous year. Here are some considerations for assessing the company’s future prospects:

- Revenue and Profitability Trends:

- The company has demonstrated strong revenue growth, which is a positive indicator for future performance. If this trend continues, it could suggest a robust demand for the company’s services.

- The improvement in profitability, as indicated by the positive change in total comprehensive income and earnings per share, suggests that the company is managing its costs effectively and could continue to do so in the future.

- Industry Outlook:

- The leisure and hospitality industry is highly dependent on factors such as disposable income, travel trends, and economic conditions. A positive outlook for tourism in Sri Lanka and the Maldives could benefit Hayleys Leisure PLC, especially if the company’s resort properties and city hotel maintain a competitive edge.

- Global and regional economic conditions, including post-pandemic recovery, will also play a significant role in the company’s performance. Increased travel and tourism activities could lead to higher occupancy rates and revenue.

- Operational Efficiency:

- The company’s ability to control costs and improve operational efficiency will be crucial for maintaining profitability. This includes effective management of supply chains, labor, and other operational expenses.

- Strategic Initiatives:

- Any new strategic initiatives, such as expansion plans, renovations, or service enhancements, could attract more customers and increase market share. The company’s ability to innovate and adapt to changing consumer preferences will be important.

- Regulatory and Economic Environment:

- Changes in regulations, taxation, and government policies related to tourism and hospitality can impact the company’s operations. It’s important to monitor these factors for potential risks or opportunities.

- Currency fluctuations and economic stability in key markets can affect the company’s earnings, especially since it operates in multiple countries.

- Sustainability and Social Responsibility:

- As consumers become more environmentally conscious, the company’s commitment to sustainability and social responsibility could influence its reputation and appeal to customers.

- Competitive Landscape:

- The company’s performance relative to its competitors, such as Richard Pieris & Co. PLC and John Keells Holdings PLC, will also be a factor. Staying competitive in terms of pricing, quality, and service offerings is essential.

- Management and Governance:

- The expertise and experience of the company’s management team and board of directors can significantly influence its strategic direction and ability to navigate challenges.

In conclusion, while the interim financial statements show positive signs, a comprehensive analysis of the company’s strategic positioning, industry trends, and external economic factors is necessary to make a well-informed assessment of Hayleys Leisure PLC’s future prospects. Potential investors or stakeholders should also consider the latest market data, news, and the company’s audited financial statements when they become available.